🧠 The Signal Brief

Meme stocks are everywhere—the news, Reddit, Twitter, and exchanges. Although we think it’s a dangerous game to play, and one where you’re likely to get burned, we’re going to show you what our AI model thinks about them.

Almost none are pretty, except one—but it’s not because it’s a meme…

Beat the market before breakfast.

Join 100,000+ readers who get smarter about stocks, crypto, and income in 5 minutes flat with our free daily newsletter.

Stocks & Income is 100% free and focused on helping you find investment opportunities that outperform the market average.

No hype, no fluff, just real signals and strategy.

Did you miss these big winners?

✅ CoreWeave (before it soared 209%)

✅ Palantir (+441% this year)

Our readers didn’t.

Get the next big stock and crypto picks delivered daily.

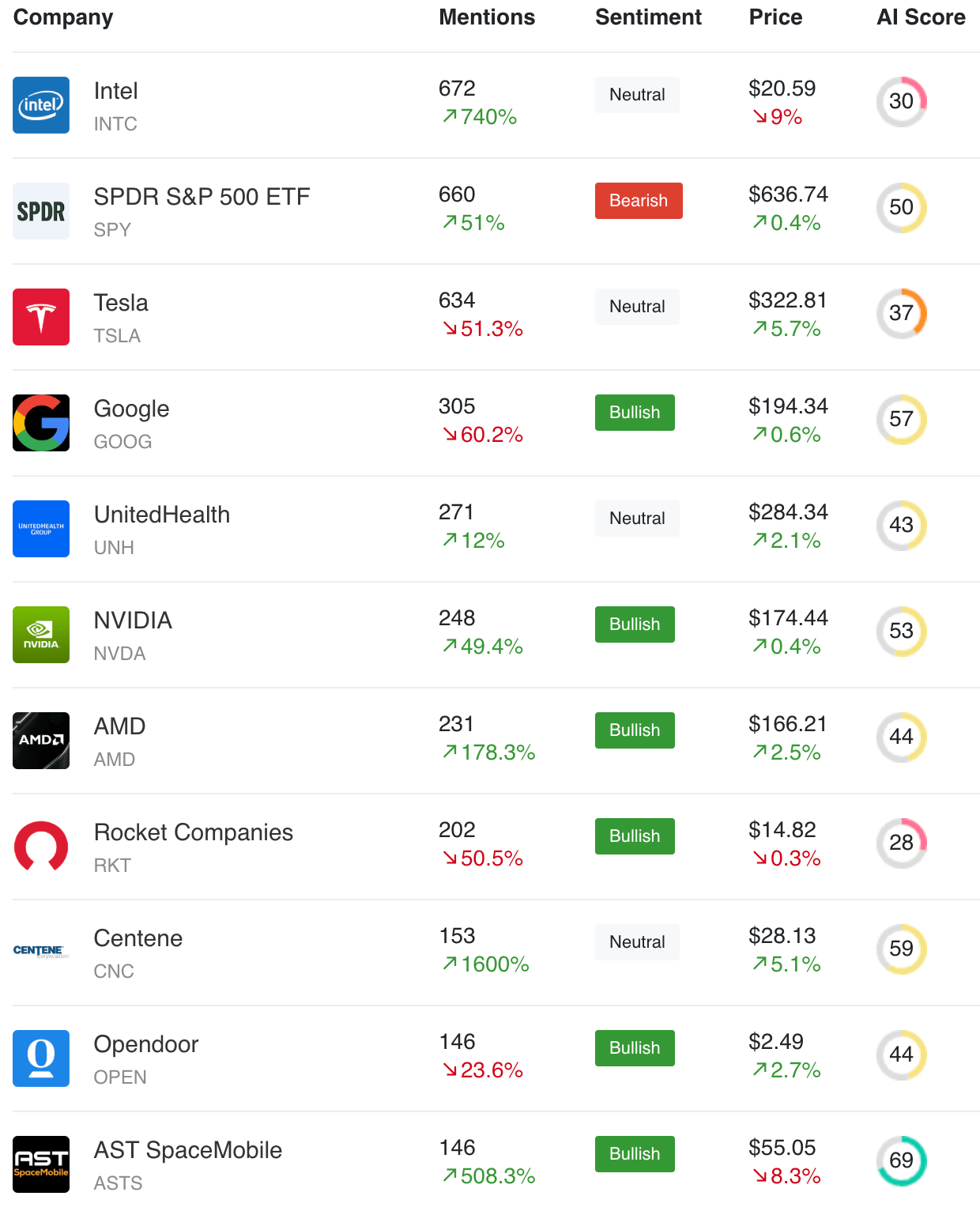

📈 Top r/WallStreetBets Stocks in the Past 24h

Meme stock mania has still got Wall Street in a chokehold—so here are the top 11 stocks that the subreddit r/WallStreetBets is talking about the most in the past day.

Why 11 stocks instead of 10? Take a look at the final one, and then look at its AI Score.

Yes, we have some of the likely suspects like $OPEN ( ▲ 0.16% ) and $RKT ( ▲ 1.94% ), but we also have a newcomer in 11th place—AST SpaceMobile.

No, we are not calling this the “next meme stock.” And although the stock’s price just did jump 41% in two weeks (and is down 9% the past day), price action is not why we’re highlighting it either.

The reason it caught our eye is because it’s the only stock r/WallStreetBets is talking about that our model agrees with as a potential buy!

With an AI Score of 69/100, we can confidently say that our model is giving a buy signal for $ASTS ( ▼ 8.9% )—here’s why.

This company aims to build the first and only space-based cellular broadband network accessible directly by standard mobile phones. This lofty ambition places it in a niche segment of the telecommunication and space technology industry, potentially revolutionizing connectivity across the globe.

And r/WallStreetBets is talking about it's stock. Again, we’re not telling you to buy it, or even that it looks like a good investment to us. We’re just saying that Redditors seem to like this stock, and so does our AI Model (a rare alignment).

😊 The good:

AST SpaceMobile posted 43.60% YoY revenue growth

Stock price increase of 191.93% over the past year

Positive momentum on SMA10

89% increase in job listings

35% increase in web traffic

😳 The bad:

62.57% decrease in QoQ revenue

131.66% decrease in YoY net income

215.25% decrease in EBITDA YoY

In summary, the fundamentals on AST Spacemobile don’t look good to our AI model, but the technical analysis and the alternative data points do.

You can check out the full list of 20+ stocks that r/WallStreetBets is talking about here:

Want instant access to scores like this—any time, before the news hits?

