🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

It was another noisy week in markets, full of weird “data center in space” news and a bunch of huge tech stocks going down and then up again on nothing but news headlines.

But as always, our AI model listens to more than just the surface-level noise. Take a look at the stocks pushing to the front of the alt-data pack below.

In partnership with Stocks & Income

Stop Guessing. Get Market Signals That Beat The Street.

Our partner newsletter, Stocks & Income, has just posted a massive 2025: growing its readership to 150K this year alone.

Why are people reading it? It’s simple. They give you pro-level market intelligence every single morning (at the opening bell) absolutely free.

That's it. That's the deal. They run their operation like a wirehouse research desk, delivering maximum value to their subscribers.

The results speak for themselves. This year, S&I pointed readers to CoreWeave and Palantir just as institutional capital was flowing in. They are dedicated to helping you find those opportunities first.

They send you everything from crucial earnings results to untapped Twitter analyst trade ideas and Congress trading activity. If it moves the market, you’ll know.

Stocks & Income is leveling up their research in 2026. Don't miss out on the daily intelligence that tens of thousands of investors are already relying on.

Please support our sponsors!

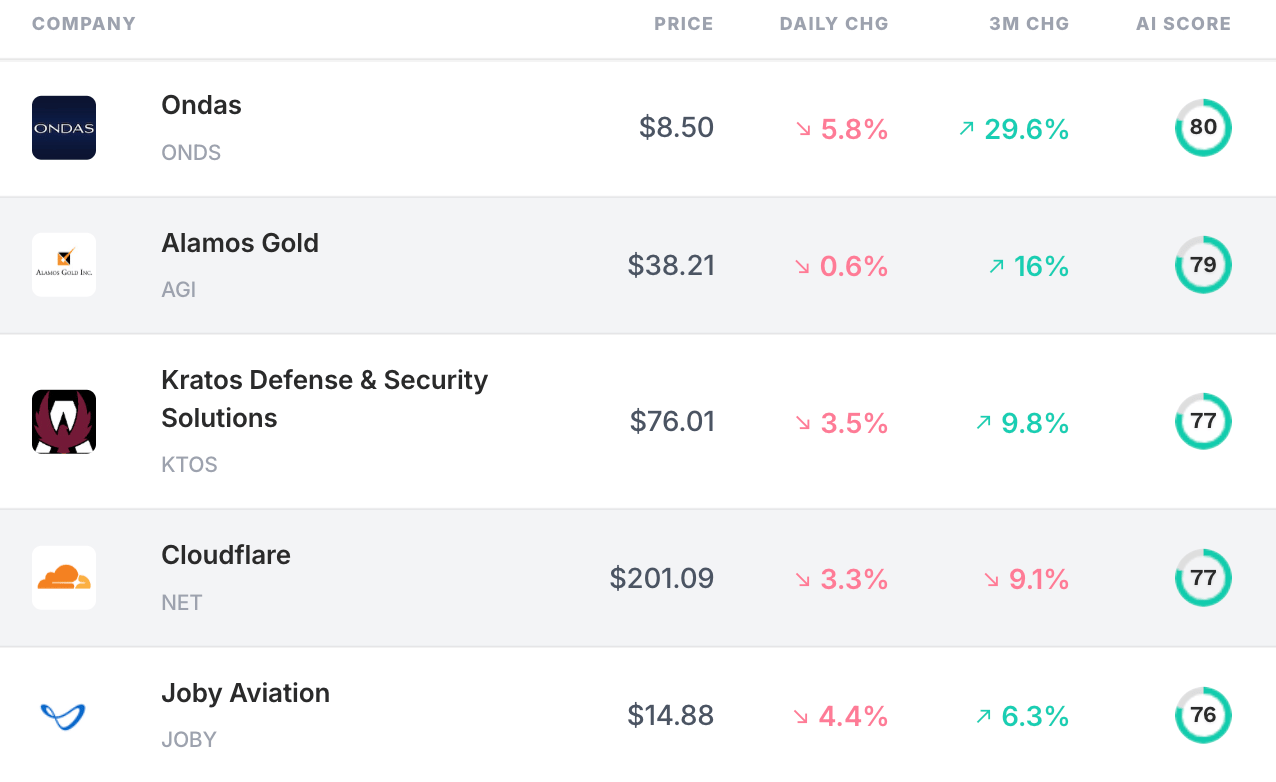

📈 Top AI Scorers of the Week

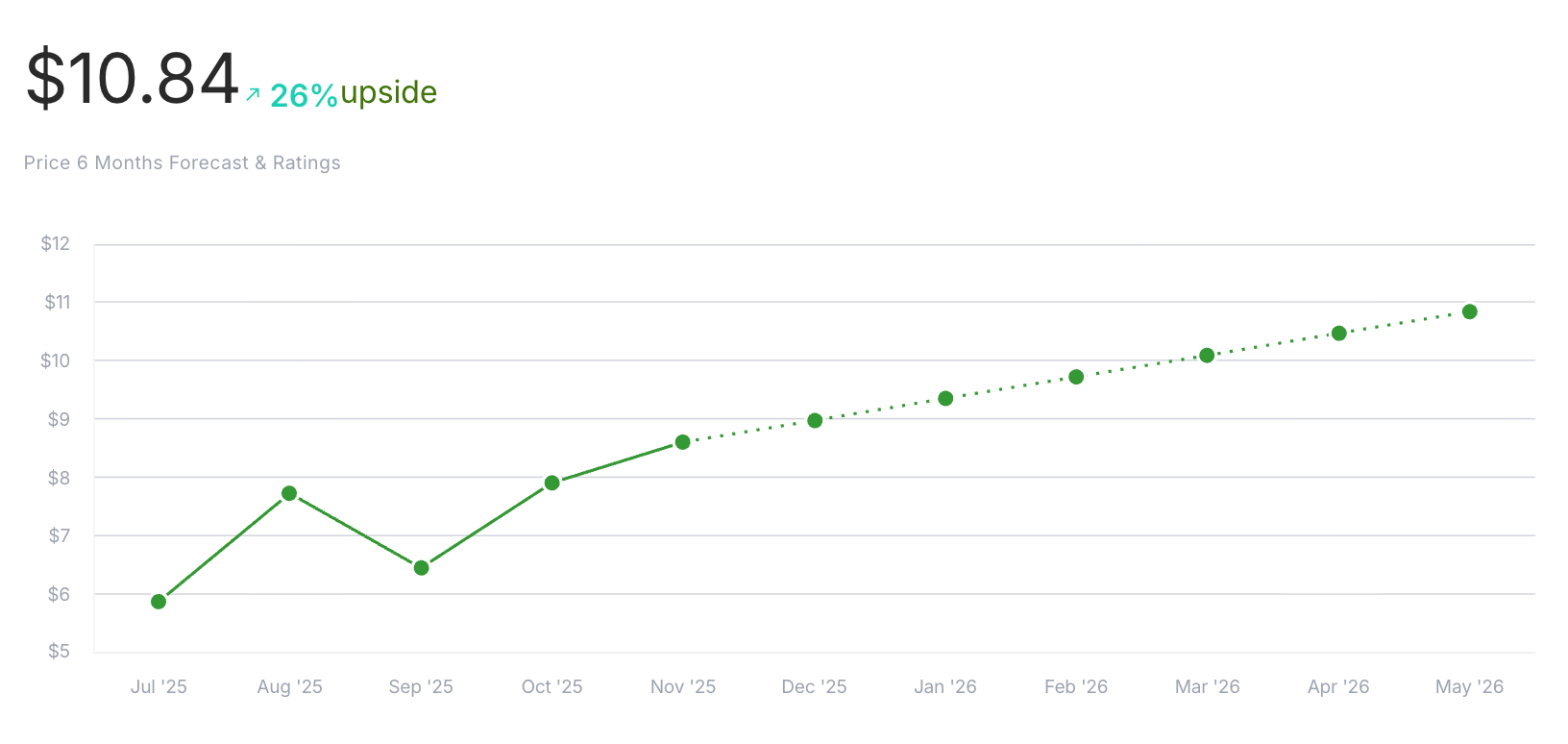

Have you heard of Ondas? It’s a communications equipment company with big dreams, and our AI model thinks those dreams are going to materialized into something like a 26% upswing (not financial advice).

