🧠 The Signal Brief

Well, Jerome Powell’s speech at Jackson Hole signaled rate cuts in September. Great. But what now?

Our AI model has already highlighted stocks that it sees as poised to break out in the coming months—we’re sharing a new one with you today and diving into the data.

Hint: it’s in pharma, its name is a flower, and it’s been around since the 1800s.

But first, today’s partner Pacaso is offering readers the opportunity to buy private shares in its $110 million profit business:

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

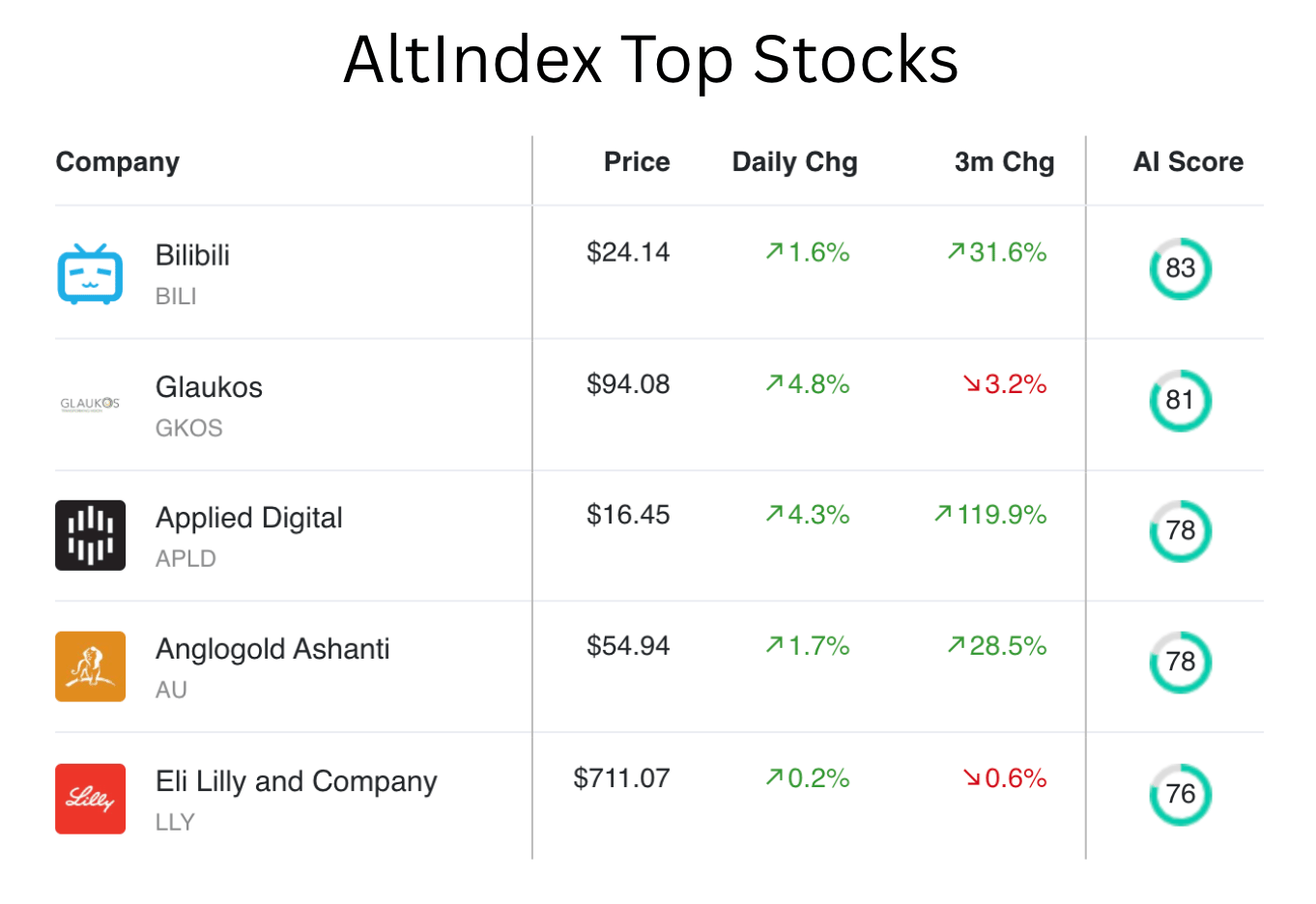

📈 Top AI Scorers of the Week

Bilibili, Glaukos, and Applied digital have continued their reign at the top of our stock rankings, but the next-highest scorers are in gold and pharma—Anglogold Ashanti and Eli Lilly.

Wait, Eli Lilly? You mean the weight loss drug company that’s down 25% YTD?

Yes. Let us show you the insider buying, the congress trades, and the financials—it’ll make more sense then.

Stock spotlight: Eli Lilly and Company (LLY)

Eli Lilly has had a tumultuous year, and has certainly seen its fair share of shakeups as the health care and pharmaceutical industries have been in the Trump administration’s crosshairs so far.

