🧠 The Signal Brief: Special Edition

Hello, and welcome to the AltIndex newsletter. In today’s special edition, we’re back again to show you 5 stocks that our AI model thinks will outperform the rest of their industries.

This time, we’re hitting metals, quantum computing, healthcare, defense, and retail.

And a look into the fintech stock that’s replacing Palantir, Microsoft, and FICO for banks:

On Behalf of The FUTR Corp.

Tiny Float. $100M Pipeline.

Scarcity plus a roadmap to triple-digit millions creates rare upside.

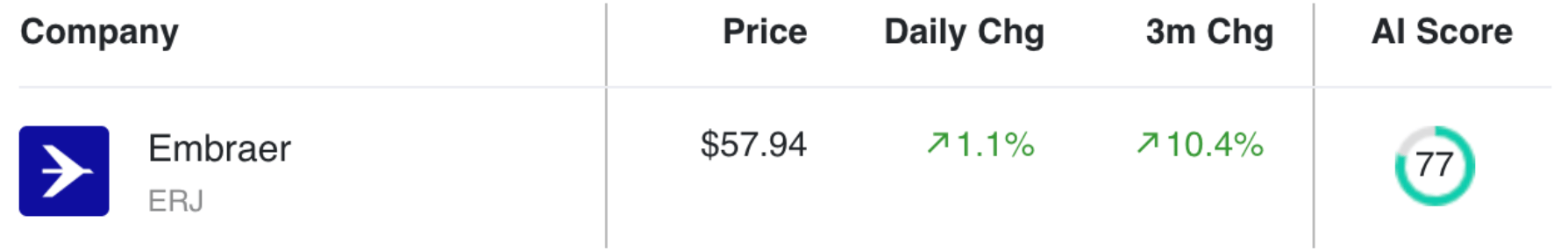

The Best Aerospace & Defense Stock

Embraer (ERJ) manufactures regional aircraft, business jets, and defense and security products. The company also offers a range of services to support its installed base of hardware. Its defense and security business is currently focused on developing the KC-390 military transport aircraft.

The signals

Revenue: at $1.82 billion, revenue increased 64.93% QoQ and 21.75% YoY

Net Income: $79 million. Increased 7.08% QoQ but decreased 20.93% YoY

ACGL has both short- and long-term positive price momentum

Over the past few months:

13% increase in job listings (could signal company growth)

22% increase in web traffic (could indicate more sales)

