🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

What a wild week it’s been. Markets had their worst day in over a month yesterday. Today has been a bit better so far, but sentiment still feels quite negative.

You know what’s helpful at a time like this? An AI model that evaluates market signals and sentiments objectively, then gives you stock ratings. Wish we had that.

Oh wait, we do. And oh wait, that’s the point of this email. On with the show.

In partnership with Masterworks

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Please support our partners!

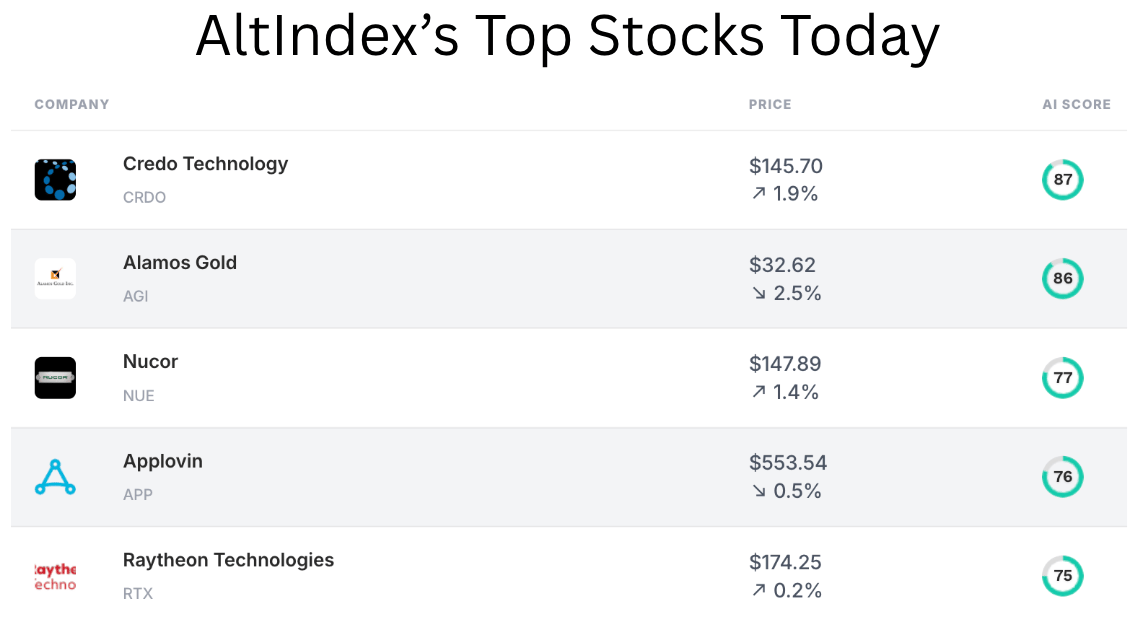

📈 Top AI Scorers of the Week

If you haven’t heard of Applovin by now, you’ve missed out on a serious runner in the stock market. But our AI model doesn’t think the Palo-Alto-based mobile tech company is done running yet.

And here’s what CNBC’s Jim Cramer had to say about the stock recently:

“They have no competition. No one does what they’re doing… no one. No one does that, they have almost a total, a hundred percent market share.”

Stock spotlight: Applovin (APP)

Applovin is a prominent player in the mobile technology landscape, focusing on the development of software and tools designed to help app developers monetize their applications effectively. The company's broad portfolio includes a robust advertising platform, various analytics tools, and game development capabilities. Founded in 2012, Applovin has grown significantly, driven by its proficiency in leveraging data to optimize user acquisition and improve overall return on investment (ROI) for app developers.

The data:

Revenue: $1.41B, up 11.90% QoQ and up 17.50% YoY.

Net income: $820M, up 1.95% QoQ and up an incredible 92.63% YoY.

EBITDA: $1.11B, up 13.03%% QoQ and up 72.63% YoY.

Price Momentum: Negative short-term momentum but positive long-term momentum.

Analyst rating: 79% buy

Alt data from the past few months:

Job listings ↓ 20%

Employee business outlook: 67% positive

Web traffic ↑ 39.7%

Facebook followers ↑ 10.8%

Instagram followers ↑ 9.3%

The verdict:

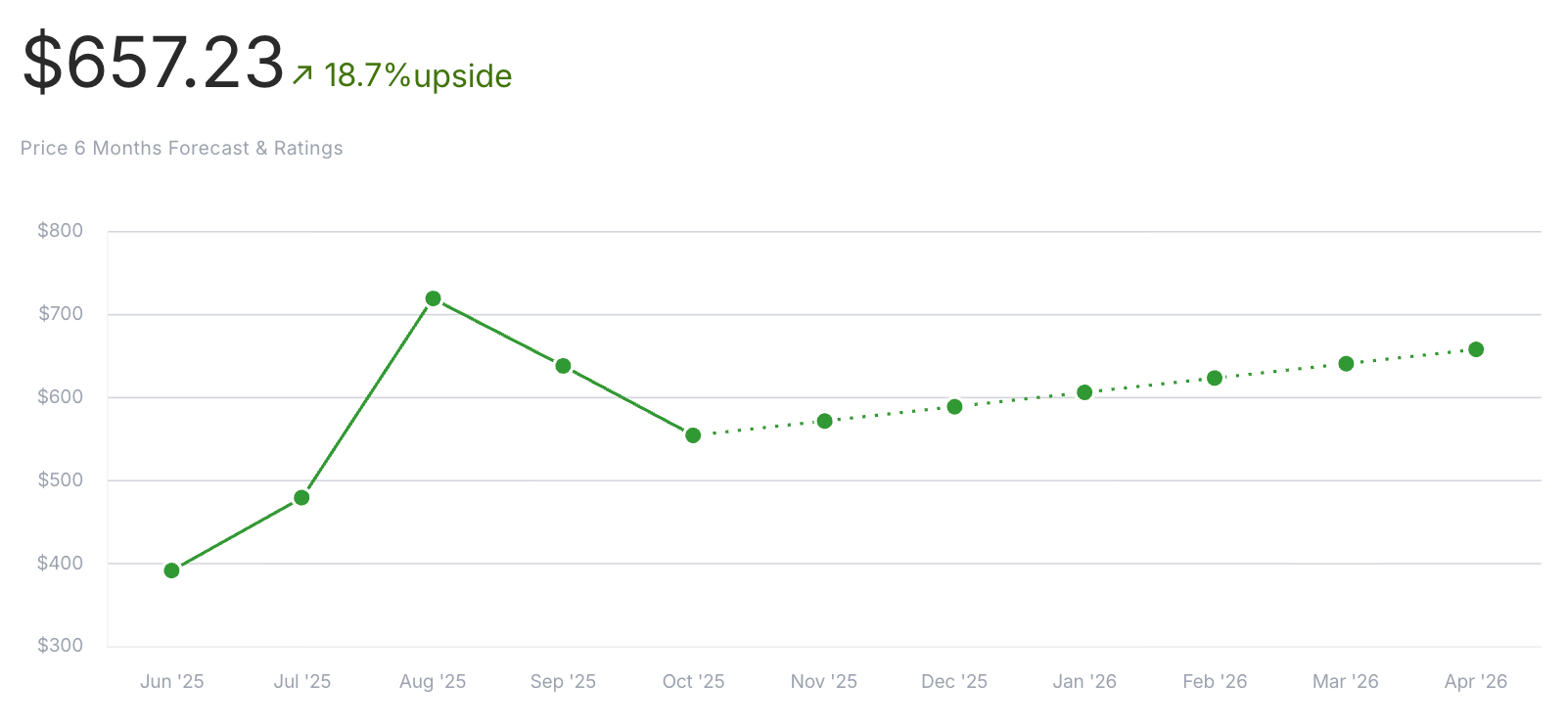

AI score: 76 — buy signal.

Current price: $563.50

Price prediction: $657.23 (16.2% upside)

Bottom line: Based on our AI model’s analysis, Applovin presents an interesting case for itself as an investment. With swiftly rising revenue, net income, and EBITDA, the company is performing well on the business front. Relatively positive employee business outlook is a plus as well, although we typically like to see that percentage in the 80s or higher. The company is also doing well with its social presence, growing account followings on both Facebook and Instagram. Overall, our AI gives it a rating of 76/100: a buy signal.

🔎 Alt-Data Signals

Congress Trades

We’ve got another slew of HUGE trades from none other than Congressman Cleo Fields himself, the man who invested in IREN early.

He’s posting six-figure tech company buys and only made one sale: Chipotle (lol). The interesting thing is that he doubled down on Apple and Google, buying those stocks twice (and way more APPL than any other stock). Clearly, Fields isn’t scared of the AI bubble, but he IS scared of the slop bowl economy falling apart. Check it out:

Buy: TSMC (TSM)

$100K - $250K

Buy: Apple (APPL)

$100K - $250K

2nd Buy: Apple (APPL)

$250K - $500K

Buy: Alphabet (GOOGL)

$100K - $250K

2nd Buy: Alphabet (GOOGL)

$15K - $50K

Sell: Chipotle (CMG)

$15K - $50K

Reddit Alerts

Redditors are actively discussing Direct Digital Holdings (DRCT) on Reddit, focusing primarily on its recent compliance with the Nasdaq Stock Market listing rule for minimum stockholders’ equity. They also highlight that DRCT has until January 30, 2026 to meet the minimum bid-price rule. The discussions revolve around potential catalysts such as a reverse stock split and positive earnings or revenue growth updates which could push the share price above $1 (currently $0.20). This would eliminate the risk of delisting, potentially triggering an aggressive flow of speculative capital into this micro-cap company.

People are also talking about NVIDIA's (NVDA) financial position and future prospects on Reddit. Some users express concerns about companies potentially inflating their profits by spreading out the cost of GPUs, which could eventually lead to reduced orders for NVIDIA due to poor cash management. Others speculate on NVIDIA's earnings report, with mixed opinions about its potential impact on the stock market, while some users share personal experiences with investing in NVIDIA stocks.

Other Alternative Data Signals (3 Month Time Frame)

Mercury General’s (MCY) job postings are up by 54.9%.

Tyler Technologies (TYL) job postings are down by a shocking 87.3%.

Atlassian’s (TEAM) Facebook PTAT (People Talking About This) is up 89.1%.

Want instant access to scores like this—any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.