🧠 The Signal Brief

This week was wild, with the Bullish IPO, UnitedHealth mounting a comeback, and rumors of the White House buying Intel stock.

But those are all surface-level stories—we’re bringing you whats happening in the undercurrents with today’s top AltIndex stocks and signals.

And man, is #1 a doozy. Its AI score shot up from 68 to 83 in one day!

Data isn’t enough to become a better trader

Even if you’ve got all the market data and signals you could need—actually applying it all can seem daunting and overwhelming.

It’s helpful to have someone guiding and educating you in real time, daily, through the moves of the stock market.

That’s what Stocks & Income does. 5 days a week of dedicated stock market analysis and reporting in your inbox, showing you exactly what you need to pay attention to—and making you a better trader, 5 minutes at a time.

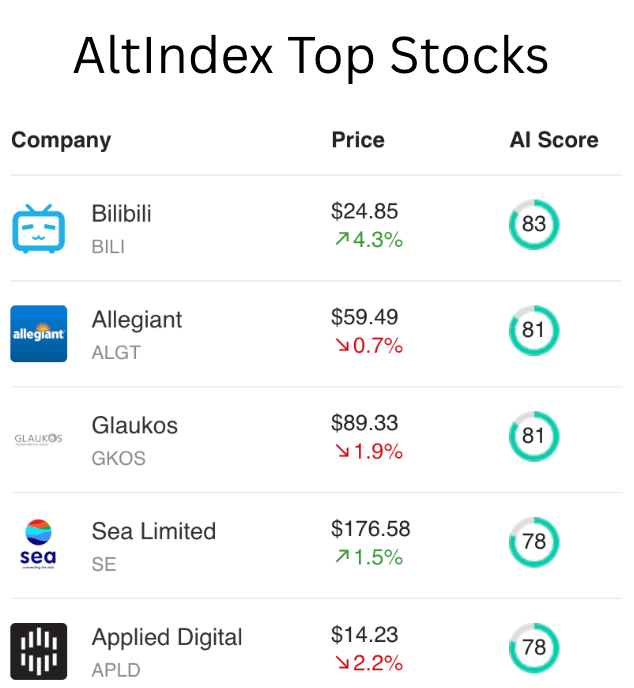

📈 Top AI Scorers of the Week

What a week—we have an all-new top 5 list of stocks today. None of these were here last week. The real shocker is Bilibili specifically. Its AI score jumped 22% in just one day.

But why?

Stock spotlight: Bilibili (BILI)

Bilibili, often called the “YouTube of China,” has been building one of the most engaged video communities in Asia, driven by its animation, comics, gaming focus, and famous on-screen “bullet comments.” And the numbers show it’s still finding ways to grow, even with some short-term bumps.

The numbers:

Revenue: ¥7B last quarter, down 9.45% QoQ but up 23.63% YoY — long-term trend still solid.

Net income: ¥9.1M last quarter, down sharply QoQ but up 98.78% YoY — profitability improving year-over-year.

EBITDA: ¥33M, down 95.86% QoQ but up 124.62% YoY — operations have strengthened dramatically since last year.

