🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update.

We have a sweet fintech stock in the top 10 for our spotlight today, but more important than that, we supercharged the Alt-Data Signals section below with some key new narratives and observations that we think you’ll like. Check them out and let us know your feedback. We’ll tweak as needed.

Alright, enough of the intro, on with the show!

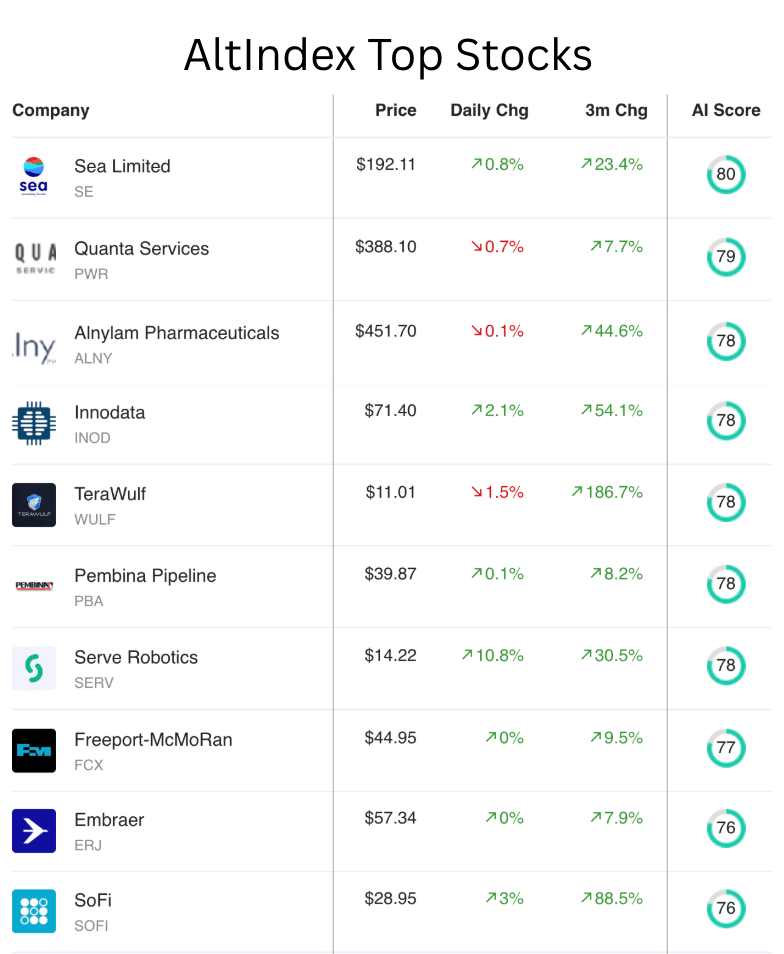

📈 Top AI Scorers of the Week

We see a lot of familiar faces on the Top Stocks list this week, but one newcomer catches our eye.

From starting as a Chamath Palihapitiya SPAC to becoming a profitable fintech company, ladies and gentlement, it’s SoFi! 👏

Whether you love it or hate it, it’s got steadily increasing revenue and net income, and its alternative data looks good as well.

Stock spotlight: SoFi (SOFI)

SoFi (Social Finance, Inc.) is a leading financial technology company that offers a wide array of services, including personal loans, student loans, mortgages, investment services, and banking products. The firm initially gained prominence through student loan refinancing but has since expanded its offerings to create a comprehensive financial ecosystem for its customers.

Notable narratives for SoFi from AltIndex’s news aggregator:

Strs Ohio just took a $984,000 position in SoFi $SOFI

Zacks rated SoFi as a level 2 buy and a “B” momentum style score

Mizuho raised their SoFi price target by $5 to $31 ($1 less than ours)

The data:

Revenue (Q2 2025): $1.12B, which is an increase of 8.16% QoQ and 30.30% YoY.

Net income (Q2 2025): $97M, up 36.77% QoQ and a staggering 458.85% YoY.

Both short- and long-term bullish price momentum. Shares are up 27.38% on the month and 260.00% over the past year.

P/E ratio (price/earnings): Pretty high at 54.28.

Analyst rating: Mixed. $SOFI has 6 buy ratings, 12 hold ratings, 2 underweight ratings, and 4 sell ratings. So, a 25% buy rating and a 50% hold rating.

