🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

Not going to lie, I’m pretty sure that the past week will go down in history as one of the craziest weeks of trading ever.

Want to see what stocks our AI model thinks are the diamonds among such rough circumstances?

Us too, that’s why we’re here. Lets get started.

In partnership with Longview Tax

It's not you, it’s your tax tools

Tax teams are stretched thin and spreadsheets aren’t cutting it. This guide helps you figure out what to look for in tax software that saves time, cuts risk, and keeps you ahead of reporting demands.

Please support our partners!

📈 Top AI Scorers of the Week

It’s nice when you see a stock consistently get high ratings like Astera Labs (ALAB) or Marvell Technology (MRVL). But honestly, it’s refreshing to see new names like Amer Sports, Apollo Global, and McGrath in our top 5.

Today, we’re going to focus on Apollo Global Management specifically. Why? Because it’s a company that specifically deals in alternative assets like private credit, private equity, and real assets. And whenever we find an opportunity to get exposure to alternative assets in a highly-rated form like this, we’re interested.

Stock spotlight: Apollo Global Management (APO)

Apollo Global Management, Inc. (NYSE: APO) is one of the leading global alternative investment management firms. Founded in 1990, Apollo focuses on three primary business segments: private equity, credit, and real assets. The firm has a diversified client base, including pension plans, endowments, and sovereign wealth funds, and it manages a substantial pool of assets globally.

Notable narratives for APO from AltIndex’s news aggregator:

Apollo Global’s (APO) Funds to Acquire Major U.S. Hydropower Platform (Insider Monkey, Yahoo Finance)

Apollo Global Management (NYSE:APO) shareholders are still up 230% over 5 years (Simply Wall St., Yahoo Finance)