82% positive employee business outlook

AI Score: 77/100

Current Price: $57.94

Target Price: $68.64

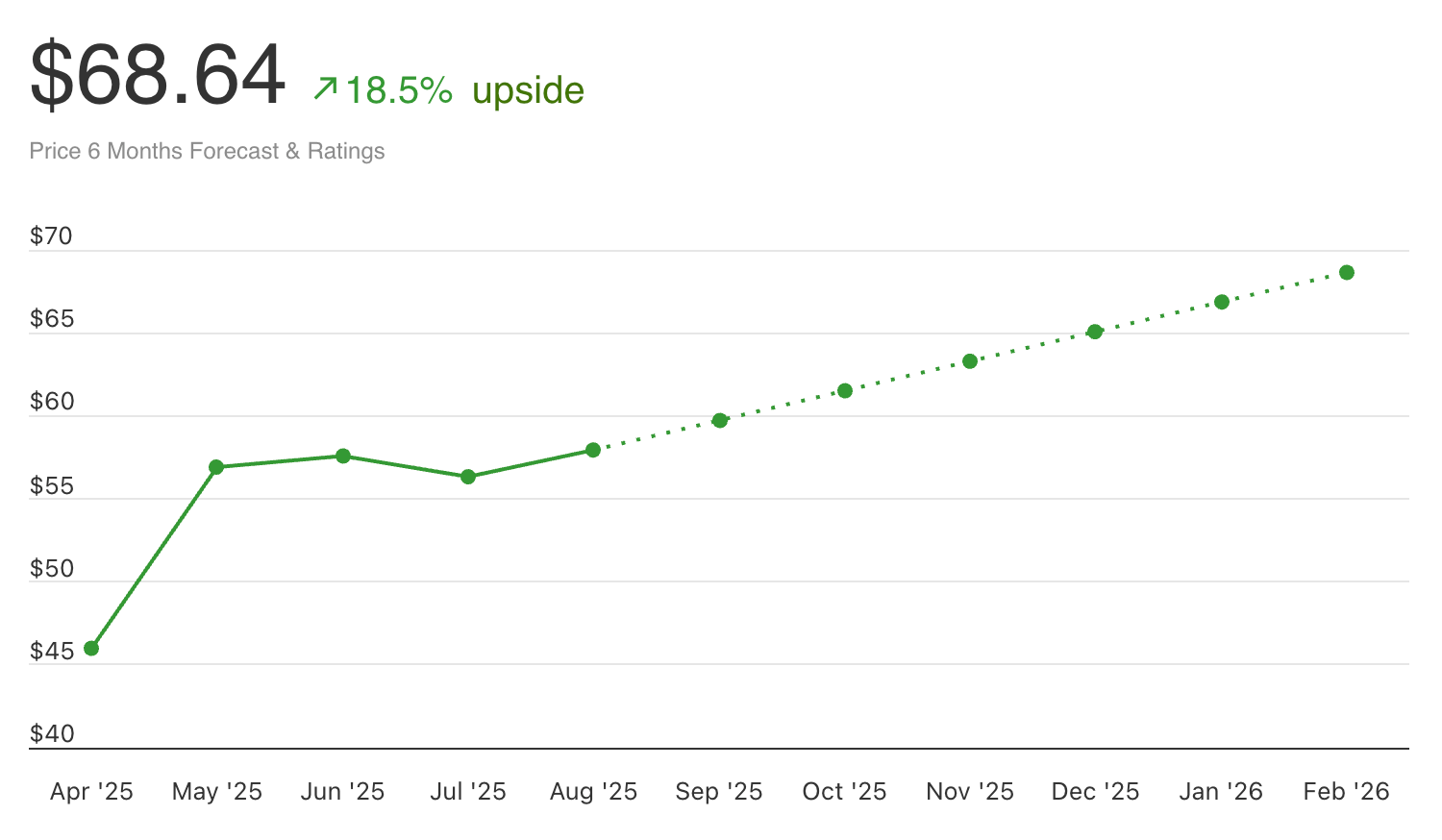

The Best Metals Stock

Freeport-McMoRan Inc., often called Freeport, is an American mining company based in the Freeport-McMoRan Center, in Phoenix, Arizona. The company is the world's largest producer of molybdenum, is a major copper producer and operates the world's largest gold mine, the Grasberg mine in Papua, Indonesia.

The signals

Revenue: $7.58 billion. Up 32.29% QoQ and up 14.50% YoY

Net Income: $772 million. Up 119.32% QoQ and 25.32% YoY

FCX has both positive short- and long-term price momentum

Over the past few months:

9% increase in job postings

54% increase in web traffic

11% increase in Instagram followers

AI Score: 80/100

Current Price: $44.94

Target Price: $53.97

The Best Online Retail Stock

Mercado Libre, Inc. (MELI) is the leading e-commerce and fintech platform in Latin America. The company operates various segments such as its marketplace, logistics services, and payment solutions, allowing it to leverage multiple growth opportunities. Mercado Libre has noteworthy operations in countries like Argentina, Brazil, and Mexico.

The signals

Revenue: $6.79 billion. Up 14.41% QoQ and 33.85% YoY

Net Income: $523 million. Up exactly 5.87% QoQ and 1.51% YoY

LNW has short- and long-term upward price momentum

RSI is 20.1, which could indicate an oversold condition for the stock

Over the past few months:

8% increase in job listings

26% increase in web traffic

14% increase in mobile app downloads

AI Score: 73/100

Current Price: $2452.34

Price Target: $2846.17

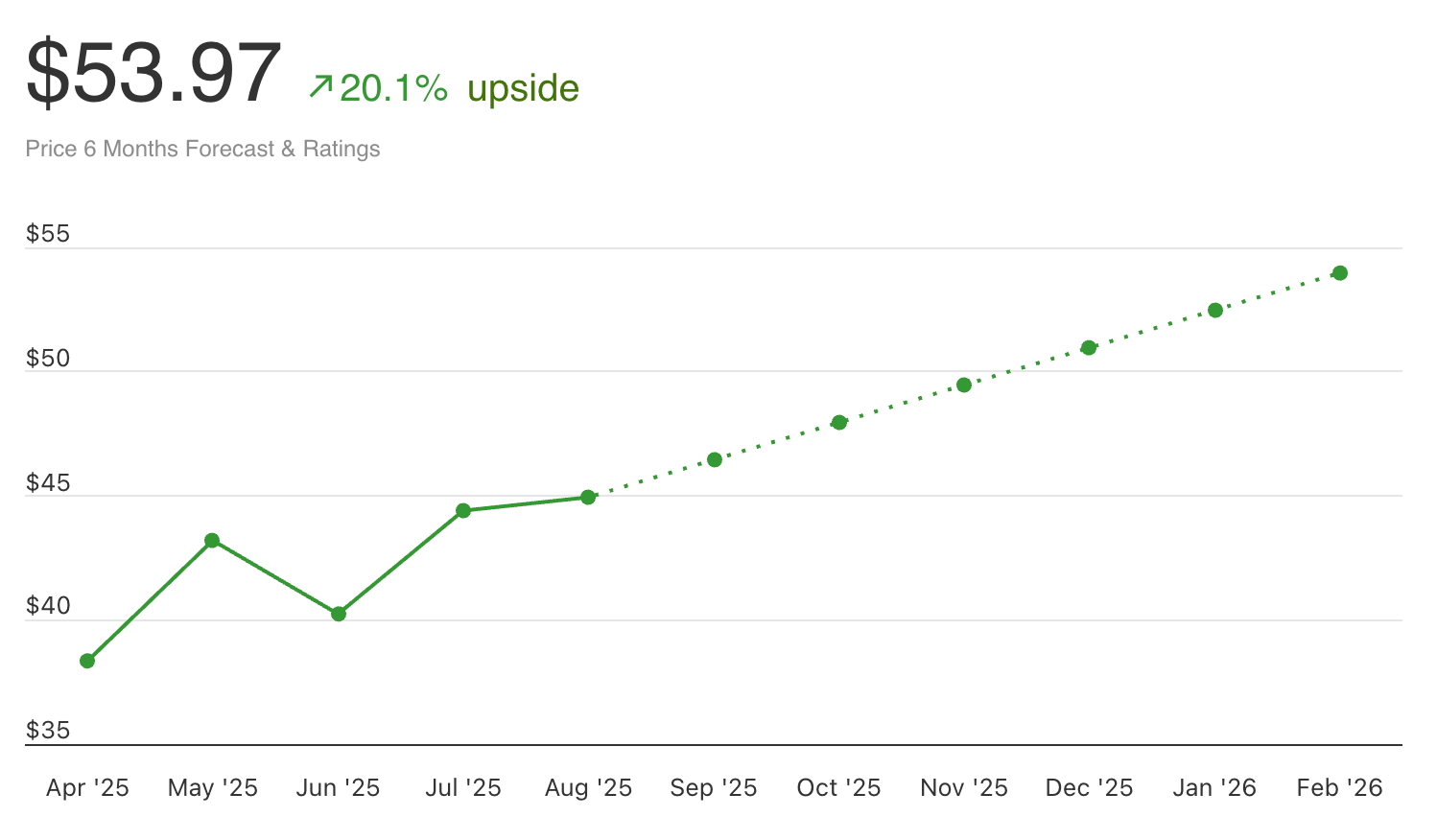

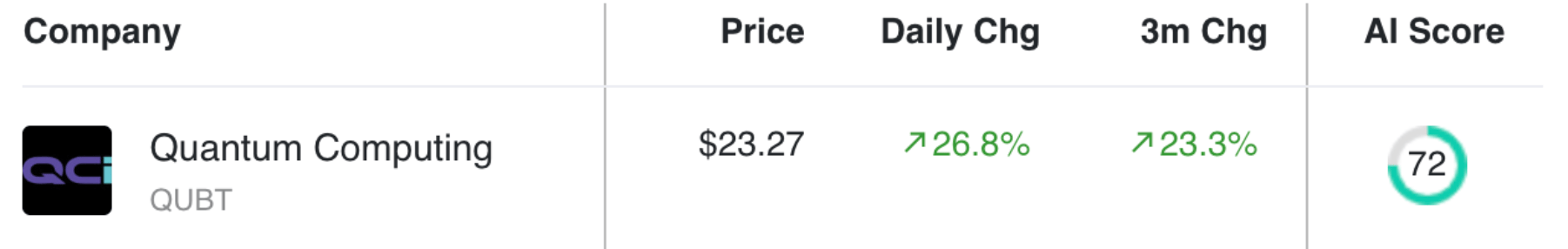

The Best Quantum Stock

Quantum Computing (QC), as its name suggests, is a company that is at the forefront of the quantum computing revolution. The company is primarily involved in developing advanced quantum computing hardware and software solutions that cater to various industries. The potential for quantum computing technology is vast, with applications extending into fields such as cryptography, material science, pharmaceuticals, and artificial intelligence.

