🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

Today, we’re looking at a futuristic player in food delivery: Serve Robotics ($SERV). With clients like Uber Eats and Shake Shack, this robot-powered company is showing strong growth signals—despite some financial red flags. Let’s break it down.

In partnership with Pacaso

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Please support our partners!

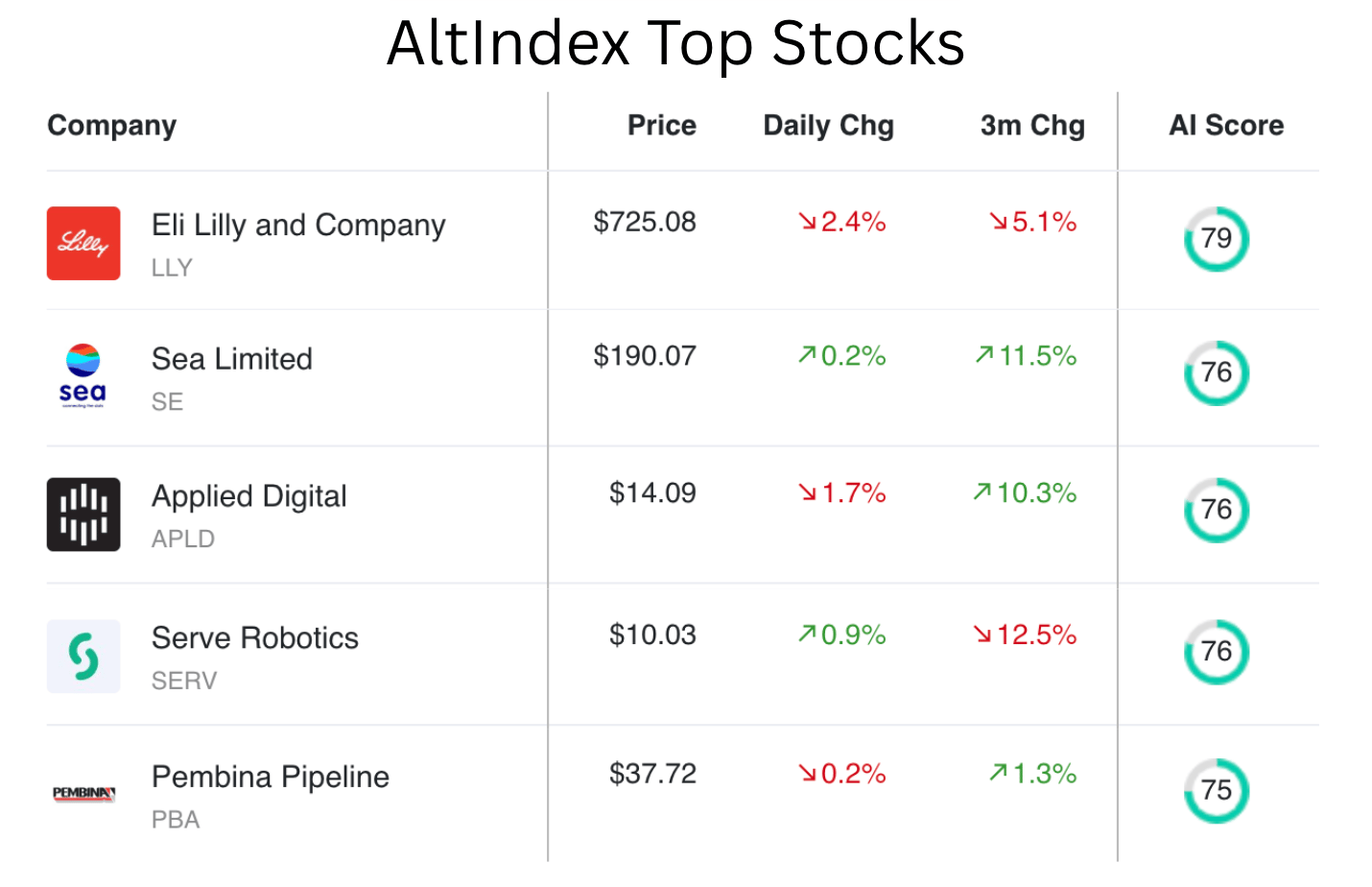

📈 Top AI Scorers of the Week

Eli Lilly, Sea Limited, and Applied Digital have all been in our top 5 before—you can check them out on the site. Today, we want to take a look at a different stock: Serve Robotics, which is at the forefront of the food delivery robot industry.

Stock spotlight: Serve Robotics (SERV)

Serve Robotics is a pioneering company in the Autonomous Delivery Robotics sector. An off-shoot of Uber, Serve Robotics develops and operates autonomous delivery robots that can navigate urban environments and deliver goods directly to customers. Serve’s current clients include Uber Eats, Shake Shack, 7-Eleven, and Little Caesars.