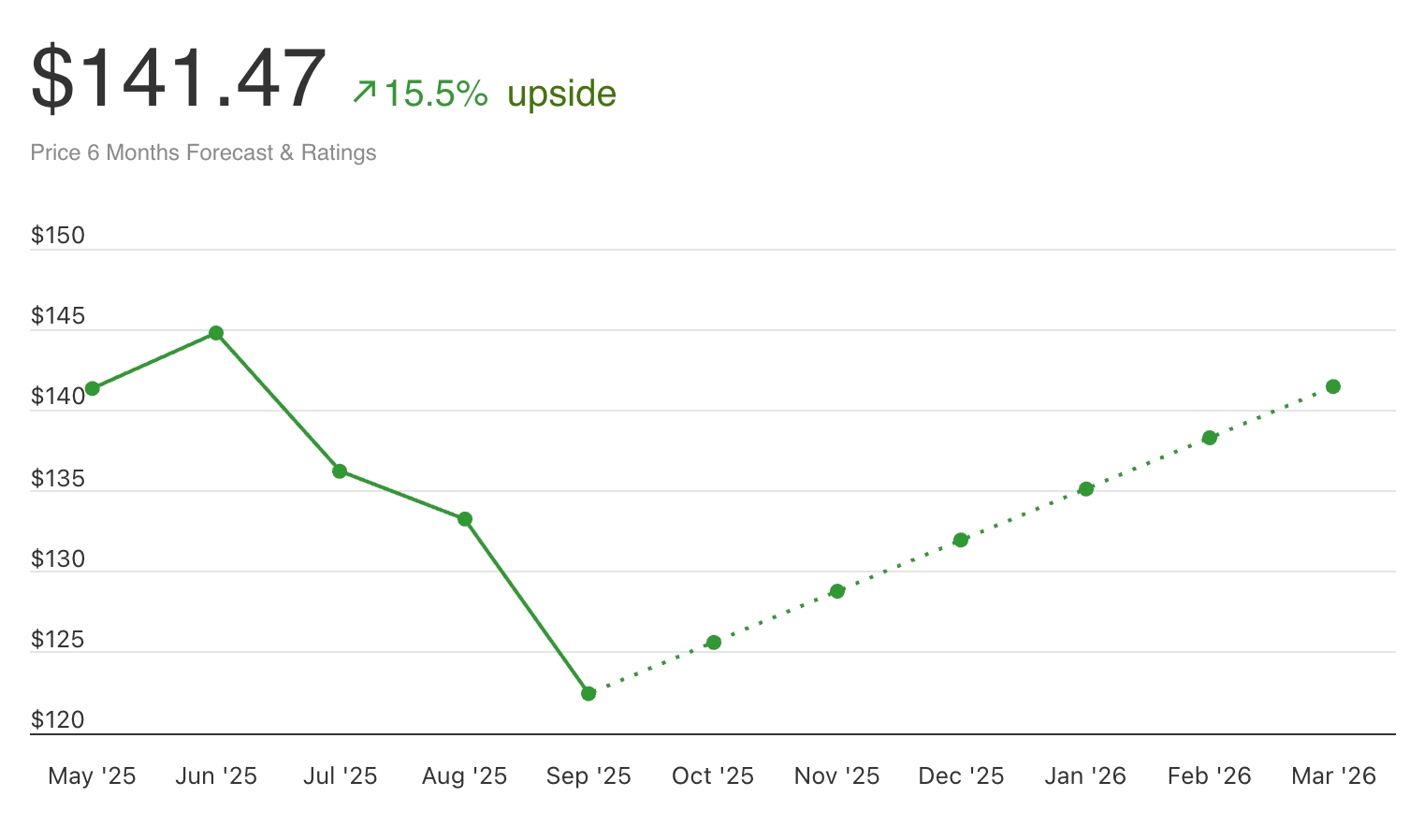

Price prediction:

The data:

Revenue: $6.81B. Up 22.82% QoQ and 13.23% YoY.

Net income: $630M. Up 48.24% QoQ but down 23.36% YoY.

EBITDA: $1.26B. Down 20.00% from the last quarter and down 29.71% from last year.

Analyst rating: 72% buy

Price Momentum: negative price movement both short and long term

Insider trades: there has been insider selling recently, potentially signaling profit taking

Alt data from the past few months:

Job listings ↓ 42%

Employee business outlook is 85% positive

Web traffic ↑ 32%

Twitter followers ↑ 6%

The verdict:

AI score: 78/100 — a buy signal.

Current price: $122.25

Price prediction: $141.47 (15.5% upside)

Bottom line: Based on our AI model’s analysis, Apollo Global Management exhibits mixed but overall positive signals. While the fundamental metrics show parts of positive growth, the operational challenges, as indicated by declining EBITDA and insider selling, warrant caution. The technical indicators highlight a bearish trend, and current price movements could concern potential investors. However, high employee sentiment and increased web traffic present bullish signals in the alternative data analysis. The high AI score further supports this optimism.

Considering these factors, our AI model thinks it could be worth keeping an eye on Apollo Global Management for those looking to invest.

