- AltIndex

- Posts

- Today's AI Stock Picks, Data & Scores

Today's AI Stock Picks, Data & Scores

Free, weekly email with top AI scores, stocks trending down, alternative data & more you can use to help make smarter investment decisions.

🧠 The Signal Brief - AI Stock Insights & Picks

Well, Jerome Powell’s speech at Jackson Hole signaled rate cuts in September. Great. But what now?

Our AI model has already highlighted stocks that it sees as poised to break out in the coming months—we’re sharing a new one with you today and diving into the data.

Hint: it’s in pharma, its name is a flower, and it’s been around since the 1800s.

But first, today’s partner Pacaso is offering readers the opportunity to buy private shares in its $110 million profit business:

Get Top AI Stock Picks— Now in Our App

The average investor only does 6 minutes of research before buying a stock.

Is that long enough to get an edge over the market by yourself?

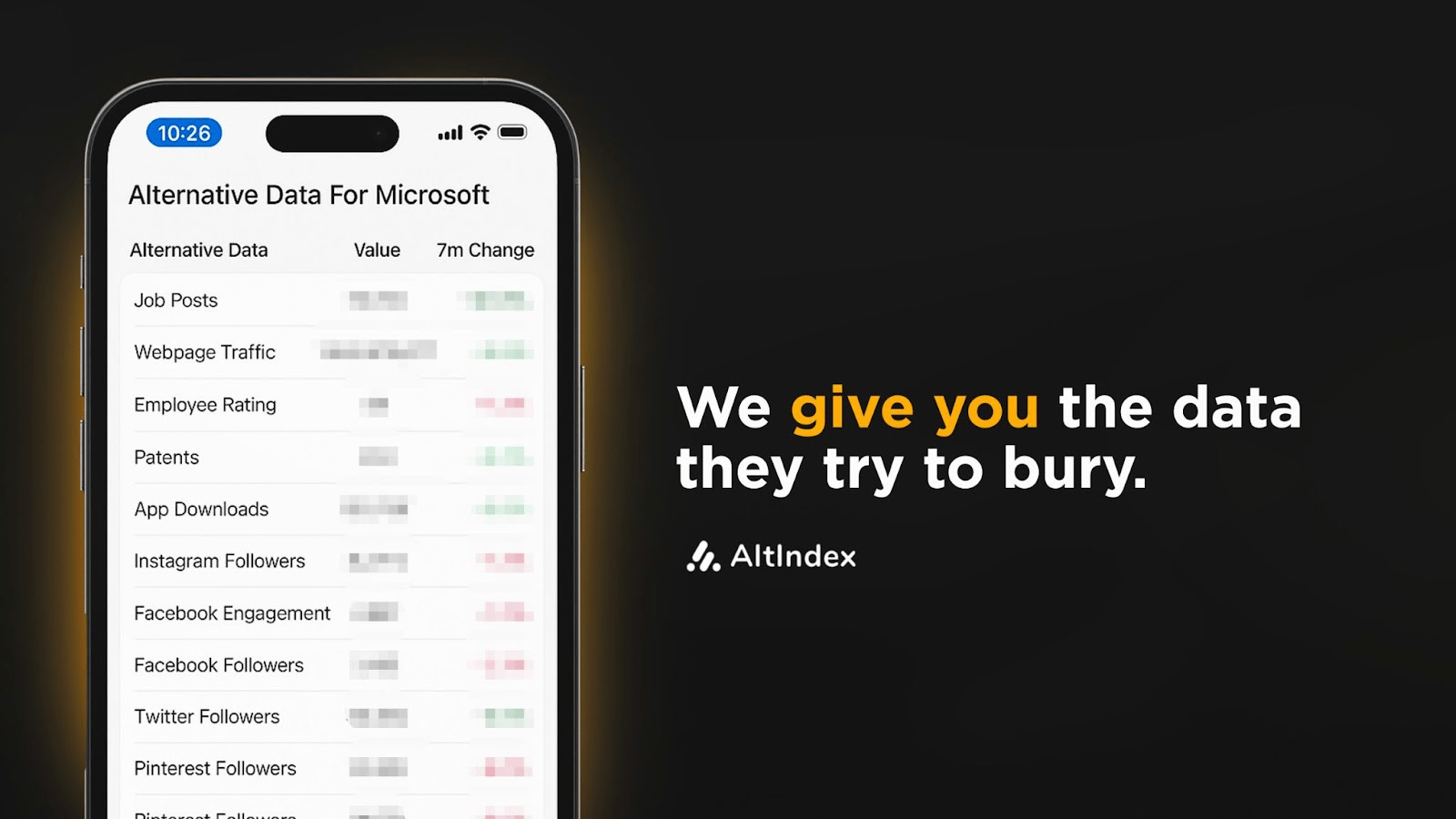

No, but it is long enough to use AI to inform your stock picks—now conveniently on your phone in our iOS app...

AltIndex uses wide-reaching alternative data and technical analysis to arrive at its stock picks.

It’s easy to incorporate into your trading flow, too, with a built-in portfolio feature and daily alerts.

Get an edge you won’t find elsewhere with AltIndex’s unique AI-powered stock picks—generating an average of 22% returns over six months.