But the analysts might not be looking at alt data 👇

Alt data from the past few months:

Reddit mentions ↑ 150% the past three months, ↑ 103.1% just today

Stocktwits mentions ↑ 23.6%

Daily app download rate ↑ 7%

Employee business outlook ↑ 11%

The rating:

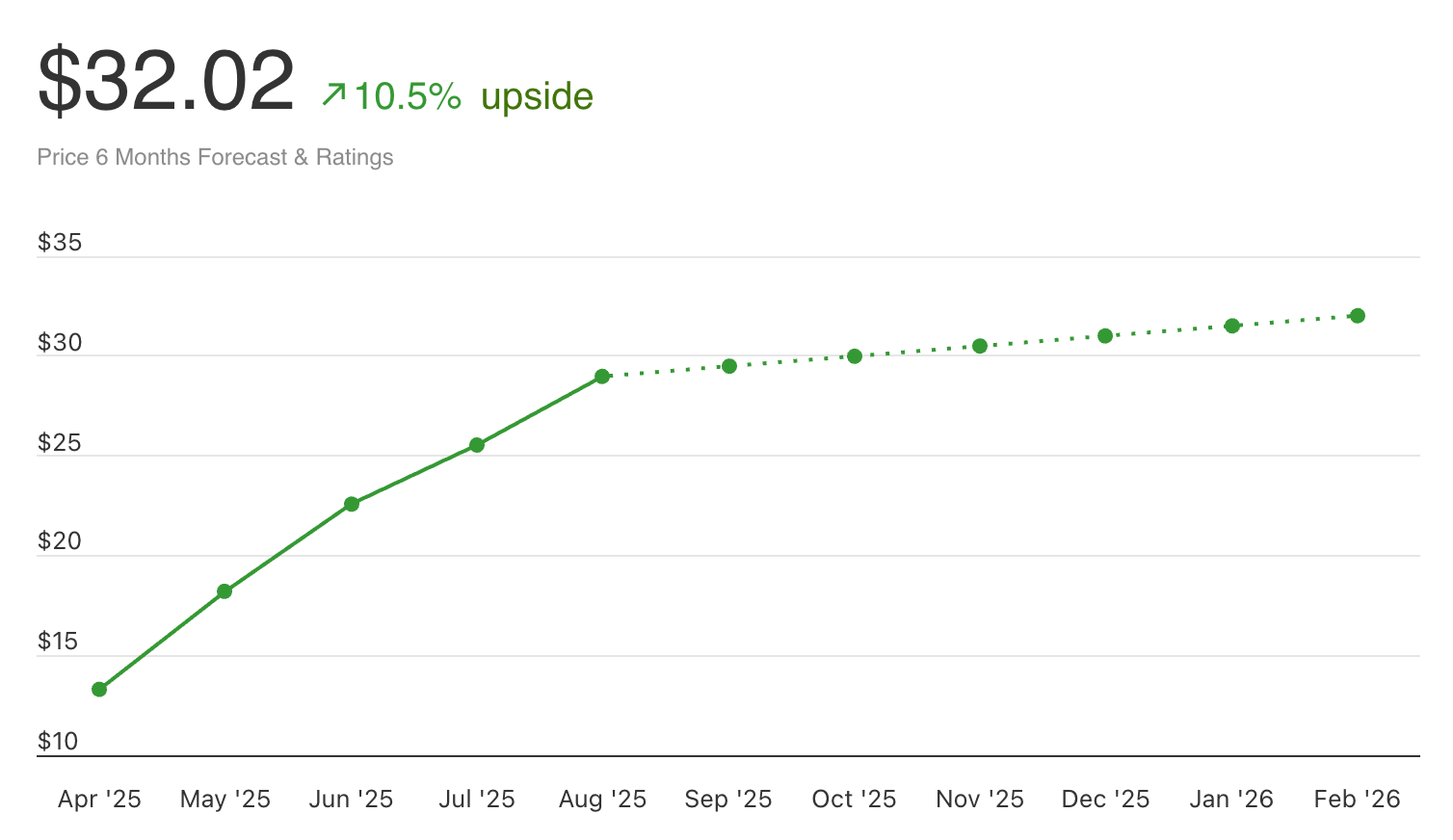

AI score: 76 — a buy signal.

