🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

Today:

A nutrition/chemicals company that just broke its old sales and profit records

One of Congress’s best traders is back with brand new buys

A huge potential opportunity in Hollywood’s weight loss drugs: Peptides

From Hollywood to Main Street

Celebrities proved peptides work. Now a Canadian innovator is taking them to the masses with needle free peptide delivery. See the story.

On Behalf of Pangea Natural Foods

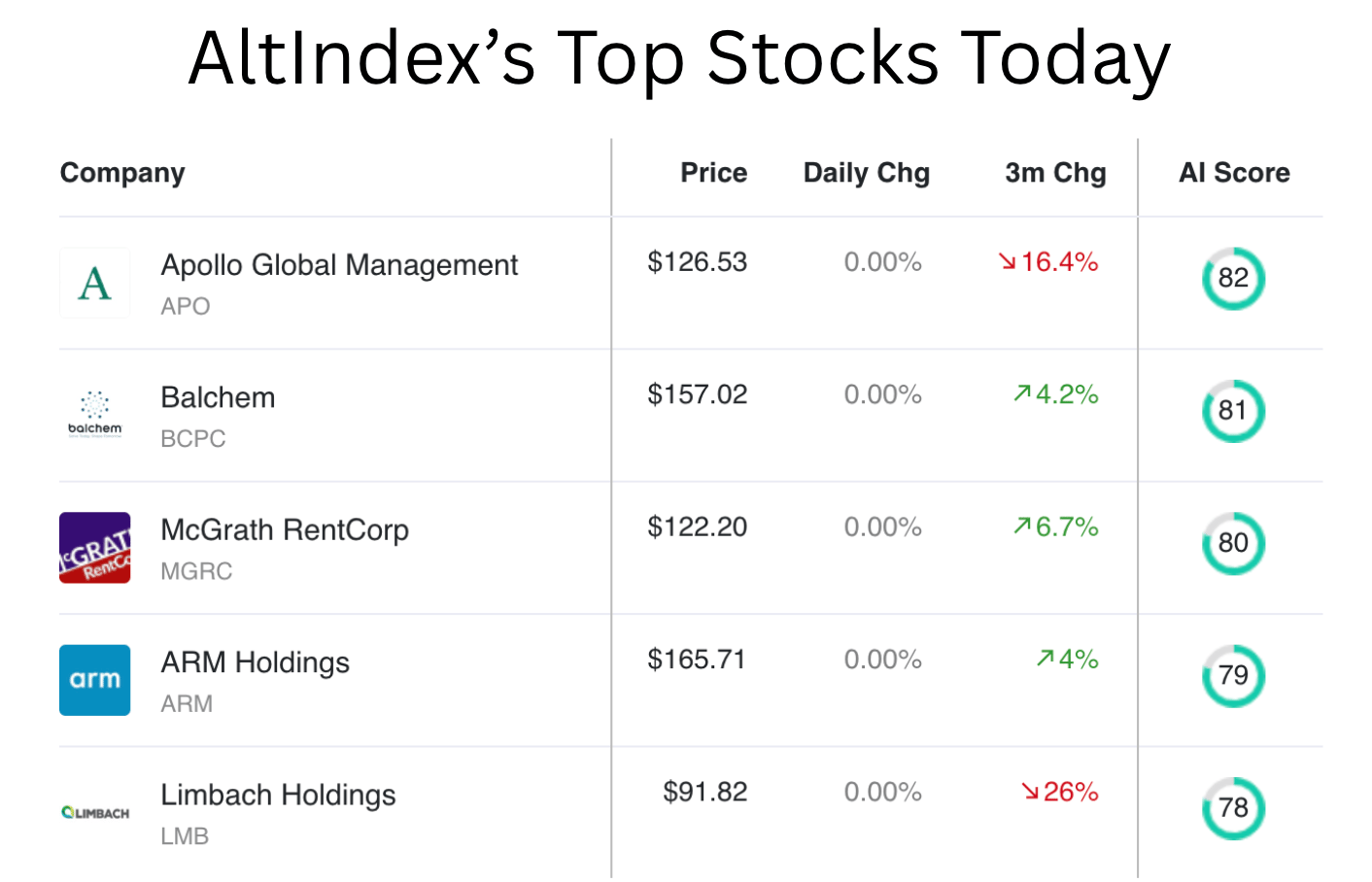

📈 Top AI Scorers of the Week

Ever heard of Balchem (BCPC)? We hadn’t either until they CRUSHED their earnings report yesterday:

Record sales

Record profit

Expansion plans

And an interesting tidbit… it’s currently priced at about 75% of its “most widely followed narrative fair value.”

Let’s look a bit deeper.

Stock spotlight: Balchem (BCPC)

Balchem Corporation develops, manufactures, and markets specialty performance ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets in the United States and internationally. It operates through three segments: Human Nutrition and Health, Animal Nutrition and Health, and Specialty Products.

Notable narratives for BCPC from AltIndex’s news aggregator:

BCPC just reported record sales and profit results yesterday and announced plans to expand manufacturing capacity.

Investing group leader The Value Pendulum on Seeking Alpha just raised its BCPC rating from a hold to a buy.

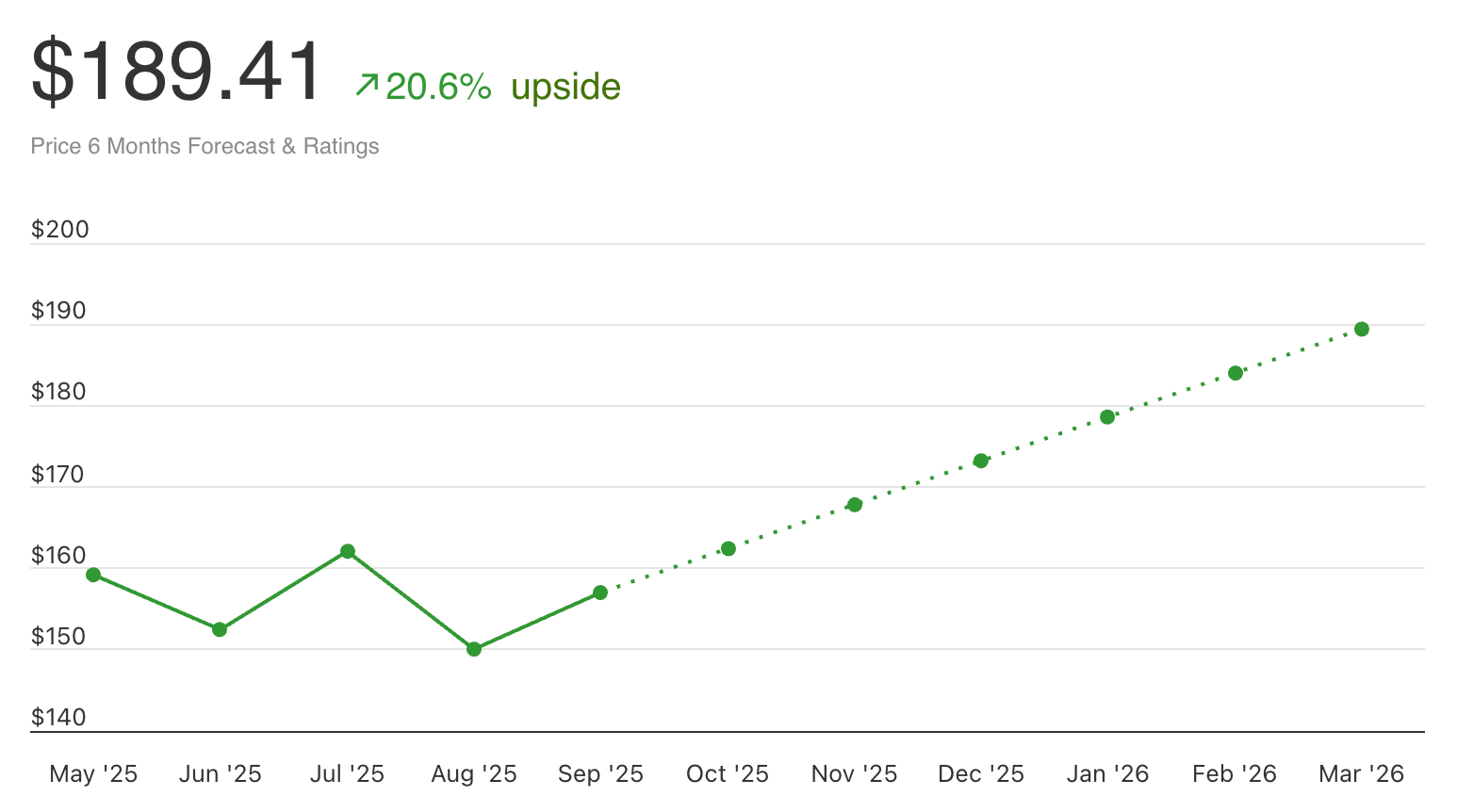

Price prediction:

The data:

Revenue: $255M. Up 1.98% QoQ and 13.23% YoY.

Net income: $38M. Up 3.31% QoQ and 19.36% YoY.

EBITDA: $41M. Down 34.42% from the last quarter and down 30.00% from last year.

Analyst rating: 100% buy (very small amount of total ratings though)

Price Momentum: Positive short-term price movement (+2.15%), negative long term (-5.01%)

Insider trades: there was some insider selling in Aug and May, potentially signaling profit taking

P/E ratio: high at 35.98

Alt data from the past few months:

Stable job listings (45 openings)

Employee business outlook ↑ 6% (overall: 83% positive)

Web traffic ↓ 7%

The verdict:

AI score: 81/100 — a buy signal.

Current price: $157.02

Price prediction: $189.41 (20.6% upside)

Bottom line: Balchem exhibits strong fundamentals with increasing revenue and net income. Despite concerns in EBITDA performance and a high P/E ratio suggesting potential overvaluation, the company's overall financial health appears robust (especially with record-breaking revenue in mind). The technical analysis points toward a bullish short-term trend, but long-term concerns remain present. Employee sentiment is positive, though declining web traffic may signal future challenges in customer acquisition.

