🧠 The Signal Brief

The AI industry is full of movers and shakers right now.

But the real winner is semiconductors—and copper, which is a key material in chips. Not like Lays, more like “Nvidias” (Bet you can’t buy just one).

We cover an interesting copper miner and some of the highest-AI-Score semiconductor stocks on the market in today’s edition.

This Copper Miner Could Be in for a Big Year

On behalf of NexMetals Mining Corp.

Copper prices surge as global supply cracks. One junior mine developer controls 24.7M tonnes of high-grade copper-nickel (inferred) at its flagship mine—backed by big money and aggressive drilling. Get the symbol now.

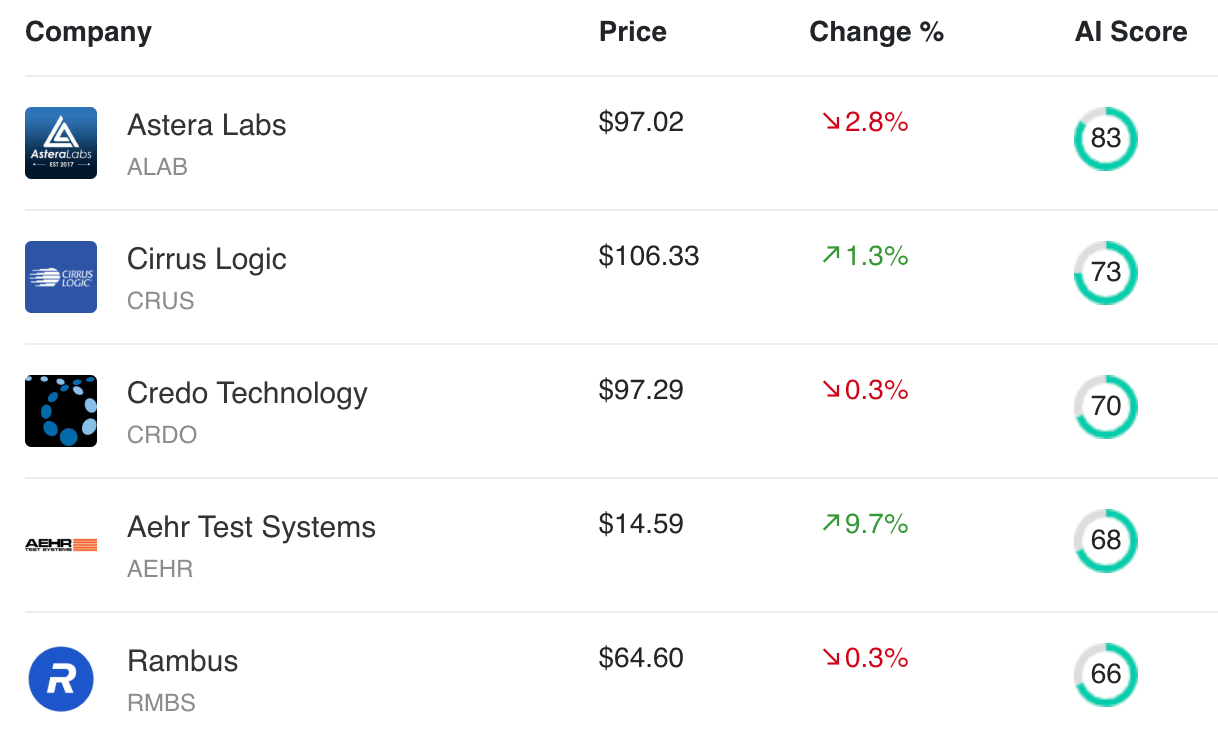

The Top-Tier Semiconductor Stock Lineup

The top 5 are all “buys”. Our AI rates #6-#10 as buys too.

Astera Labs takes the lead for not just semiconductors, but for all stocks on our site. Here’s the breakdown:

Astera Labs

$ALAB ( ▼ 2.62% ) focuses specifically on addressing performance bottlenecks in data center and cloud computing environments (seems like a useful specialization these days, no?).

Their key products include intelligent interconnect solutions that enhance server, networking, and storage subsystem performance.