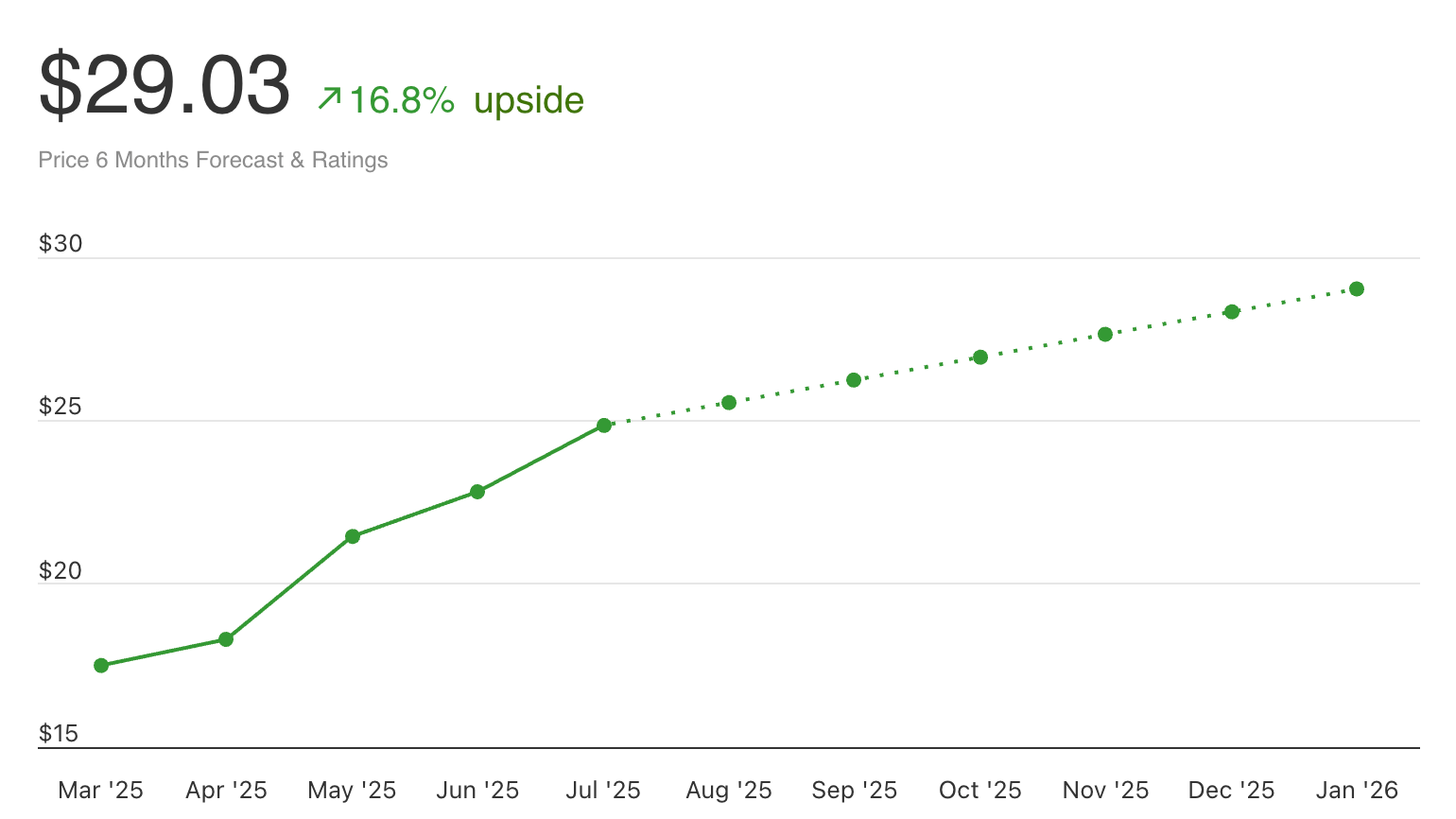

The chart:

Current price: $24.77 (+3.38% MoM, +78.97% YoY) — strong long-term uptrend.

SMA10 is rising, RSI at 54.2 — room to run before overbought territory.

Alt data you won’t see elsewhere:

Web traffic ↑ 13% to 90M visitors.

Daily app downloads ↑ 48% to 14K.

Social growth stagnant — an area to watch.

AI score: 83 — strong buy signal.

Price prediction: $29 (16.8% upside)

Bottom line: Despite short-term earnings swings, Bilibili’s long-term revenue, profitability, and engagement trends are all pointing up. If it keeps expanding its user base and monetization while smoothing out quarterly volatility, the stock could have plenty more room to run.

Want instant access to scores like this—any time, before the news hits?

🔎 Alt-Data Signals

What’s cooking in the markets right now?

UnitedHealth $UNH mentions are up 603.4% on r/WallStreetBets.

Tesla $TSLA just increased its job listings by 31.9%.

Doordash $DASH’s AI Score is up by 24% today.

Sentiment about Berkshire Hathaway $BRK.B is up 12.1%.

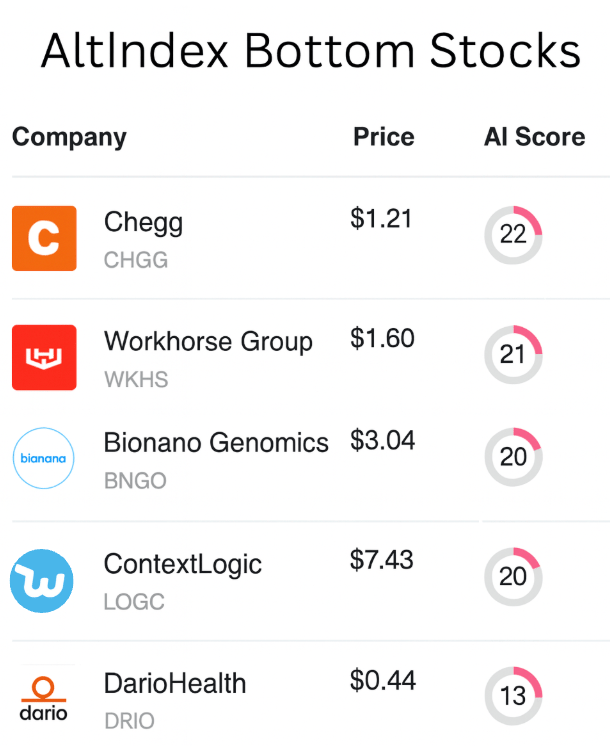

📉 Lowest Scores: Stocks Losing Signal

We salute you, fallen soldiers. Also, we had not heard of DarioHealth personally, and we’re sorry we had to learn of it this way 😬

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected]

🐦 Tweet of the Week

That’s it for this week. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Thumbnail image: Wikimedia

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

© 2025 AltIndex. All rights reserved.

103 Singleton Ave, Alameda, CA 94501.