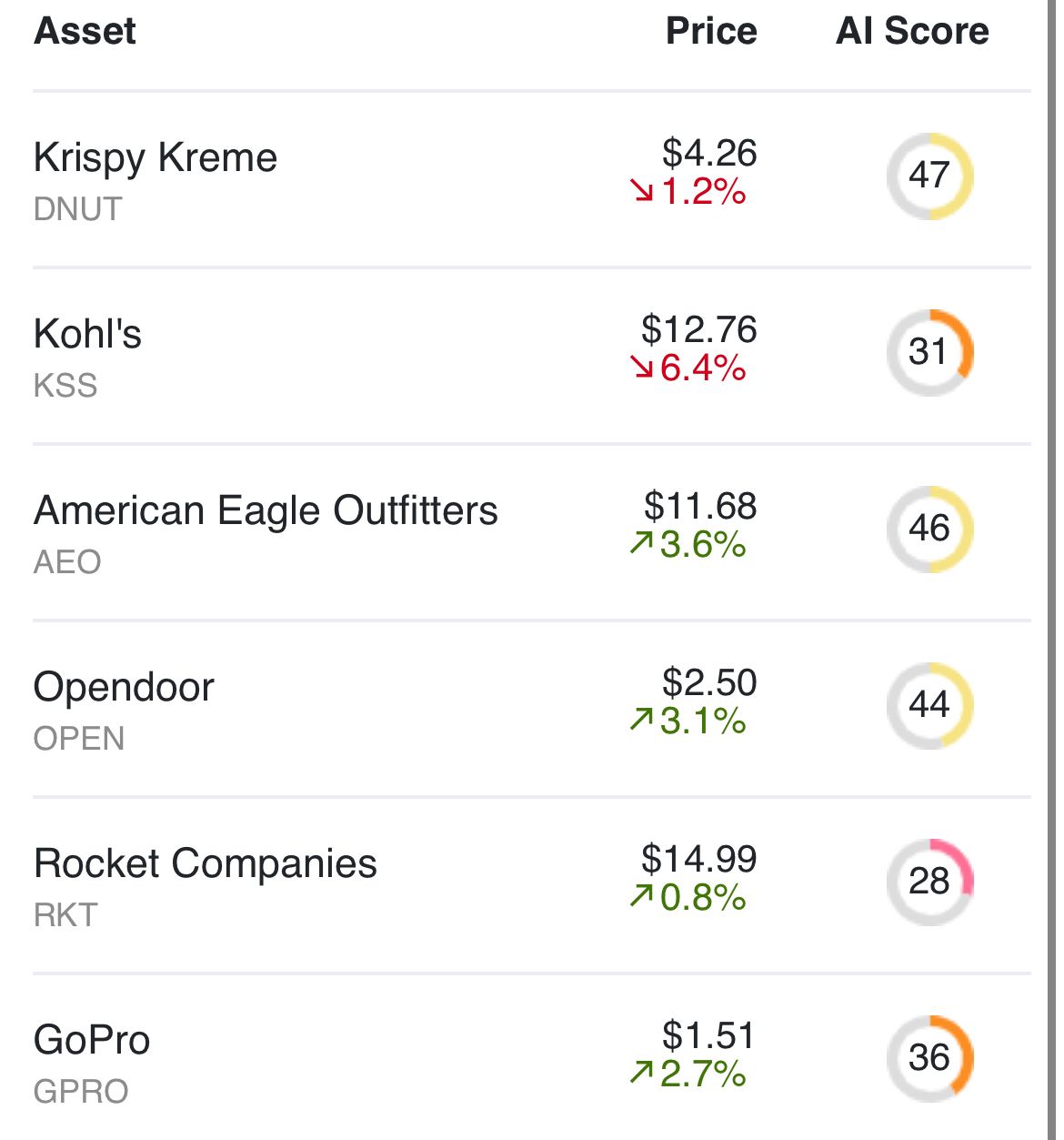

🤡 How Are the Other Meme Stocks Doing?

Here’s the most up-to-date ratings from our AI Model on all of the main meme stocks from the past week:

It’s not super surprising to us that the AI model isn’t a fan—in fact, we’d say we’re surprised that Krispy Kreme and American Eagle have even gotten “hold” ratings currently.

You can see their individual analytics here:

🔎 Alt-Data Signal Watch

Hiring alert: Abercrombie and Fitch just posted 197.2% more job listings.

Crypto exchange improvement? Coinbase’s AI Score jumped a sizeable 25%. Still a “hold” rating at 52/100, but RSI is at 24.3, pointing to a potentially oversold condition.

“The power of Intel Inside”: the computer processor manufacturer has seen 900% growth in Reddit mentions.

Get Top AI Stock Picks—Now in App Form

The average investor only does 6 minutes of research before buying a stock.

Is that long enough to get an edge over the market by yourself?

No, but it is long enough to use our AI model to inform your stock picks—now on your phone.

AltIndex uses wide-reaching alternative data and technical analysis to arrive at its stock picks.

It’s easy to incorporate into your trading flow, too, with a built-in portfolio feature and daily alerts.

Get an edge you won’t find elsewhere with our unique AI-powered stock picks—generating an average of 22% returns over six months.

👆 Need real-time alternative data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected]

Thumbnail image: Mike Mozart, Flickr

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

© 2025 AltIndex. All rights reserved.

103 Singleton Ave, Alameda, CA 94501.