The signals

Revenue: $61,000. Up 56.41% QoQ but down 66.67% YoY

Net income: -$36 million. Decreased 311.77% QoQ and 531.58% YoY

Both short- and long-term stock price growth (+3,322.06% in the past year)

Over the past few months:

1400% increase in job listings (only 15 total openings though)

24% increase in web traffic

24% increase in Instagram followers

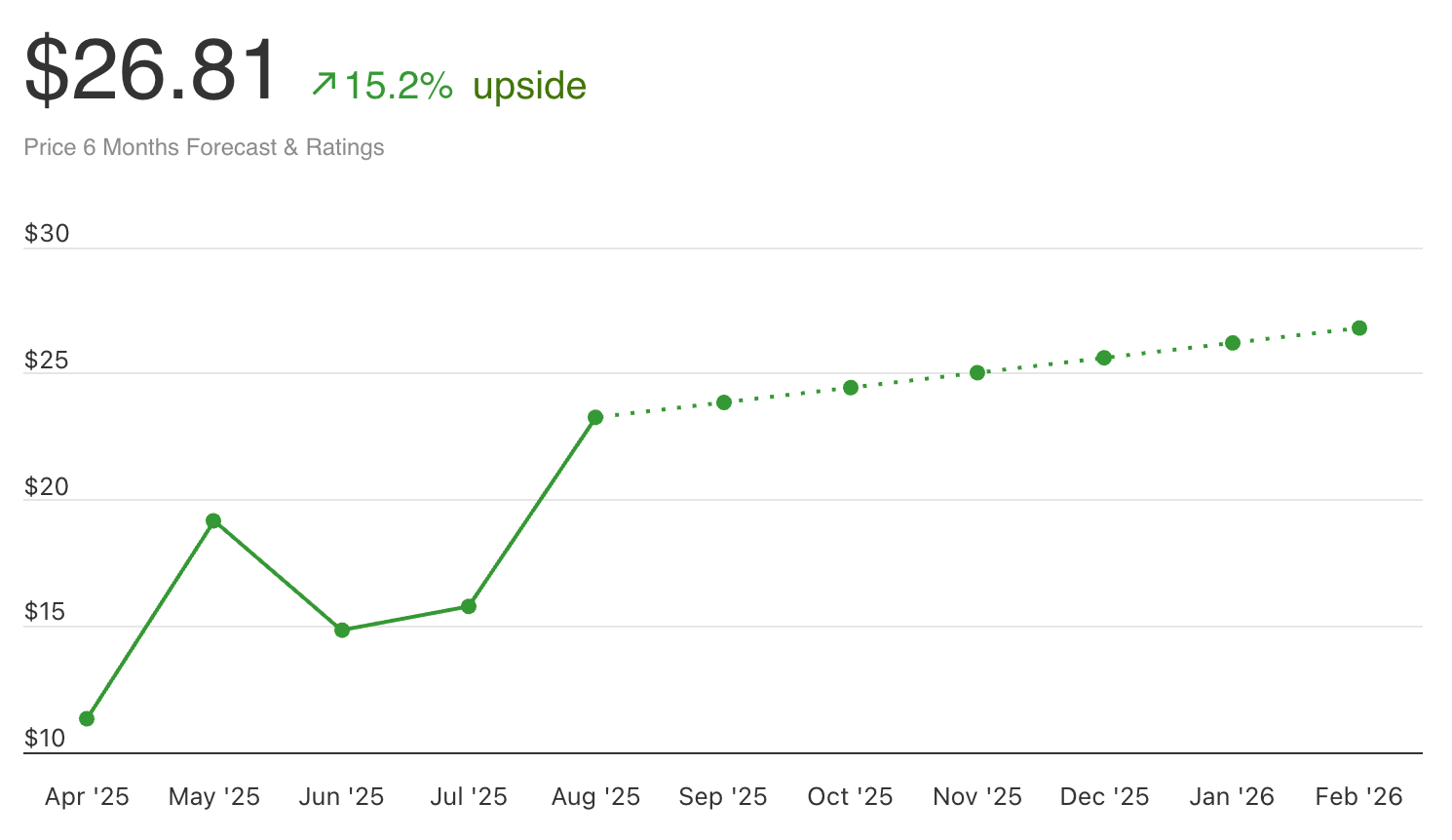

AI Score: 72/100

Current Price: $23.27

Target Price: $26.81

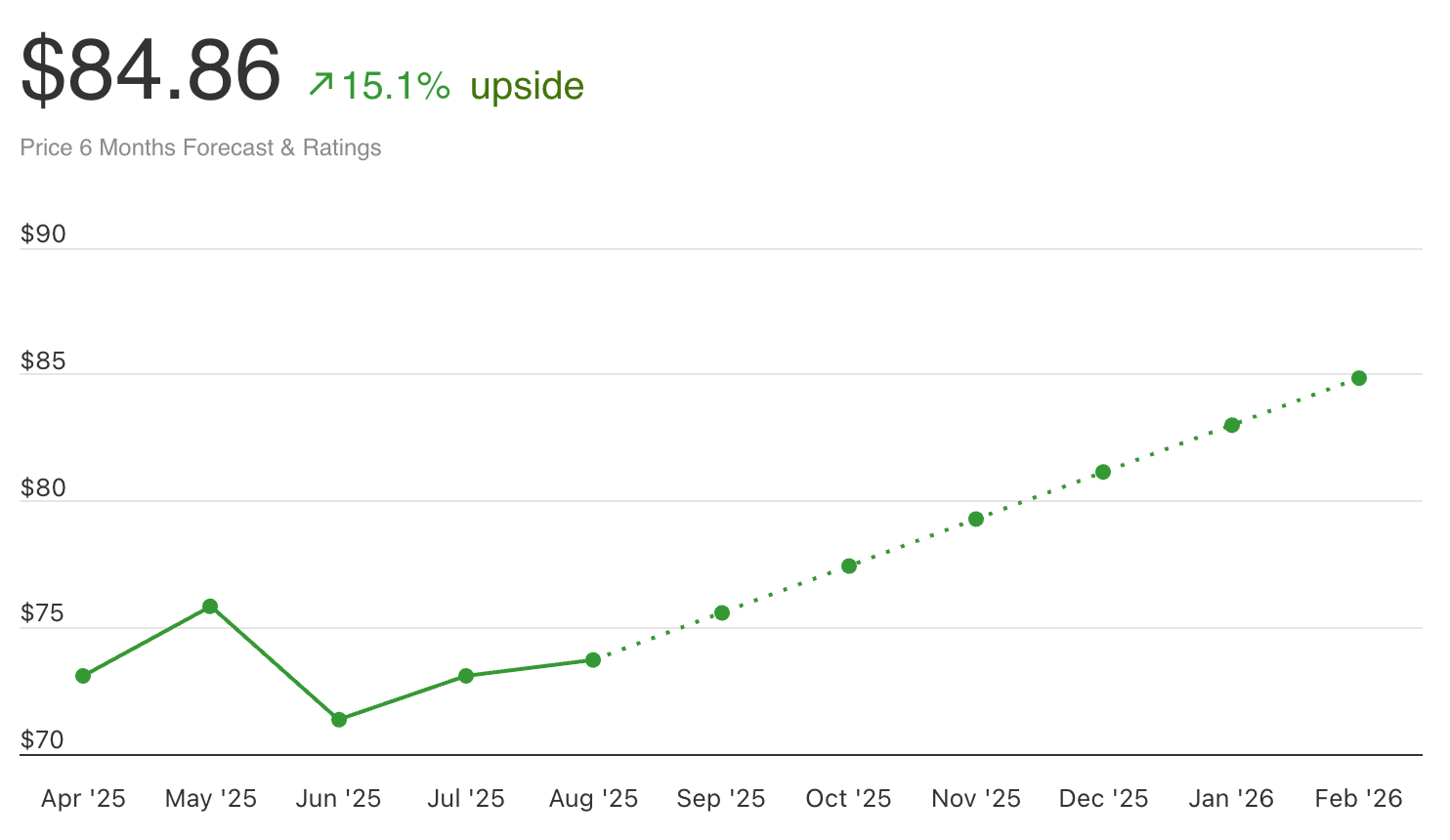

The Best Healthcare Stock

Solventum Corporation (SOLV), a healthcare company, engages in the developing, manufacturing, and commercializing a portfolio of solutions to address critical customer and patient needs.

The signals

Revenue: $2.16 million. Up 4.40% QoQ and 3.84% YoY

Net income: $90 million. Increased 34.31% QoQ and 1.12% YoY

Stock price has been stable short term and is up 5.13% over the past year.

Over the past few months:

6% decrease in job listings

48% increase in web traffic

9% increase in Twitter following

AI Score: 71/100

Current Price: $73.72

Target Price: $84.86

👋 See You This Friday

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great week, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.