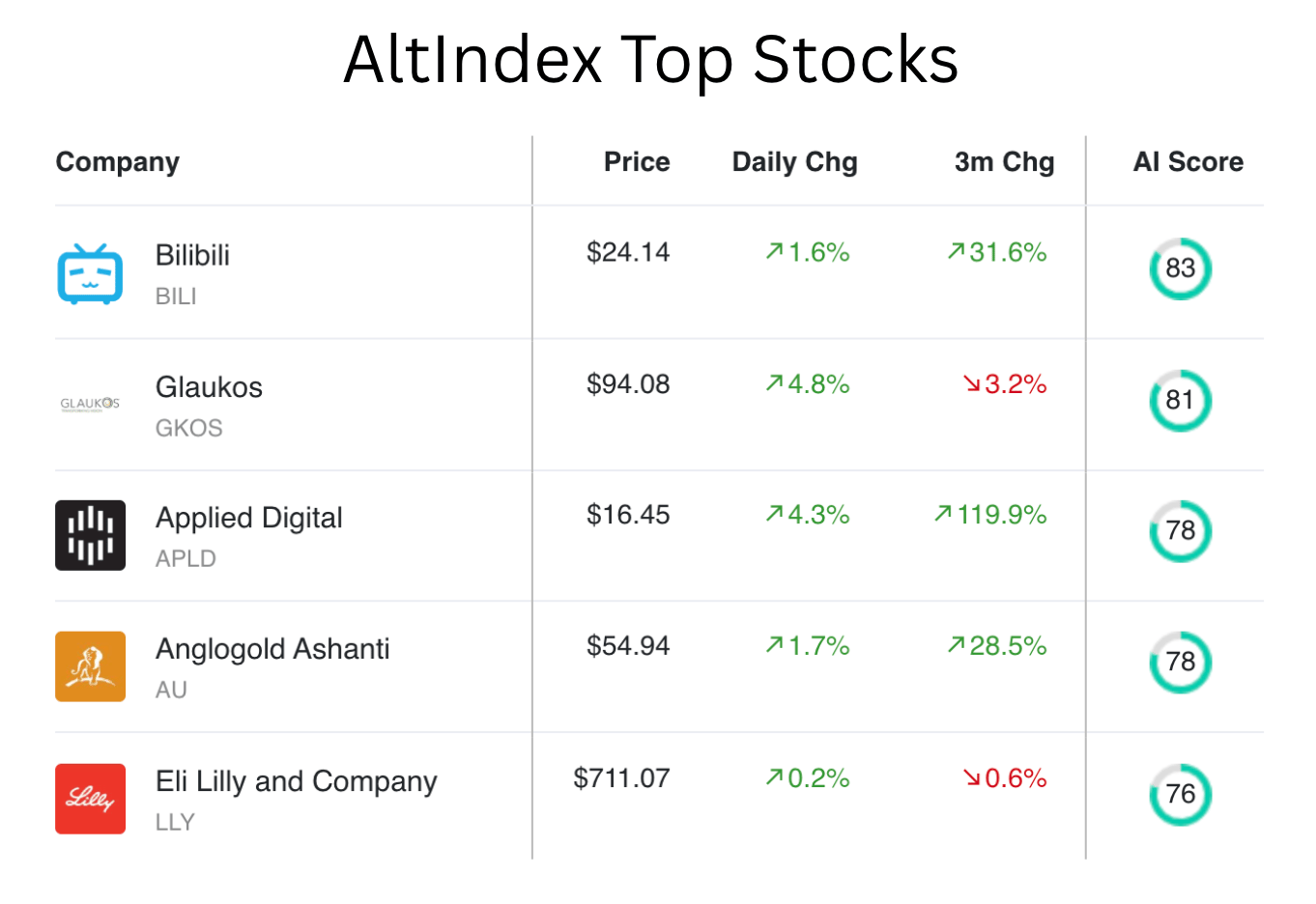

📈 Top AI Scorers of the Week

Bilibili, Glaukos, and Applied digital have continued their reign at the top of our stock rankings, but the next-highest scorers are in gold and pharma—Anglogold Ashanti and Eli Lilly.

Wait, Eli Lilly? You mean the weight loss drug company that’s down 25% YTD?

Yes. Let us show you the insider buying, the congress trades, and the financials—it’ll make more sense then.

Stock spotlight: Eli Lilly and Company (LLY)

Eli Lilly has had a tumultuous year, and has certainly seen its fair share of shakeups as the health care and pharmaceutical industries have been in the Trump administration’s crosshairs so far.

However, things haven’t been all bad—and our AI model predicts a serious potential upswing in price for $LLY over the next six months.

The data:

Insider and Congress buying: 9 company insiders bought a total of $5.2 million in stock in August. 2 different congress members bought $LLY in July.

Revenue: $15.6 billion last quarter, which is a 37.64% increase YoY (and a 22.23% increase QoQ).

Net income: At $5.66 billion last quarter, Eli Lilly’s net income is up 105.14% QoQ and 90.78% YoY.

EBITDA: $7.5 billion, which is a dramatic increase of 80.27% from the previous quarter and 82.35% from last year.

Alt data from the past few months:

Job listings ↑ 38%

Instagram followers ↑ 11%

85% positive employee sentiment

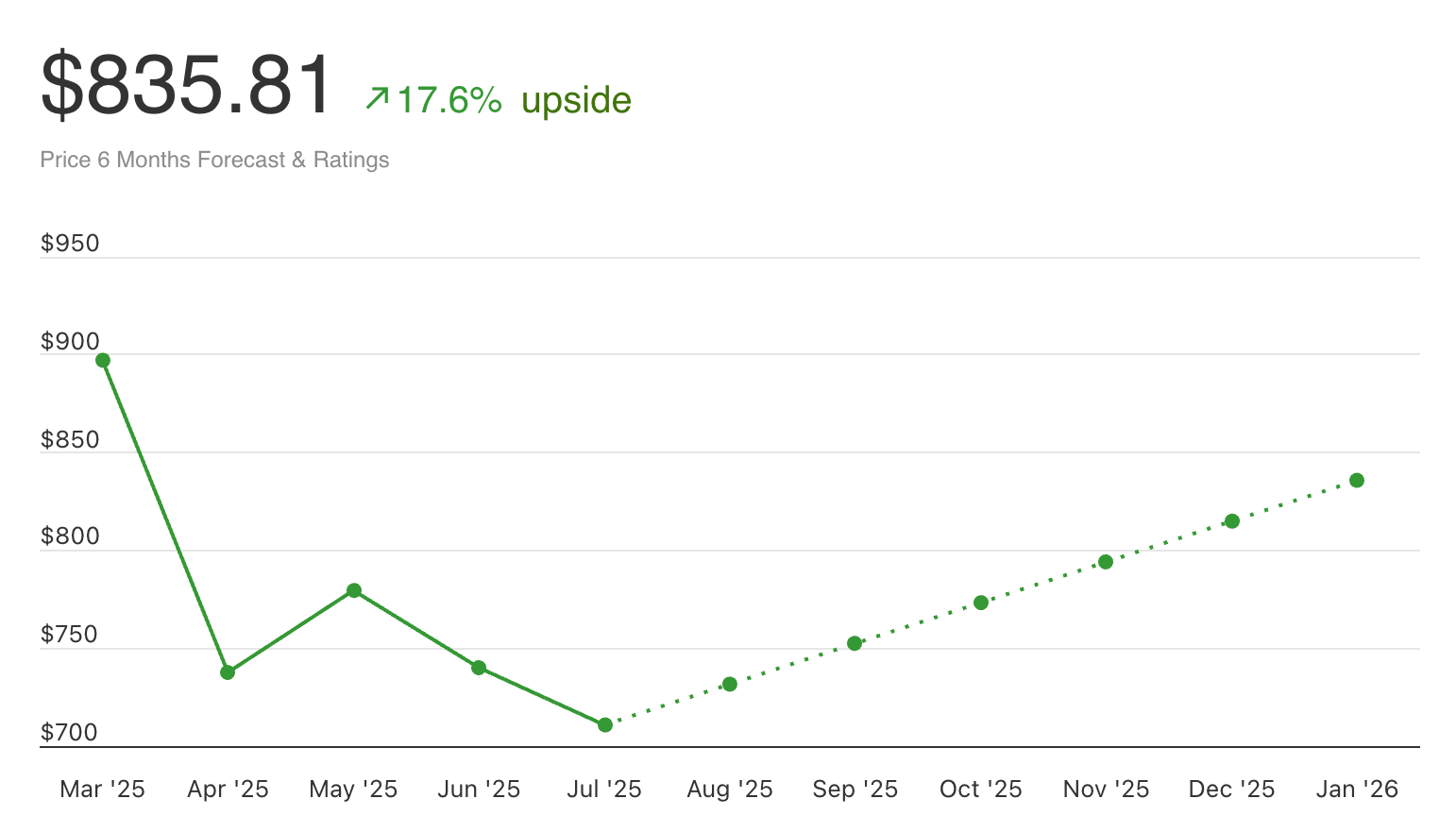

The chart:

AI score: 76 — buy signal.

Current price: $710.50

Price prediction: $835.81 (17.6% upside)

Bottom line: Eli Lilly and Company shows strong financial health and operational efficiency, as evidenced by significant increases in revenue, net income, and EBITDA. The technical indicators suggest that, despite a recent decline in the stock price, the long-term outlook remains bullish. And thus, our model arrives at a “buy” signal. Always do your own research, and this is not financial advice.

Want instant access to scores like this—any time, before the news hits?

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Interestingly, mentions of all stocks seem to be down on Reddit today, possibly because everyone was posting memes about Fed Chair Powell’s speech.

Intuit $INTU sentiment fell 13.2%, likely because of its less-than-ideal revenue forecast for the coming quarter.

Applied Industrial’s $AIT job listings are up 86.1%.

Commerce Bancshares $CBSH has gone from a “buy” rating to a “sell” rating on AltIndex over the course of just 2 weeks.