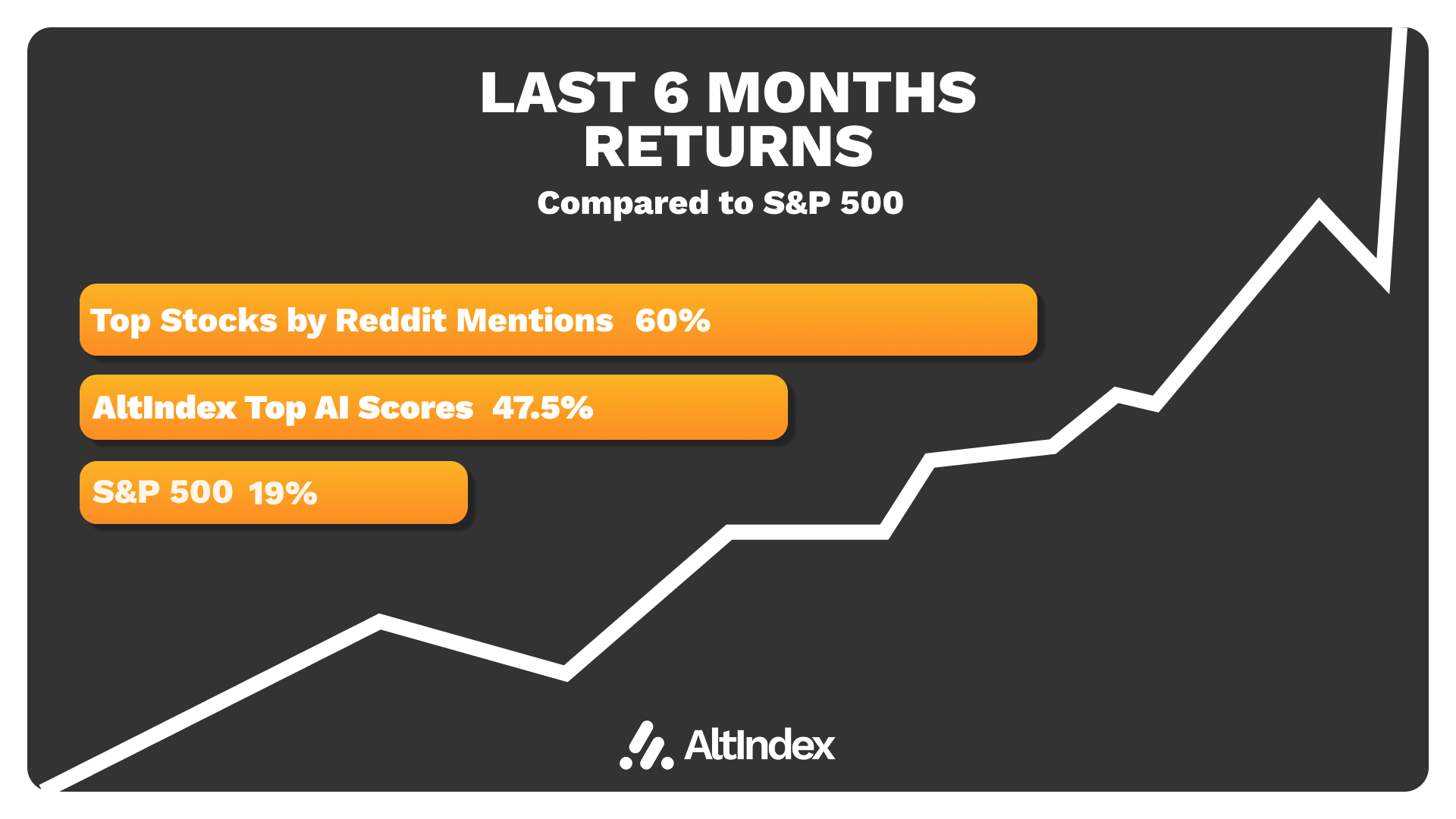

Reddit’s Top Stocks Beat the S&P by 40% Over 6 Months

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood, which was the #6 most-mentioned stock on Reddit over the past 6 months.

Other examples:

TSLA, up 74.42% the past 6 months (#1 most-mentioned stock on Reddit)

XYZ, up 36.87% the past 6 months (#10 most-mentioned stock on Reddit)

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

The pattern is obvious once you see it.

AltIndex's AI processes hundreds of thousands of Reddit comments, then factors that data into stock ratings you can access 24/7 from our app.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Congressman Josh Gottheimer reshuffled his portfolio around last month and reported his newest moves yesterday:

Sold $1K - $15K of TTD

Bought $1K - $15K of SSMXY

Bought $1K - $15K of IRT

And many more (see them here)

Reddit Alerts

Nebius (NBIS) is getting a lot of traction on Reddit right now, but not for good reasons. NBIS is down 16.80% over the past 5 days. People are talking about the stock’s crazy price movement, and many users, including one who invested 50% of his portfolio into NBIS with 5x leverage at a rate of 125, are expressing shock and concern.

SPDR Gold Shares (GLD) Reddit mentions are up 455.4%. Many users are pumped about recent gains and bullish predictions for the stock. Some are sharing their success stories about buying calls that have significantly increased in value, while others are jokingly blaming their own investments for any potential future dips. There is also a recurring theme of GLD being seen as a secure investment compared to other volatile assets like Bitcoin.

Miscellaneous 3-Month Signals

Atlasclear’s (ATCH) web traffic rose 2,700%

Liberty Energy (LBRT) saw a 707.7% increase in web traffic

AMC (AMC) saw a 2400% increase in job posts

GUESS (GES) job posts increased by 26.1%

Want instant access to data and stock ratings like this at any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algorithms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.