🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex's weekly update. Each week, we spotlight a stock making moves in our AI rankings, and this week, we're watching one that's been quietly crushing it in the semiconductor space while Wall Street debates whether AI is "overvalued."

Spoiler: The alternative data tells a different story at the moment.

After This Reddit Signal, $1,000 Turned into $5,300

July 15th: Reddit mentions of DOOR explode 3,968%

August 30th: The stock had gained 530%

The pattern repeated with OKLO: Reddit mentions surged over 800%, and now the stock is up 541% YTD.

It's happening again right now with stocks you've never heard of.

Here’s the truth: hedge funds and Reddit meme stock traders aren't smarter than you. They just get the signals first.

While you analyze earnings, they're watching Reddit sentiment shift in real-time. The data was public, it’s just that the tools weren't.

Until now.

AltIndex monitors 50,000+ Reddit comments daily. Our AI constantly updates its stock ratings based on the strongest Reddit signals along with other alternative data before they hit mainstream media.

And we’re giving you a free 7-day trial on our app so you can see which stocks are gaining traction in real time.

The next 530% winner is already being discussed on Reddit. Will you catch it this time?

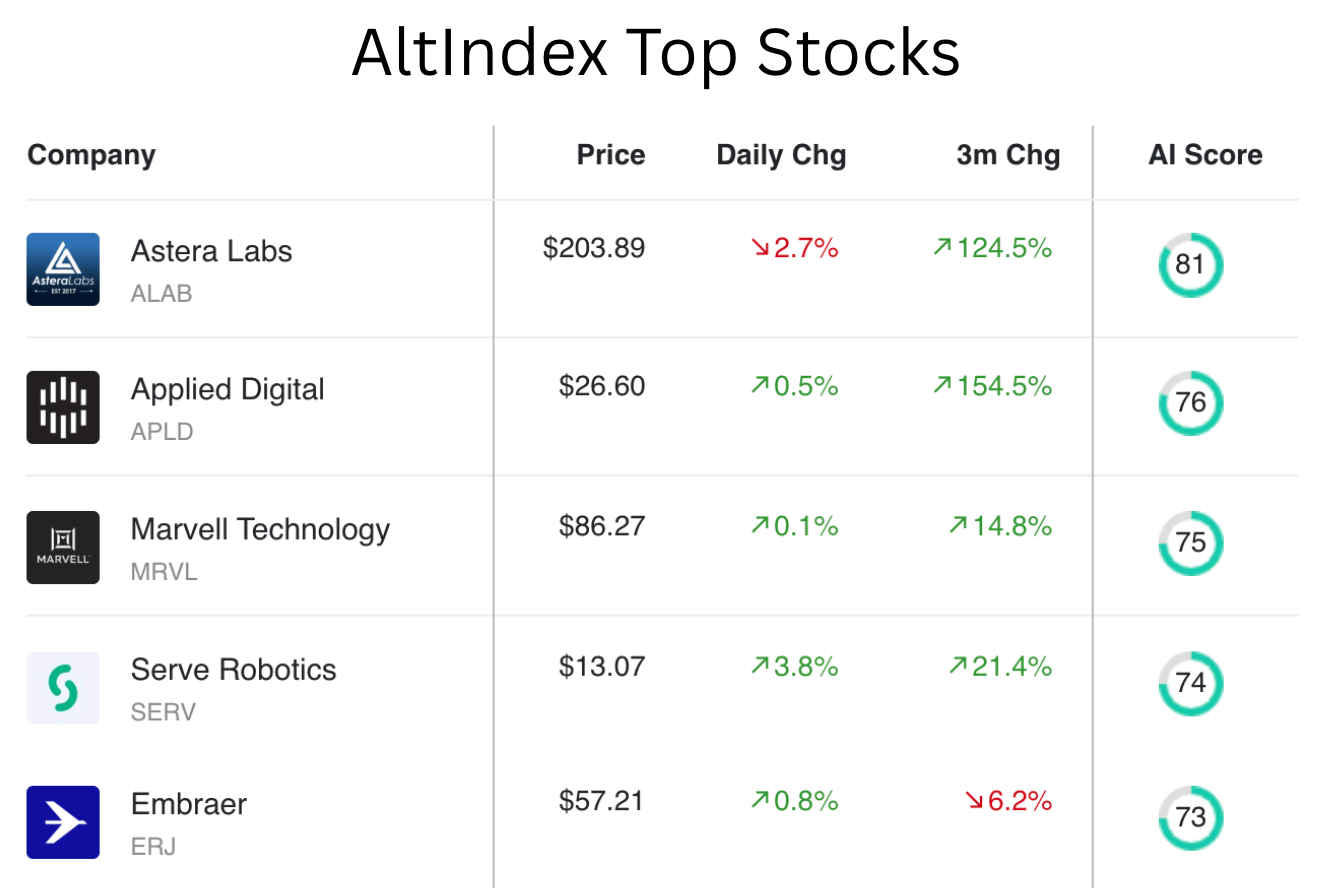

📈 Top AI Scorers of the Week

While analysts argue about tech valuations, our AI is tracking what actually matters: revenue explosions, employee sentiment shifts, and web traffic surges that predict earnings beats before they happen.