Current price: $29.15

Price prediction: $32.02 (10.3% upside)

Bottom line:

In summary, SoFi presents a compelling growth story underpinned by strong revenue and net income performance. From a technical perspective, the stock shows a positive trend. While the high P/E ratio is a point of caution, it doesn’t outweigh the positive trends in fundamental performance and alternative data insights our model is seeing.

So, SoFi looks like a potentially attractive investment opportunity, given its growth trajectory, operational improvements, and positive sentiment indicators. Investors, however, should consider the potential risks and conduct further due diligence before making any investment decisions. This is not financial advice.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

People are talking heavily about FedEx’s (FDX) earnings forecast for 2026 on Reddit, which was below estimates (probably because of tariffs). There was still excitement around FDX’s massive surge at the closing bell yesterday though. There are also jokes about FedEx’s earnings being boosted by stolen Pokémon cards, lol.

Some Reddit users are planning to hold on to their Atlasclear (ATCH) stock until September 29th, which is when the company's 10-K report is expected to be released.

Columbia Sportswear (COLM) job posts are up 62.8%, and COLM is close to a buy rating. In fact, its AI score rose by a massive 47% earlier this month and has stayed there.

Congressman Rich McCormick is only just now disclosing trades that he made in 2023. The disclosure deadline is 30 days after trades are made.

🍟 Small Data Bites

QuantumScape (QS) Reddit mentions are up 255.9%.

Duolingo (DUOL) Reddit mentions are up 178.1%.

ASML (ASML) Reddit mentions are up 131.7%.

C.H. Robinson Worldwide (CHRW) job listings are up 94.4%

Want instant access to data like this anytime, before the news hits?

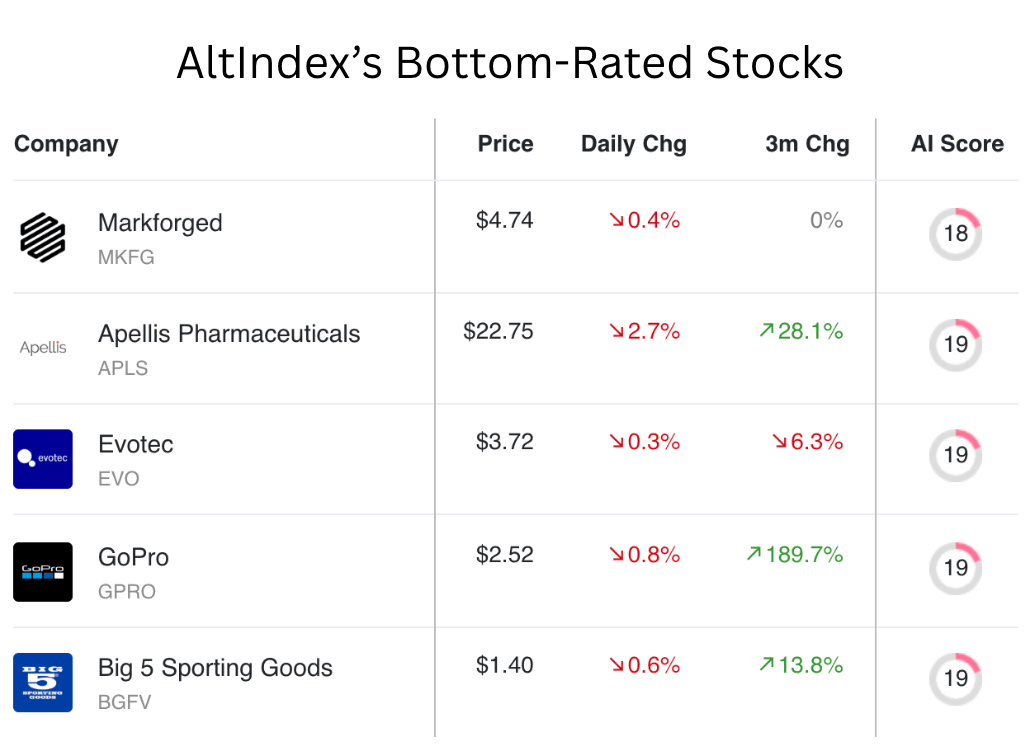

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

We have a stock screener that allows you to sort stocks by industry, AI Score, job posts, Reddit comments, web traffic, and more.

Drilling down to more specific sectors and sorting by alternative data can sometimes yield more useful results than just sorting by “top performers” and “bottom performers.”

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.