Given these insights, our AI model gives Balchem a “buy” rating overall (and the second-highest buy rating on our platform, at that). Always do your own research and take all factors into consideration, positive and negative.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Congresswoman Marjorie Taylor Green made some new buys on Oct 9th and 15th, and they are exactly what you’d think: mainly tech and crypto (with some others mixed in). Reported on Oct 21.

Buy (twice): iShares Bitcoin Trust (IBIT)

$1K - $15K x 2

Buy: Tesla (TSLA)

$1K - $15K

Buy: Exelon (EXC)

$1K - $15K

Buy (twice): Amazon (AMZN)

$1K - $15K x 2

Buy: UPS (UPS)

$1K - $15K

Reddit Alerts

Beyond Meat (BYND) mentions are up 288,700% this month. The Beyond Meat buzz has been unreal, focusing particularly on the company's insane stock performance. Redditors are encouraging each other to hold onto their shares, anticipating a significant increase in the share price due to what they believe is a short squeeze. The community also discusses data related to short borrowing and dark pool numbers, with some expressing optimism about the future of BYND's stock.

Tesla (TSLA): People are actively discussing Tesla in relation to its potential as a call option investment. They suggest that buying a call a few months out could limit IV crush and potentially yield more gains if the stock price increases. However, they also warn about the risks of deep OTM options shortly after earnings, stating that even with significant price increases, investors could still lose due to the low odds of such options hitting their target.

reAlpha Tech’s (AIRE) Reddit mentions are up by 1055%

Other Alternative Data Signals

J.B. Hunt Transport Services (JBHT) increased its job listings by 89.6%

Udemy’s (UDMY) TikTok followers grew by 17.8%

Want instant access to data and stock ratings like this at any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algorithms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.