This week's spotlight stock isn't a household name yet. But with 149% year-over-year revenue growth and alternative data that our AI model sees as "buy" signals, it might not stay under the radar for long.

Stock spotlight: Astera Labs (ALAB)

Astera Labs is a burgeoning company in the semiconductor industry, known for its innovative solutions and rapid growth. The company focuses on developing high-performance hardware products that address critical bottlenecks in data-centric systems, fostering data flow and efficiency.

The data:

Revenue: $192M. Up 20.37% QoQ and up an astonishing 149.74% YoY.

Net income: $51M. An increase of 60.97% QoQ and a remarkable 778.76% YoY.

Analyst rating: 92% buy

P/E ratio: 249.36, which is high, possibly overvalued

Price momentum: Positive both short and long term (1 month and 1 year time frame)

RSI: 81, overbought

SMA10 is trending downward slightly

Alt data from the past few months:

Employee business outlook: 94% positive

Web traffic ↑ 153%

Twitter following ↑ 20%

Some insider selling over the past few months

The verdict:

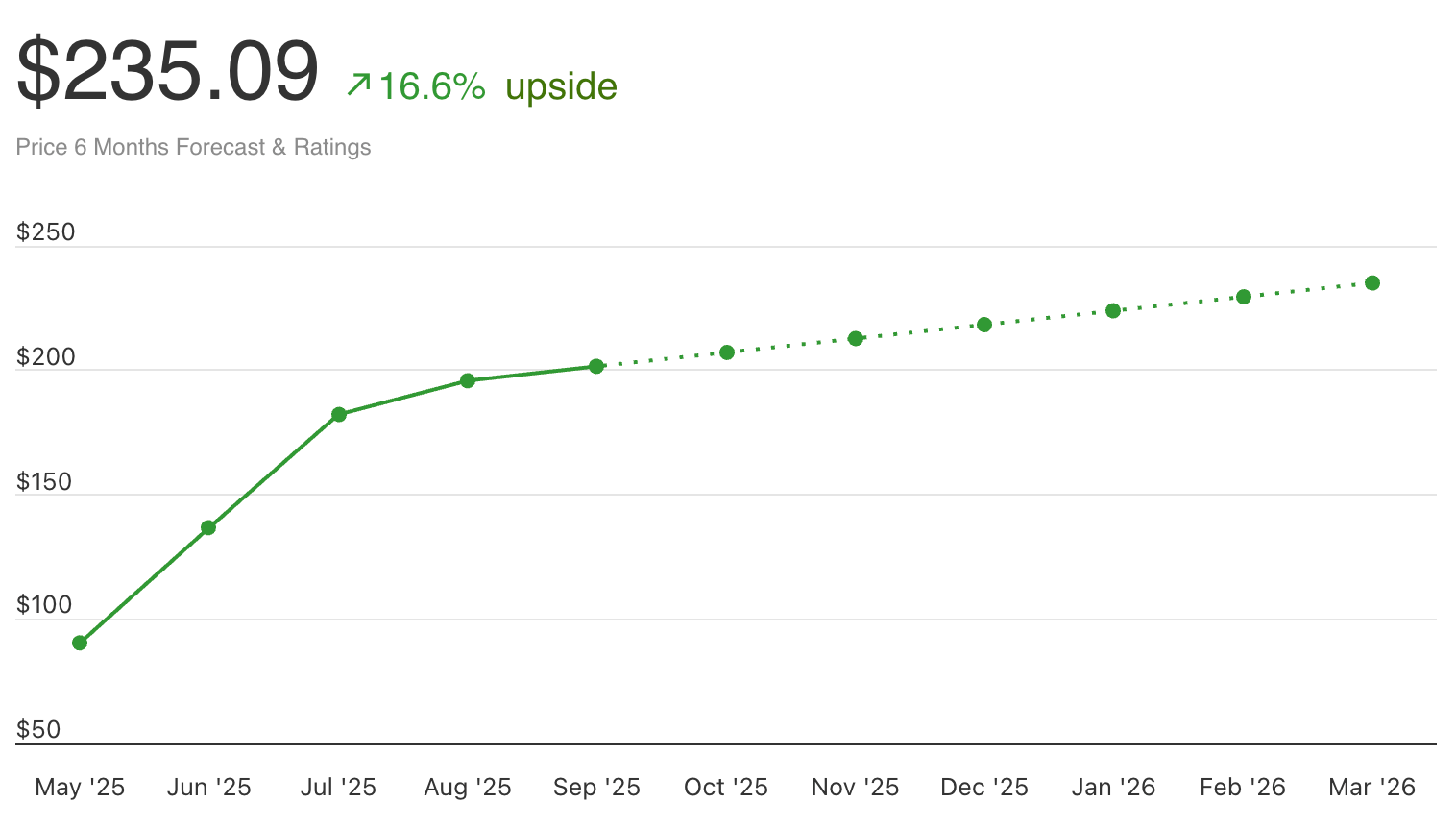

AI score: 81 — buy signal.