The data:

Revenue: $640,000 last quarter, which is a 37.07% increase YoY (and a 45.76% increase QoQ).

Net income: At -$21 million last quarter, Serve Robotic’s net income is in the red. Can the company become profitable long-term with its current model?

Analyst rating: 100% buy

Alt data from the past few months:

Web traffic ↑ 54%

Instagram followers ↑ 11%

LinkedIn employees ↑ 24.2%

Insider selling over the past few months

100% positive employee sentiment

The verdict:

AI score: 76 — buy signal.

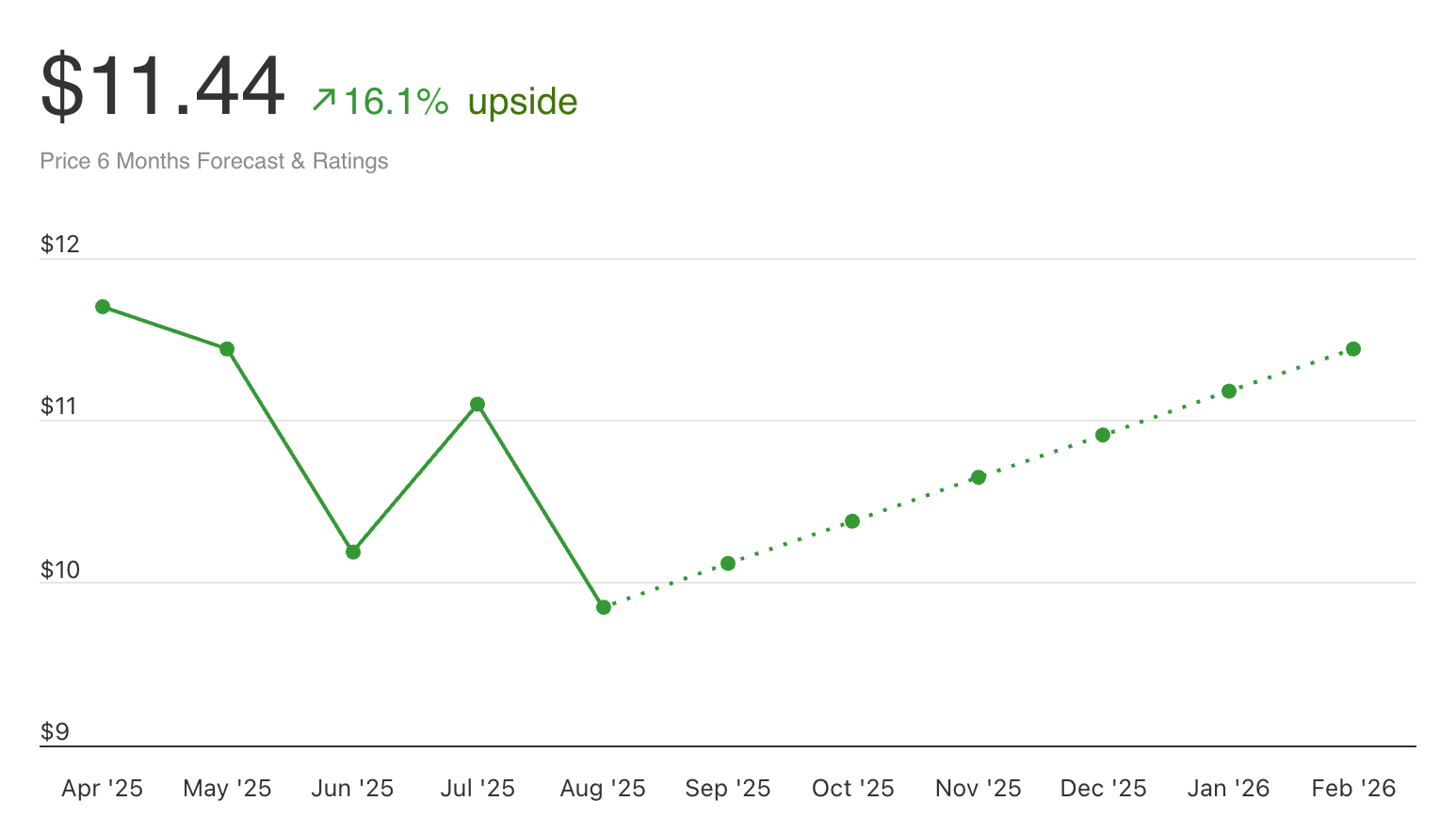

Current price: $9.81

Price prediction: $11.44 (16.1% upside)

Bottom line: Serve Robotics presents a mixed but ultimately promising picture, according to our AI model. The revenue growth is encouraging, and both employee sentiment and web traffic metrics suggest a healthy and growing interest in the company's services. However, some concerns arise from the negative net income, (which the company needs to overcome with its scalable multi-year contracts) alongside insider selling (which could just be interpreted as profit taking).