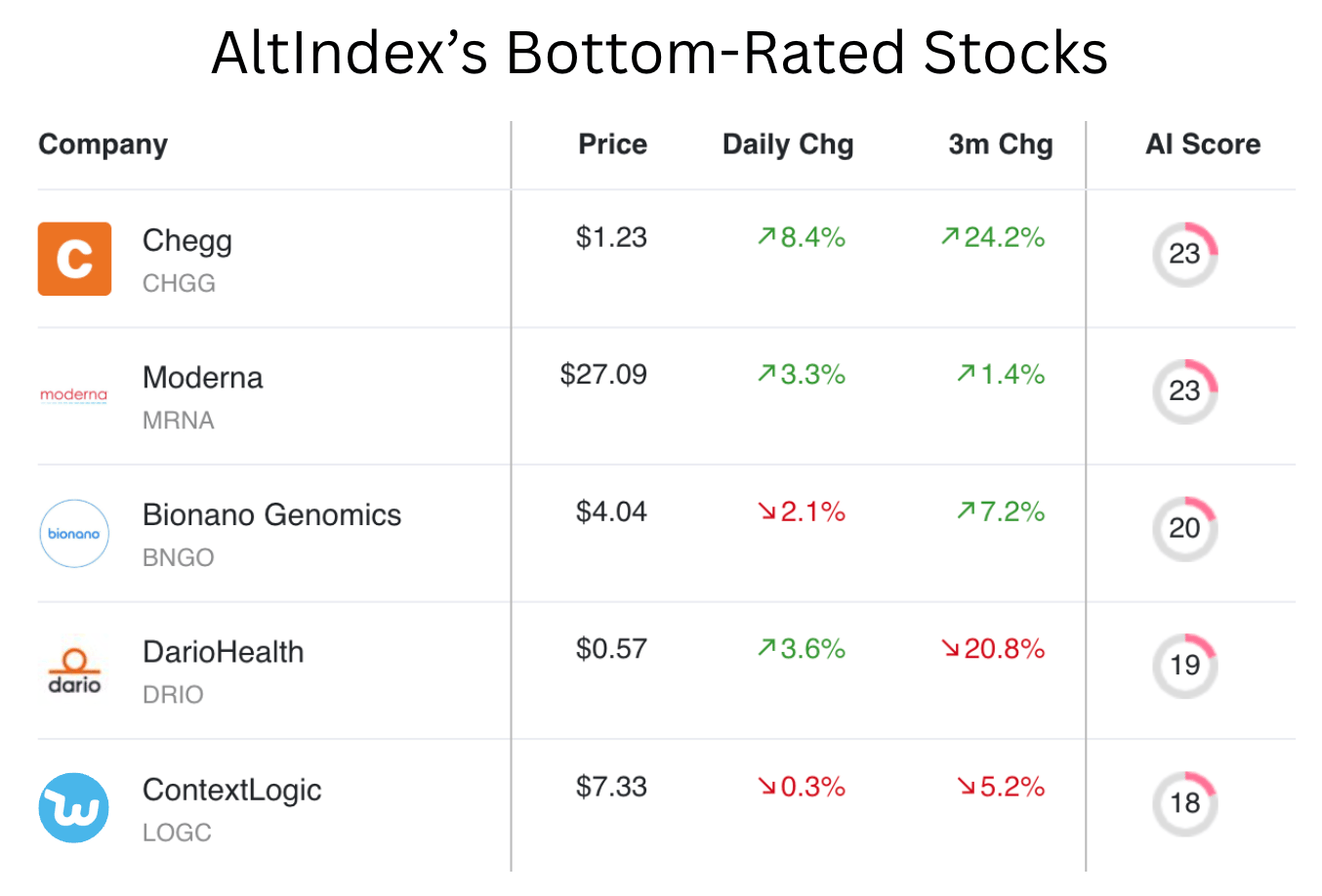

📉 Lowest Scores: Stocks Losing Signal

And here are the stocks that have not made it—and that our model thinks will not make it. Chegg may have helped you get through high school and gen eds in college, but it may not be able to help your portfolio (unless you like shorting stuff).

☝️ Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦️ Tweet of the Week

NOTICE: $ORIS stock is currently overshorted more than $GME in 2021

Short squeeze opportunity?

It's got 155% short interest over float

(GME was "only" around 140%)

Hadn't seen many people talking about it.

Do with this information what you will.

— AltIndex (@AltIndexCom)

9:14 PM • Aug 18, 2025

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Thumbnail image: Diabetes Education Events, Flickr

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.