🧠 The Signal Brief: Special Edition

Hello, and welcome to the AltIndex newsletter. In today’s special edition, we’ll be breaking down the #1 rated stocks in 5 different industries.

Where are we looking today? Industrials, autos, entertainment, cloud computing, and energy. The companies we’re listing have some of the highest AI Scores on our platform.

But before we jump in, a look at battery stock that could have a huge edge soon:

In Partnership with Trading Whisperer

Analysts warn power bills could rise 30% to 60% in parts of America by 2030. Families need backup. Utilities need relief. A small US battery stock could be the answer, with 200%+ revenue growth and government-backed programs.

The Best Industrial Stock

Veralto (VLTO) is a dynamic company that operates in the cutting-edge technology sector, consistently making strides in innovation and customer satisfaction. The company's commitment to growth is evident in its steadily increasing revenues and positive employee sentiment. With a diverse range of products and services, Veralto continues to expand its market presence and capture new opportunities.

The signals

Revenue: at $1.37 billion, revenue increased 2.93% QoQ and 6.44% YoY

Net Income: $222 million. Decreased 1.33% QoQ but increased 9.36% YoY

ACGL has short- and long-term negative price momentum at the moment

Over the past few months:

22% increase in web traffic

87% positive employee outlook

5 open job positions, down 95%

AI Score: 75/100

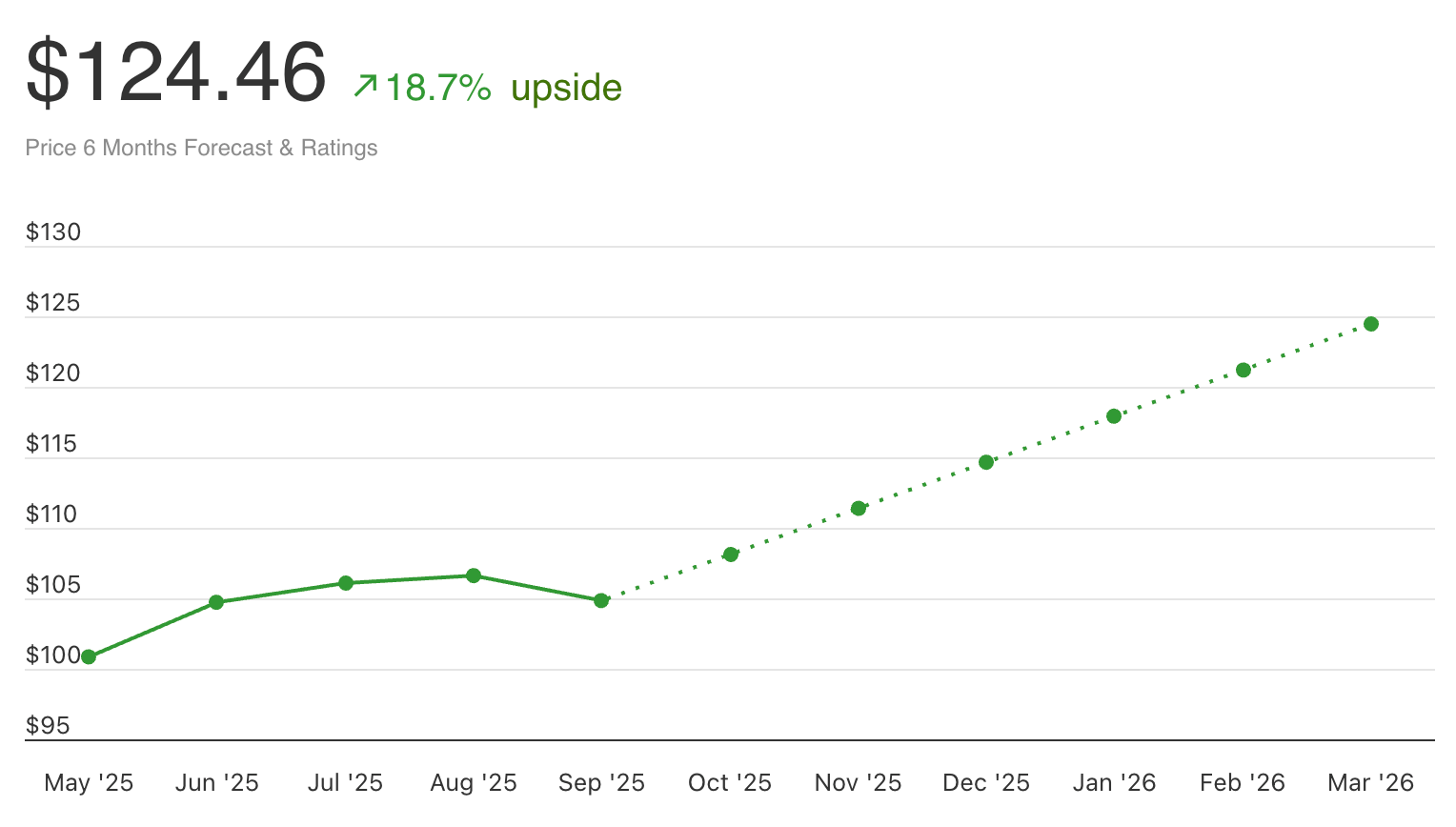