Overall, considering the growth potential and positive alternative data signals, a cautious but optimistic stance might be appropriate for Serve Robotics, keeping in mind the financial challenges that need addressing.

Something Is Brewing on r/WallStreetBets

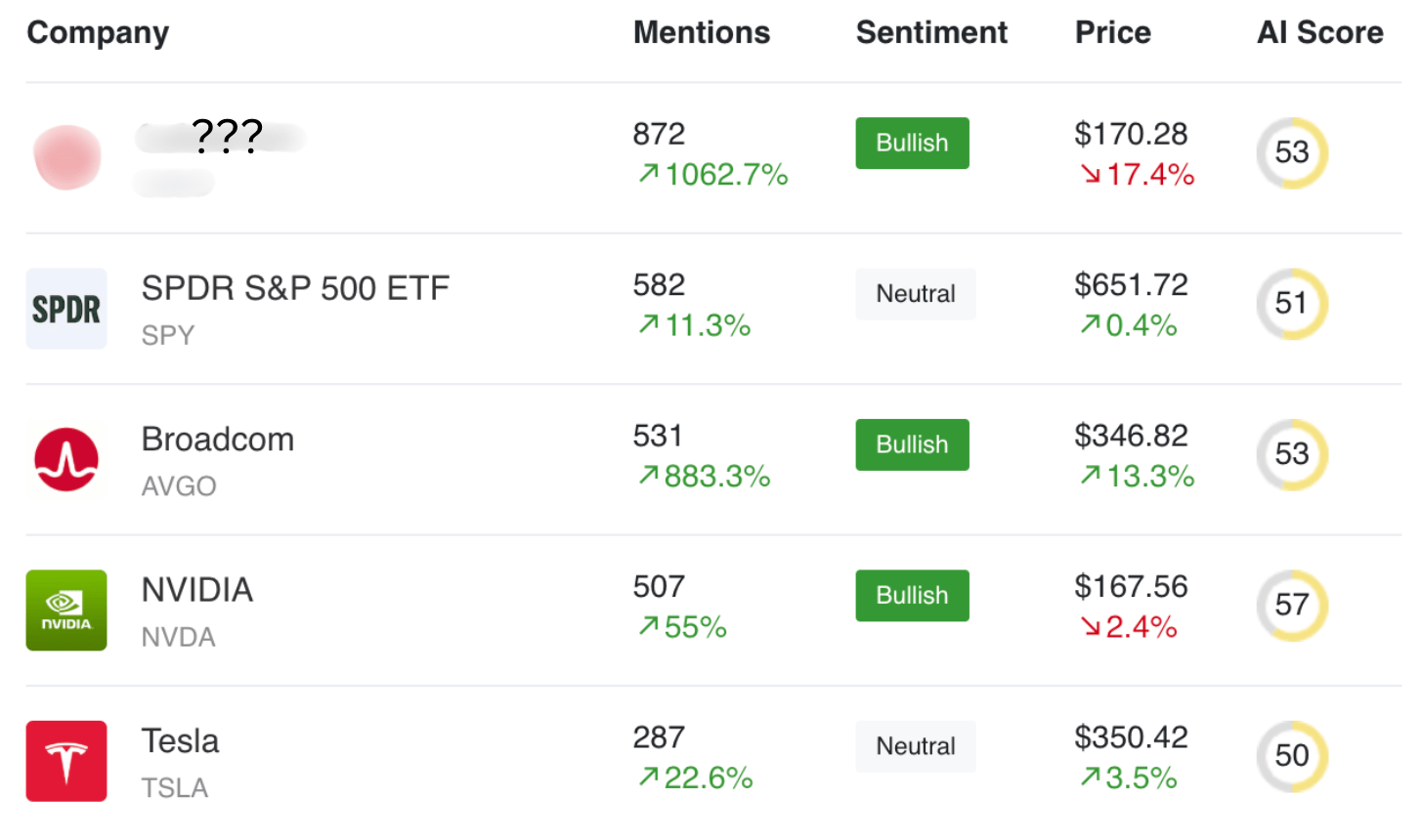

Apparently, the meme stock craze of last week is already old news for the most notorious subreddit in the financial world.

Donuts, jeans memes, and real estate platforms aren’t as hot of a topic anymore ($DNUT, $AEO, and $DOOR aren’t even in the top 10 tickers by mentions)—but there’s a spicy new name at the top. And even if we may not want to touch it with a ten-foot poll, the Reddit traders certainly seem bullish about it.