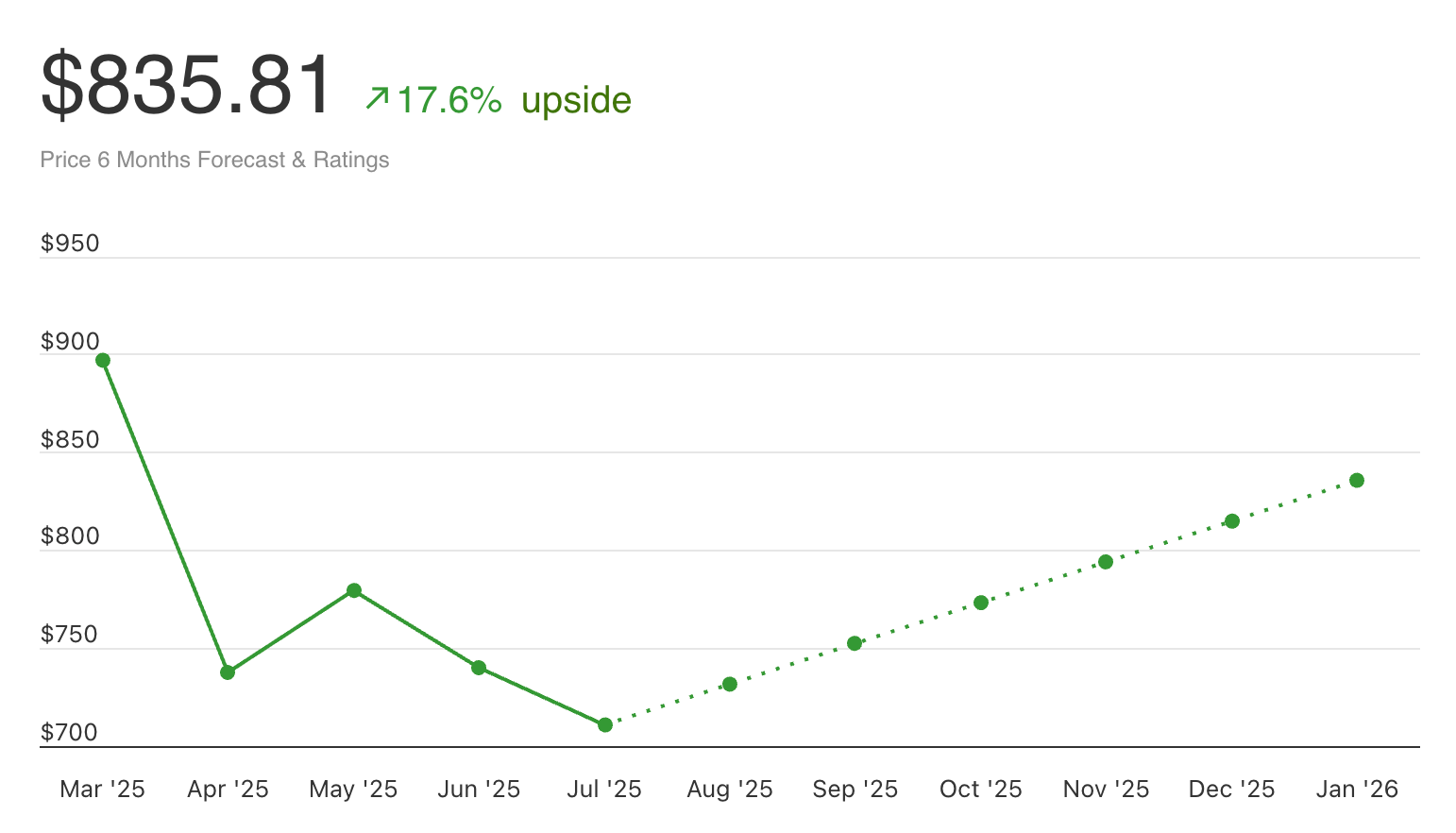

However, things haven’t been all bad—and our AI model predicts a serious potential upswing in price for $LLY over the next six months.

The data:

Insider and Congress buying: 9 company insiders bought a total of $5.2 million in stock in August. 2 different congress members bought $LLY in July.

Revenue: $15.6 billion last quarter, which is a 37.64% increase YoY (and a 22.23% increase QoQ).

Net income: At $5.66 billion last quarter, Eli Lilly’s net income is up 105.14% QoQ and 90.78% YoY.

EBITDA: $7.5 billion, which is a dramatic increase of 80.27% from the previous quarter and 82.35% from last year.

Alt data from the past few months:

Job listings ↑ 38%

Instagram followers ↑ 11%

85% positive employee sentiment

The chart:

AI score: 76 — buy signal.

Current price: $710.50

Price prediction: $835.81 (17.6% upside)

Bottom line: Eli Lilly and Company shows strong financial health and operational efficiency, as evidenced by significant increases in revenue, net income, and EBITDA. The technical indicators suggest that, despite a recent decline in the stock price, the long-term outlook remains bullish. And thus, our model arrives at a “buy” signal. Always do your own research, and this is not financial advice.

Want instant access to scores like this—any time, before the news hits?

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Interestingly, mentions of all stocks seem to be down on Reddit today, possibly because everyone was posting memes about Fed Chair Powell’s speech.

Intuit $INTU sentiment fell 13.2%, likely because of its less-than-ideal revenue forecast for the coming quarter.

Applied Industrial’s $AIT job listings are up 86.1%.

Commerce Bancshares $CBSH has gone from a “buy” rating to a “sell” rating on AltIndex over the course of just 2 weeks.

📉 Lowest Scores: Stocks Losing Signal

And here are the stocks that have not made it—and that our model thinks will not make it. Chegg may have helped you get through high school and gen eds in college, but it may not be able to help your portfolio (unless you like shorting stuff).

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Thumbnail image: Diabetes Education Events, Flickr

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

© 2025 AltIndex. All rights reserved.

103 Singleton Ave, Alameda, CA 94501.