Current price: $203.89

Price prediction: $235.09 (16.6% upside)

Bottom line: Astera Labs shows robust financial growth with significant increases in revenue and net income. While the high P/E ratio may suggest overvaluation, other fundamentals indicate strong performance. Despite short-term bearish signals from insider selling and technical indicators like the SMA and RSI, the long-term growth trajectory appears promising.

Employee sentiment, a massive spike in web traffic (possibly correlated to sales increases), and other alternative data trends further bolster the confidence in Astera Labs’ future performance. Given the comprehensive analysis, consider maintaining a positive outlook on Astera Labs while staying mindful of potential short-term corrections.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Buys

Cleo Fields went big on several positions in August (trades reported on Oct 1):

Bought $100K - $250K of AMZN

Bought $50K - $100K of NVDA

Bought $100K - $250K of GOOGL

And many more (see them here)

And Marjorie Taylor Greene also posted some new trades in September:

Bought $1K - $15K of DUK

Bought $1K - $15K of ADBE

Bought $1K - $15K of DLR

And several others (see them here)

Reddit Buzz

Palantir (PLTR) is getting discussed a lot on Reddit in the past 24 hours, and it ain’t pretty. People are talking about the recent internal Army memo that highlights security vulnerabilities and flaws in Palantir's battlefield communication system. The conversation also touches on Palantir's market performance, with some users noting a pattern of its stock price changes preceding broader market trends. There is also criticism regarding the quality of Palantir's software and skepticism about the company's valuation due to its close ties with the U.S government.

GameStop (GME) is the talk of the town again: People are actively discussing their experiences and thoughts about the stock on Reddit. Some users are talking about the new symbols related to GameStop in an OCC memo, questioning what they could mean. Some are expressing general satisfaction about being a GME holder and are talking about their purchasing activities, while others are sharing personal stories of buying products from GameStop stores during travels or seeking advice on how to order with lower shipping costs to international locations like France.

Equifax (EFX) Reddit mentions are up 7,950%!

Miscellaneous

Sentiment about Automatic Data Processing (ADP), the jobs data provider, has tanked 20.5%.

Lucid Motors’ (LCID) job listings have dropped by 36.4%.

Want instant access to scores like this—any time, before the news hits?

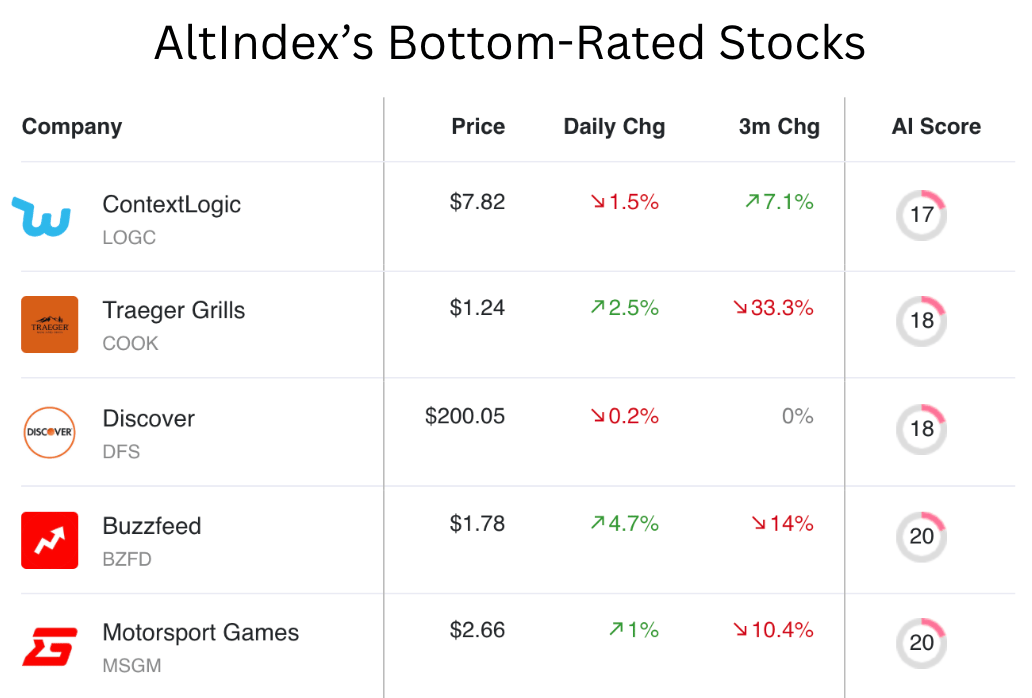

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.