🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

This week was a doozy. Anyone else feeling numb to the endless AI deal announcements? Meanwhile, everyone seems to be screaming at each other about whether the AI industry is in a bubble or these AI stock prices are warranted.

Luckily, the data doesn’t care about any of that.

Today, we’re bringing you the spiciest alternative data signals along with a stock pick fresh from our AI model’s top five.

(Oh, and we’ll share 4 congressman trades that did pretttty well, besides UNH)

Can’t wait to jump in.

Trade What You Can See, Not What You Can't Predict

Everyone's screaming about AI bubbles and dollar crashes.

Meanwhile, you're frozen. Should you buy? Sell? Wait?

Here's what actually matters:

Reddit mentions spiked 3,968% before DOOR surged 530%.

Nancy Pelosi bought TEM options months before the position was up 178%.

Palantir doubled its job postings, then PLTR grew 42% in three months.

In any market (even a bubble), some stocks will outperform. And you can follow the actionable signals instead of guessing at vague narratives.

With the AltIndex app, you can track Reddit sentiment, Congress trades, hiring trends, and more in real-time. Get alerts when your watchlist stocks show signals. And we’re giving you a free 7-day trial.

See which stocks are showing signals right now.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Buys

Richard McCormick (R-GA, House) took some major profits recently. He bought these four stocks in March of 2023 (but didn’t disclose the purchases until last month 😅). Then yesterday he disclosed the sales of these stocks.

Here’s how he did on his two-year investments, all bought on Mar. 15, 2023 and sold on Sep. 18, 2025:

Sold Microsoft (MSFT): +91.55%

Sold Blackrock (BLK): +80.00%

Sold L3Harris Technologies (LHX): +40.82%

Sold United Health (UNH): -28.06%

Reddit Buzz

Nebius (NBIS) is gaining traction on Reddit but the opinions are mixed. Some users highlight the company's potential growth due to its 28% ownership in Clickhouse, which is expected to go public next year and could significantly increase Nebius' value. However, other users express dissatisfaction and disappointment with the company's performance.

Oklo (OKLO) mentions are rising too, and people are primarily saying that it might be a good energy stock to invest in during market dips. Some users are sharing their personal success stories with Oklo's stock performance, while others are highlighting the company's potential competition in the nuclear reactor industry.

And Rocket Lab (RKLB) mentions are everywhere too, with a focus on its recent increase in value. Users are sharing their positive experiences of investing in the company, with some expressing regret for not buying more shares. There is also speculation about a user who made a significant investment in Rocket Lab and discussions about bets related to the future price of the stock.

Miscellaneous

Dillard’s (DDS) job posts have decreased 72.1% over the past month.

United Health (UNH) sentiment is up 10.2% to 85/100.

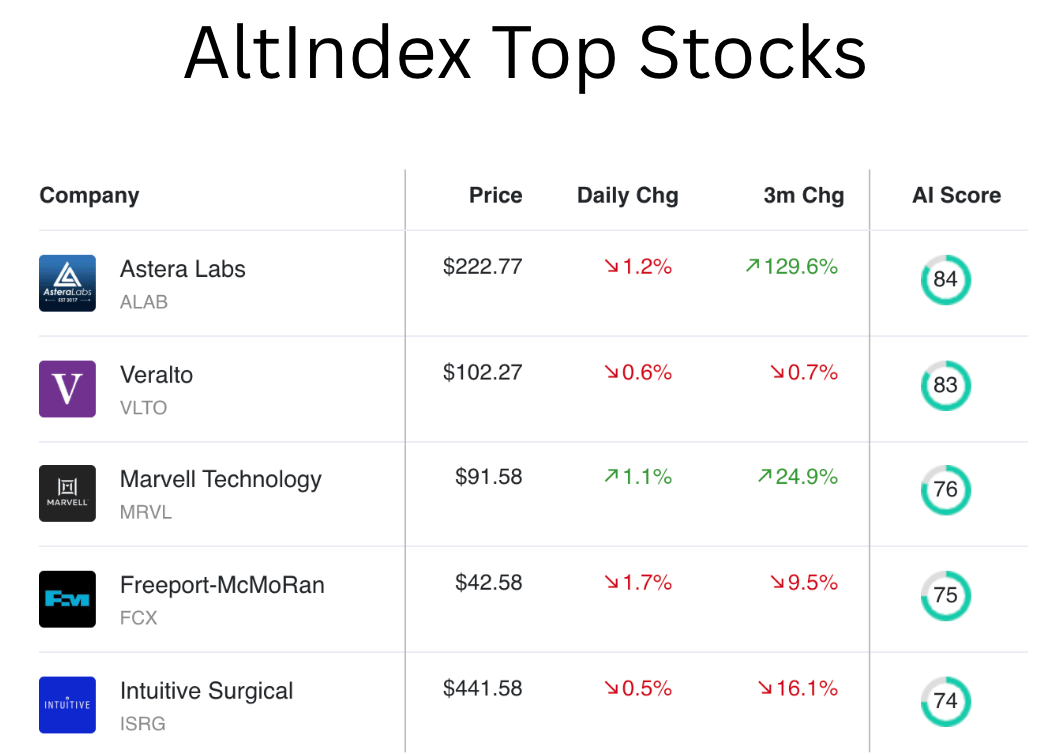

📈 Top AI Scorers of the Week

The robotics trend is not over and may be picking up steam. Yes, ALAB (an AI king) is still at the top, and yeah, industrial player Veralto’s score is pretty great too, but we’ve covered ALAB extensively and we talked to you about Veralto 3 days ago.