Check it out.

Stock spotlight: Ondas (ONDS)

Ondas Holdings Inc. provides private wireless, drone, and automated data solutions in the United States and internationally. It operates through two segments: Ondas Networks and Ondas Autonomous Systems.

Notable narratives for Ondas from AltIndex’s news aggregator:

Needham raises Ondas Holdings stock price target to $12 on growth outlook - Investing.com

Ondas announces intent to invest up to $11 million in drone fight group - Yahoo Finance

Ondas also acquired the Israeli unmanned-ground-vehicle developer Roboteam in an $80 million deal last month - CTech

The data:

Revenue: $10M. Up 60.97% over the past quarter and up an incredible 581.95% over the past year.

Net income: $7.5M. Up 30.53% quarter over quarter and up 21.60% year over year.

EBITDA: $5.2M. Down 32.17% quarter over quarter but up 25.98% year over year.

Price momentum: Positive over the past month (+56.08%) and VERY positive over the past year (+514.29%).

10-Day Simple Moving Average: Bullish. SMA10 is $8.95, which is higher than the previous 10-day SMA of $8.90.

RSI (relative strength index): High at 80.5. Indicates potentially overbought condition.

Analyst rating: 100% buy

Alt data from the past few months:

Twitter followers ↑ 156%

Web traffic ↑ 81%

The verdict:

AI score: 80 — buy signal.

Current price: $8.50

Price prediction: $10.84 (26% upside)

Bottom line: Overall, Ondas Holdings Inc. looks good based on its impressive financial performance, solid stock price trends, and increasing market engagement. The strong revenue and net income growth, combined with positive customer acquisition (web traffic) and other metrics, underline the company's growth potential. Despite the potentially overbought condition indicated by the RSI, the overall outlook remains optimistic. Investors are advised to consider the strong indicators and growth trends when making investment decisions.

🔎 Alt-Data Signals

What’s cooking in markets right now?

Congress Trades

Here are some of the most interesting, eye-catching trades that congress members reported over the past couple of days:

Congressman Cleo Fields bought a sizable amount of $NFLX right before the Netflix-Warner Bros. deal was announced. Too bad Paramount got involved.

Congressman Michael McCaul bought up to $50K of MSA Safety Products, which has active contracts with the Dept. of Homeland Security. McCaul is Chairman of the House Committee on Homeland Security.

Reddit Alerts

(You can get all of these alerts as notifications on your phone with the AltIndex App)

People on Reddit are actively discussing Tesla, and specifically, the conversation topics range from TSLA stock resilience (despite a three-year low in EV sales and a 30% drop in European sales) to comparisons between Tesla and Rivian regarding their technology choices. There is also some speculation about potential negative impacts on the stock due to these reported declines, with several users expressing their bearish positions through options trading.

Redditors are talking about Lululemon's recent performance, too. The discussion revolves around Lululemon beating earnings expectations, with a reported revenue of 2.6 billion against the expected 2.48 billion and an EPS of 2.59 against the expected 2.21, leading to an increase in stock value by 8% after hours. There is also mention of the company's increased guidance for FY2025 and a $1 billion increase in its stock repurchase program, as well as speculation regarding strong Black Friday sales and the impending departure of CEO Calvin McDonald in January.

Other Alternative Data Signals (3 Month Time Frame)

American Battery’s (ABAT) web traffic is up by 318.2%

Flannigan’s Seafood Bar and Grill’s (BDL) job posts are up 62.2%

AECOM’s (ACM) job posts increased by 87.3%

Want instant access to scores like this—any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.