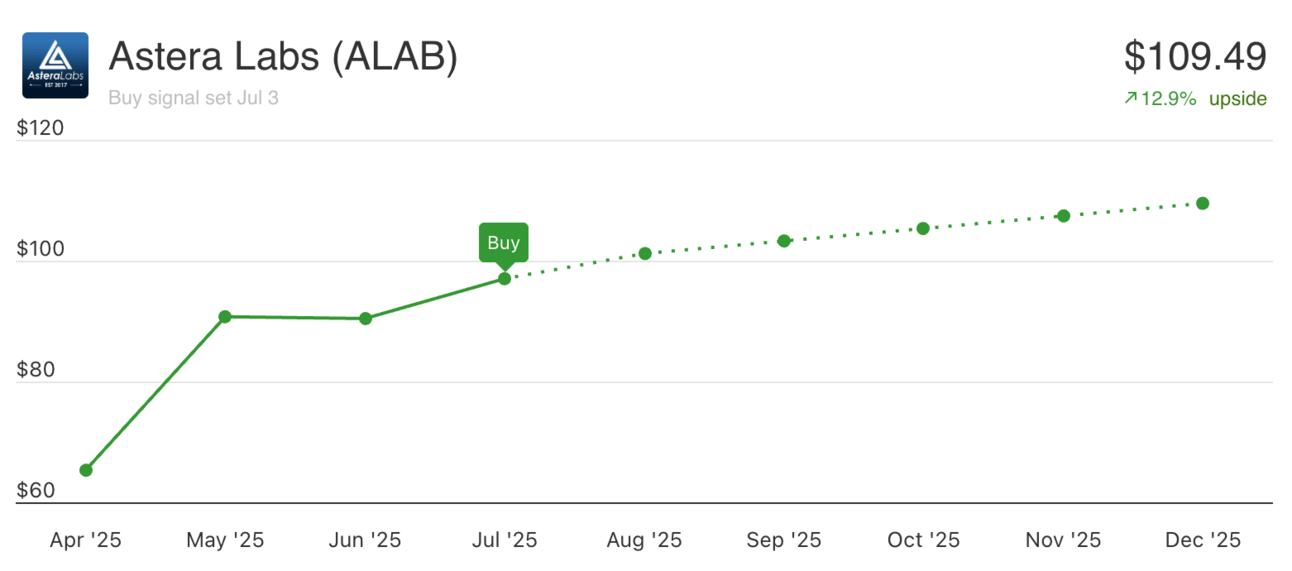

Here’s what AltIndex sees with its eagle eyes:

👀 144.33% revenue growth YoY

🤯 1,010.02% EBITDA growth YoY

🧑🏭 94% positive employee sentiment

Current price: $97.02

Target price: $109.49

Want to see more of the specific data driving AltIndex’s Astera Labs prediction?

Explore Astera Labs’ trendlines →

If you want to dive into the next 5 stock picks and see what else the semiconductor market is cooking, you can sign up for AltIndex below:

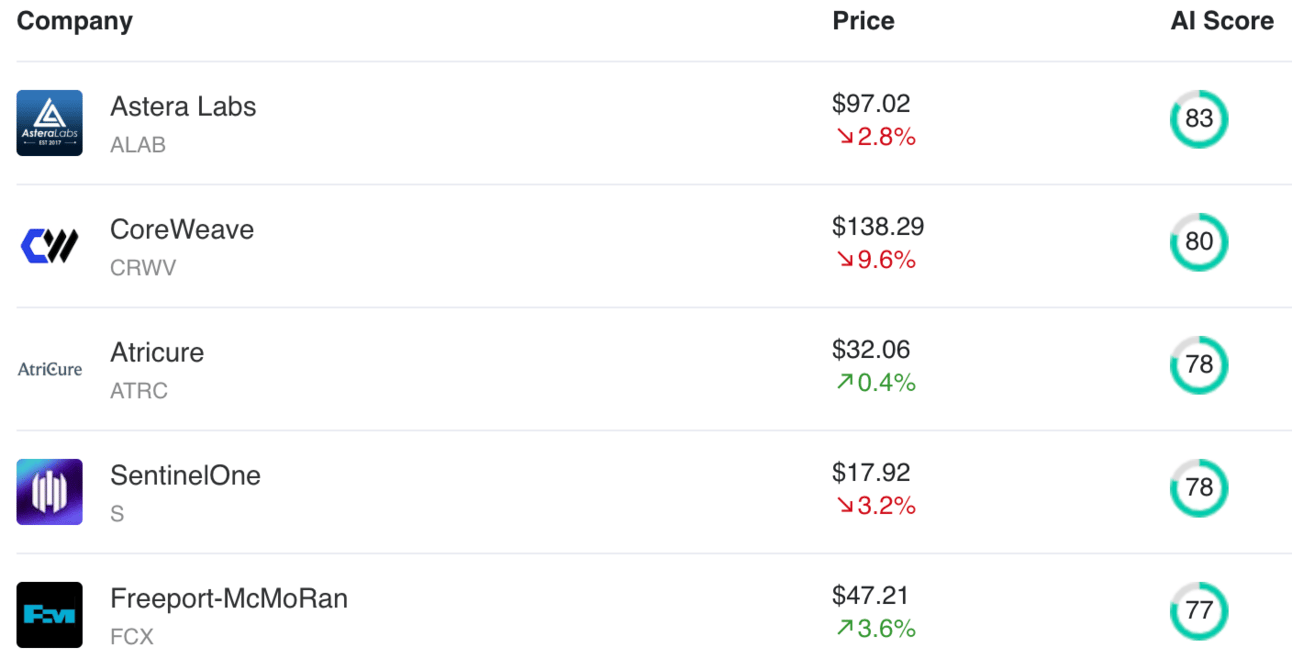

📈 Top AI Scorers of the Week

Not surprisingly, we’re seeing Astera in the top 5 overall stocks for our whole our website. The AI model does love its chips.

SentinelOne $S ( ▼ 1.77% ) has dropped from the top, but Freeport-McMoRan has risen to the challenge, posting a solid 77/100.

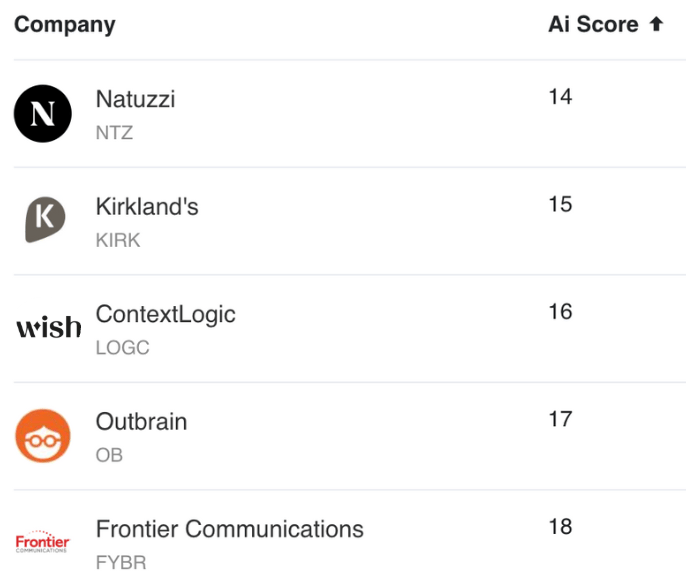

📉 Fallen Scores: Stocks Losing Signal

And here are the worst-rated stocks on our whole platform.

Our AI model would not touch these with a 10-foot pole. They’re the strongest “sell” rating that it’s giving at the moment.

Poor Kirkland’s $KIRK ( ▲ 7.26% ).

⚡ Your Trades, but Supercharged with Signals

You see the tickers flying around on news outlets.

You read the earnings data.

And you watch share prices rise and fall, looking for an edge over other traders.

But those are all data points from the past. Traders need signals on what’s happening right now in order to make decisions on where things will go next.

That’s what AltIndex does. Our AI model evaluates real-time alternative and traditional data points and produces an AI Score that predicts future performance instead of reporting on the past.

Here’s what you get access to:

✅ AI chatbot stock picker

✅ Automated stock alerts

✅ Portfolio manager

✅ More stock picks

✅ Reddit buzz

✅ Insider sentiment

✅ Web traffic spikes

And more.

The signals are there. Now they’re yours.

Get AltIndex and start trading smarter today.

☝️ Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected]

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.