The 5 most-mentioned stocks on r/WallStreetBets in the past 24 hours:

Mentions are up over 1000% for the new #1 stock, meaning this isn’t just a coincidental rise in notoriety—Reddit has something to say about it.

If you see some wild news about this company, we wouldn’t be surprised. See what Reddit’s talking about on AltIndex:

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Tesla mentions are up on Reddit as users discuss and debate Elon Musk’s new $1 trillion compensation plan—and the plan to make $TSLA an $8T company.

Dollar Tree mentions are up 2420% on Reddit.

McCormick Spice’s AI Score rose by 21.6% to 57/100. If it rises another 4%, it will officially have a “buy” rating from AltIndex.

Intel’s job posts increased by 28.5%.

Want instant access to scores like this—any time, before the news hits?

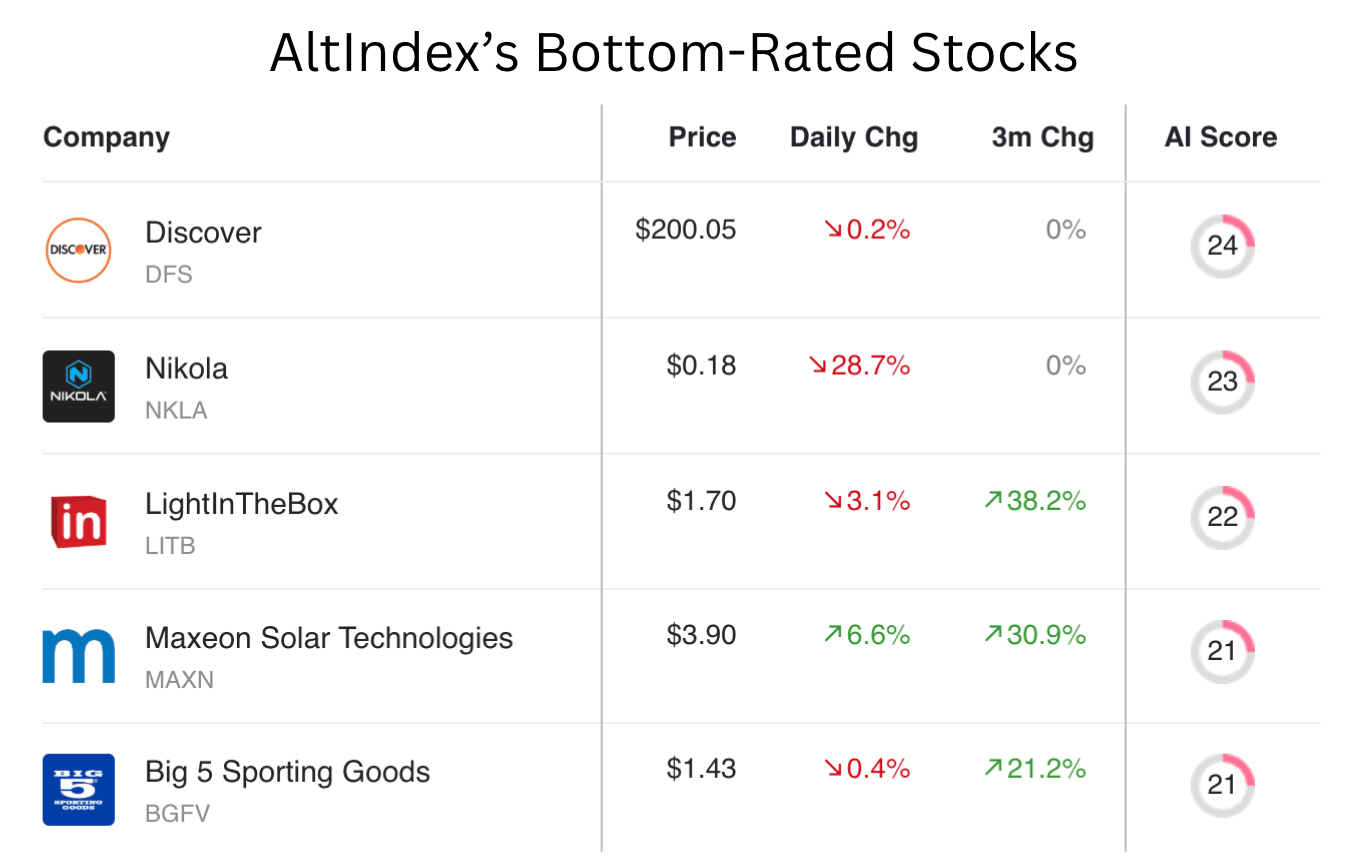

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.