Current Price: $104.84

Target Price: $124.46

The Best Auto Stock

XPeng Inc. (XPEV) is a leading Chinese electric vehicle (EV) manufacturer that focuses on the design, development, manufacturing, and marketing of smart electric cars. Founded in 2014, XPeng aims to enhance the driving experience with state-of-the-art technology, including autonomous driving algorithms, smart cockpits, and cutting-edge battery systems.

The signals

Revenue: $18.3 billion. Up 15.58% QoQ and 125.29% YoY

Net Income: $28.05 million. Up 28.05% QoQ and up 62.81% YoY

ALNY has positive short- and long-term price momentum

Over the past few months:

65% increase in job postings

17% increase in web traffic

9% increase in Instagram followers

AI Score: 71/100

Current Price: $23.67

Target Price: $27.13

The Best Entertainment Stock

Tencent Holdings Limited (TME) is a Chinese multinational conglomerate holding company. Founded in 1998, Tencent is one of the world's largest technology companies and has a significant presence in various sectors including social media, gaming, fintech, and artificial intelligence. Tencent's flagship products include the messaging app WeChat, the mobile payment platform WeChat Pay, and the extremely popular online game League of Legends.

The signals

Revenue: $8.44 billion. Up 4.52% QoQ but down 1.10% YoY

Net Income: $95 million. Up 14.76% QoQ and up 17.91% YoY

TME has slight short-term downward price momentum but positive long-term

Over the past few months:

156% increase in Instagram followers

12% increase in job listings

17% decrease in web traffic

AI Score: 73/100

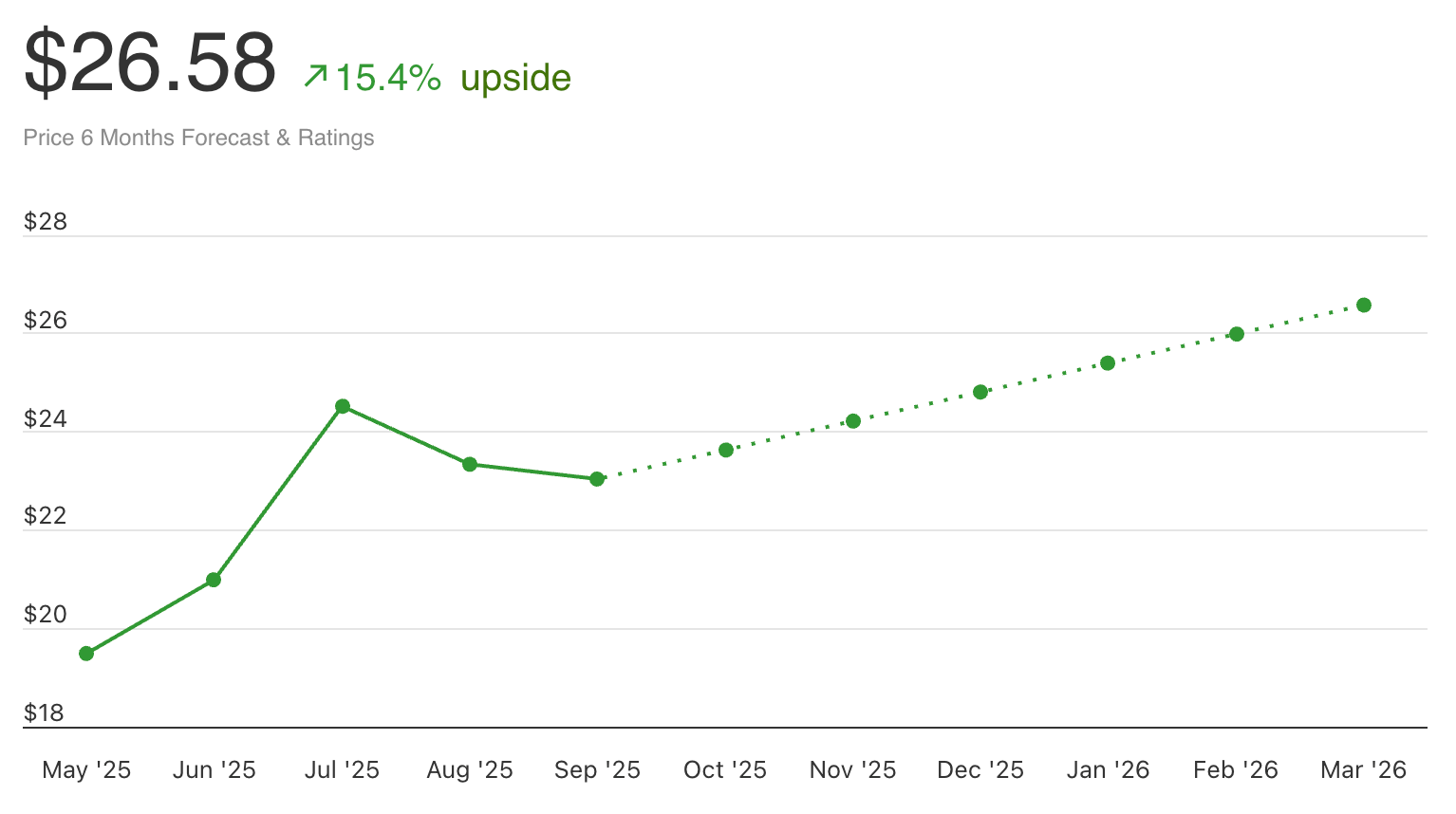

Current Price: $23.04

Price Target: $26.58

The Best Cloud Computing Stock

Nebius (NBIS) is an emerging player in their respective industry, showing impressive growth metrics over recent quarters. The company has experienced a significant increase in both revenue and profitability, indicating robust underlying fundamentals. Nebius's mission seems aligned with tapping into market opportunities and expanding its market reach, leveraging technology and innovative solutions.

The signals

Revenue: $103 million. Up 89.22% QoQ and 314.63% YoY

Net income: $574 million. Increased 612.18% QoQ and 685.38% YoY

Both short- and long-term stock price growth (+521.44% in the past year)

Over the past few months:

Job listings decreased by 39%

Web traffic increased 6%

Twitter followers are up by 49%

AI Score: 70/100

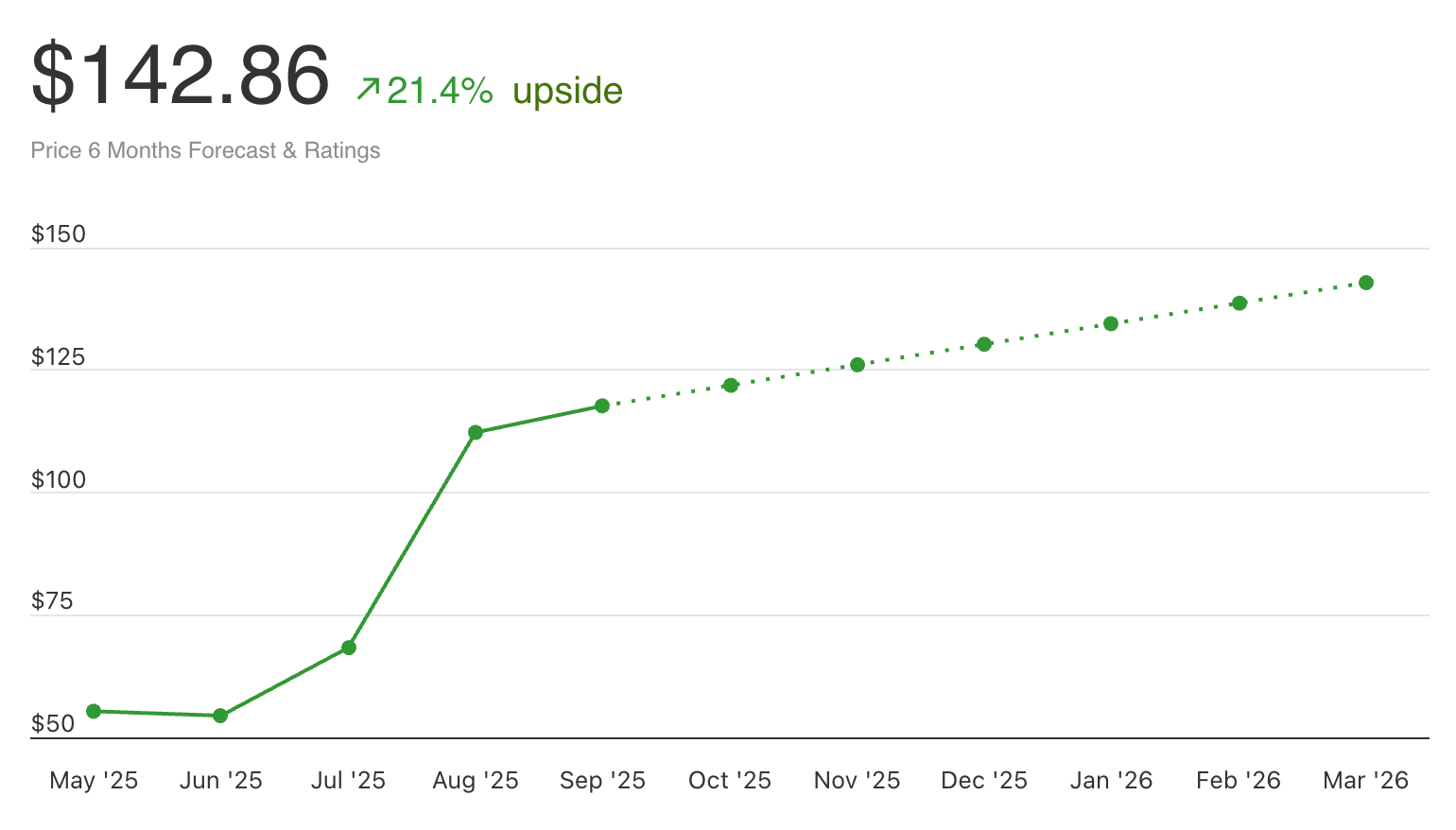

Current Price: $117.70

Target Price: $142.86

The Best Energy Stock

BWX Technologies, Inc. (BWXT) is a leading supplier of nuclear components and fuel to the U.S. government, a provider of environmental site restoration services, and a developer of advanced nuclear power technologies. BWXT operates through three segments: Nuclear Operations Group, Nuclear Power Group, and Nuclear Services Group. The company is noted for its robust product portfolio and strategic positioning within the defense and nuclear energy sectors.