Meanwhile, the robotics company Intuitive Surgical (ISRG) just broke into the AltIndex top 5.

This is the highest “buy” signal our AI model has given the surgical robotics stock since February. Here’s why it got the rating.

Stock spotlight: Intuitive Surgical, Inc. (ISRG)

Intuitive Surgical, Inc. is a global technology leader in minimally invasive surgical systems. The company designs, manufactures, and markets the da Vinci Surgical System, a robotic-assisted surgical platform. The da Vinci system enhances the capabilities of surgeons by providing high-resolution 3D vision, enhanced dexterity, and greater precision.

The data:

Revenue: $2.44 billion. Up 8.28% QoQ and 21.40% YoY.

Net income: $658 million. Decreased by 5.73% QoQ but increased 24.96 YoY.

PE Ratio: high at 62.32

Price trend: negative, dropping 3.21% over the past month and 10.16% the past year

Analyst rating: 76% buy

Alternative data from the past few months:

Stocktwits mentions ↑ 833%

Job listings ↑ 6%

Web traffic ↓ 11%

Employee business outlook is 88% positive

Lobbying cost ↑ 85%

Recent insider selling trend

A congress member bought ISRG in August

The verdict:

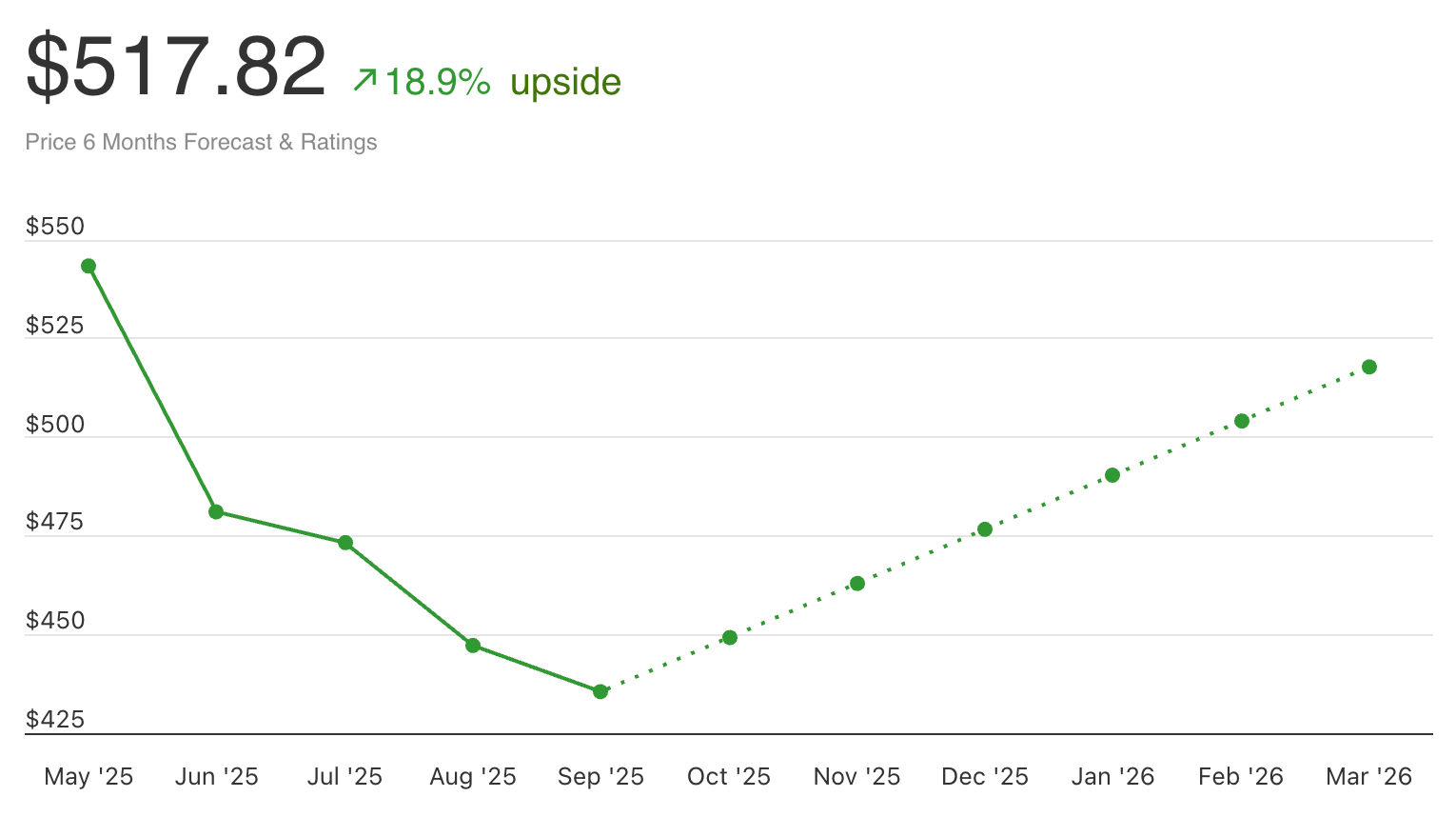

AI score: 74 — a buy signal.

Current price: $435.25

Price prediction: $517.82 (18.9% upside)

Bottom line: In conclusion, Intuitive Surgical shows solid financial health and positive long-term growth indicators with strong revenue and net income growth (besides QoQ net income). However, the recent insider selling may suggest caution; it could also just be an instance of profit taking. The technical analysis indicates a bearish trend in the short term, while alternative data presents a mostly positive picture with positive employee sentiment, extreme growth in Stocktwits mentions, and increasing job postings but declining web traffic.

Given these factors, our AI model recommends adopting a cautiously optimistic stance toward Intuitive Surgical's stock. Investors should consider the long-term growth prospects but remain wary of short-term volatility and potential overvaluation.

Want instant access to scores like this—any time, before the news hits?

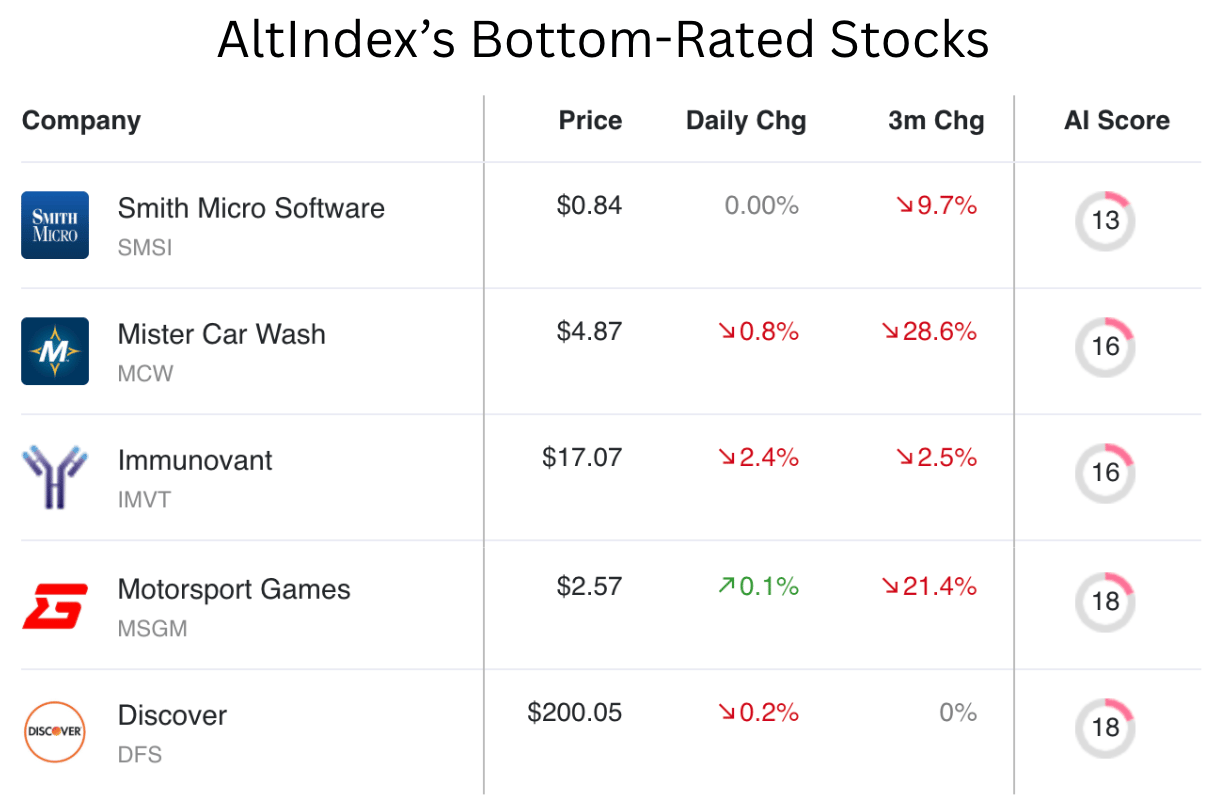

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.