The signals

Revenue: $764 million. Up 11.99% QoQ and 12.14% YoY

Net income: $78 million. Increased 3.79% QoQ and 7.42% YoY

Stock price has seen both short- and long-term growth

Over the past few months:

300% increase in Stocktwits mentions

Web traffic increased 53%

AI Score: 71/100

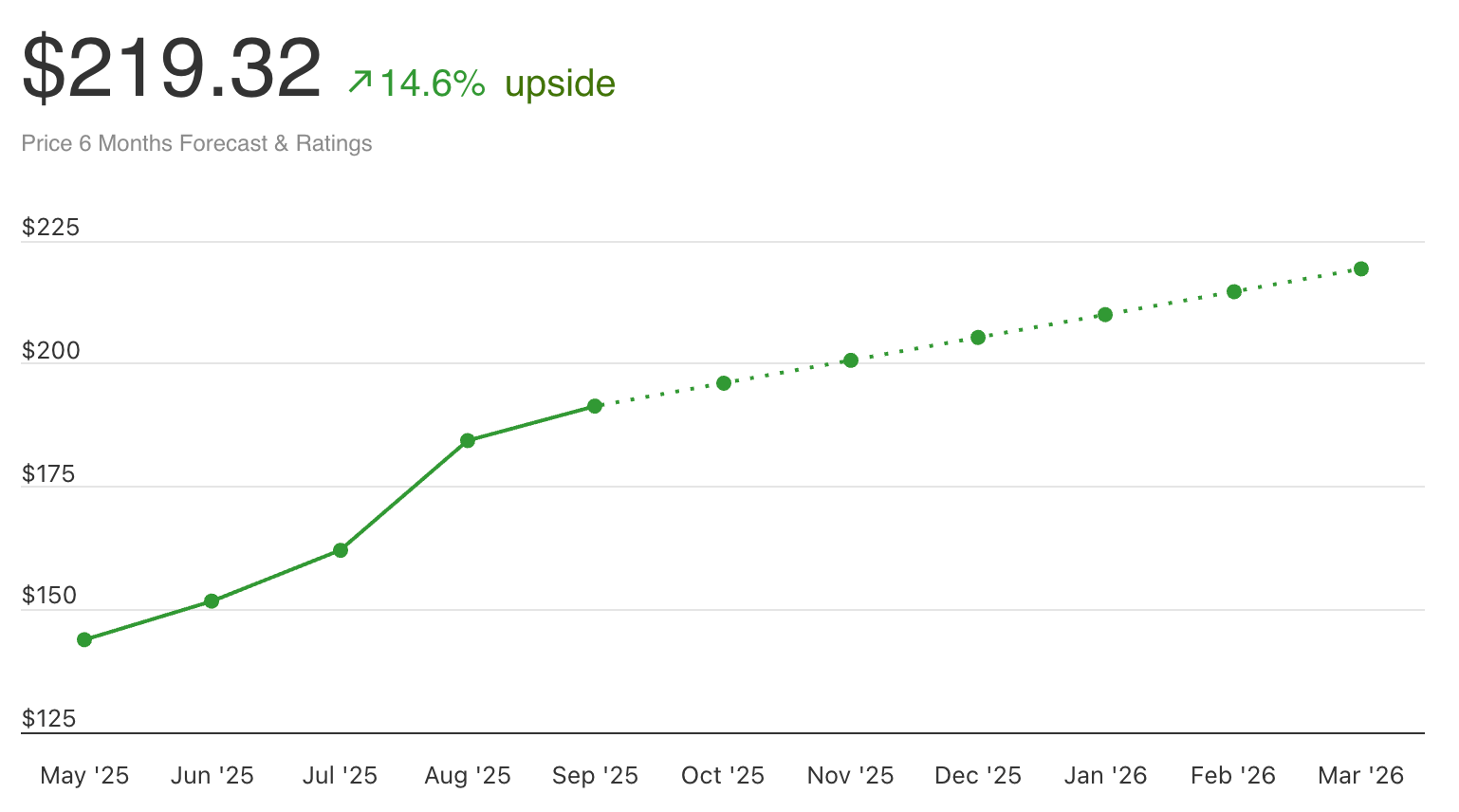

Current Price: $191.39

Target Price: $219.32

👋 See You This Friday

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.