🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

Today, we’re talking about one of the largest steel producers in the US, some spicy Congress stock purchases, and two Reddit alerts that will tip you off on what’s happening beneath the surface of the market.

Let’s dig in to the data.

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We're giving you free access to our app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

📈 Top AI Scorers of the Week

Stock spotlight: Nucor (NUE)

Nucor Corporation (NYSE: NUE) is one of the largest steel producers in the United States and is known for its innovative approach and sustainable practices in steel manufacturing. Founded in 1940, Nucor has established a strong reputation for operational efficiency and a diverse range of steel products, including carbon and alloy steel, rebar, and sheet steel.

Notable narratives for BCPC from AltIndex’s news aggregator:

NUE just posted earnings and revenue beats yesterday; the stock went up by 8%.

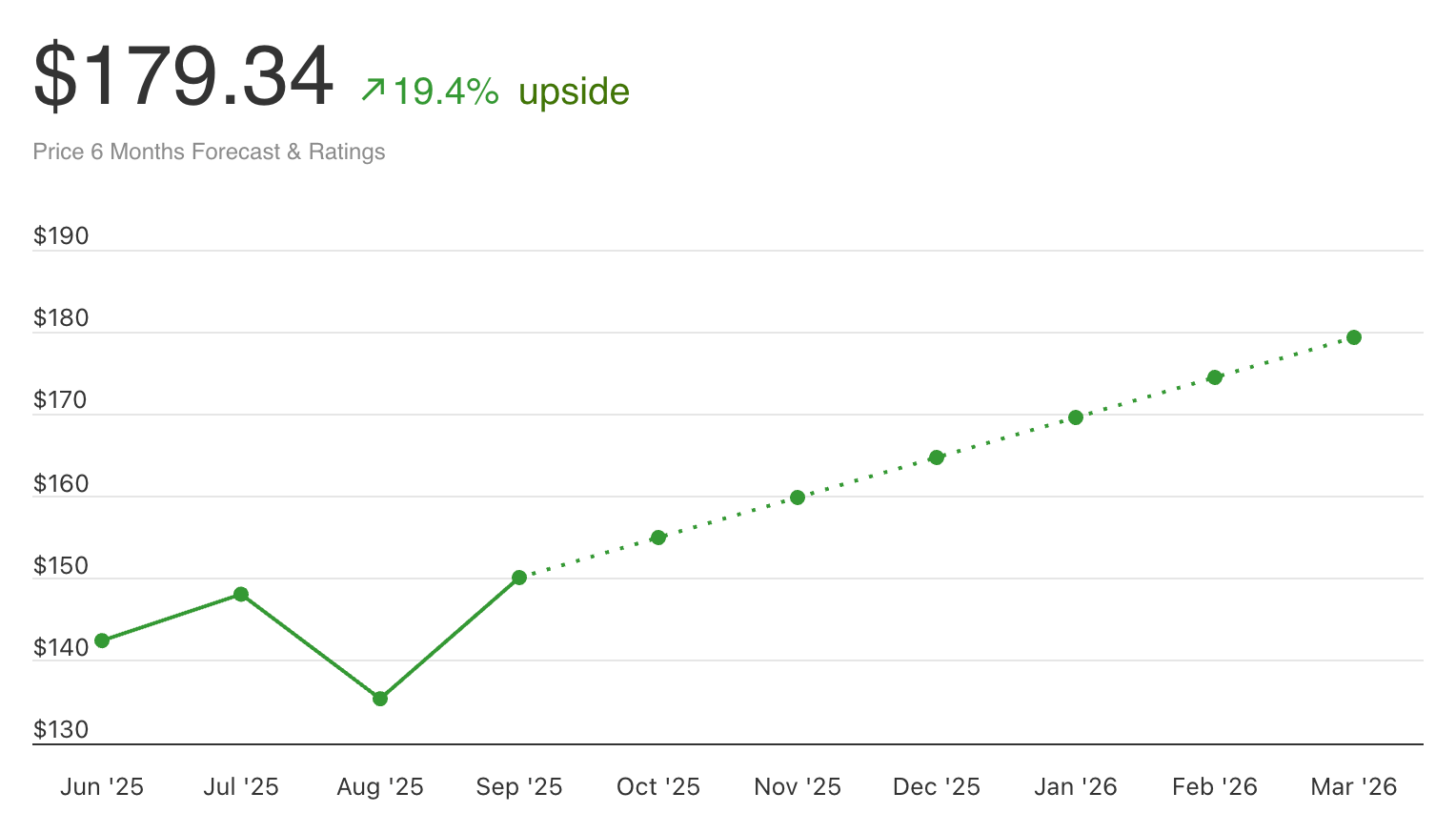

Citi just raised their price target for NUE from $150 to $180 after the earnings report, which is right in line with our model’s prediction…

Price prediction:

The data:

Revenue: $8.52B. Up 0.77% QoQ and 14.47% YoY.

Net income: $607M. Up 0.66% QoQ and 142.89% YoY.

EBITDA: $1.27B. Down 3.73% from last quarter but up 57.42% from last year.

Analyst rating: 64% buy

Price Momentum: Positive short-term (+10.91% on the month) and long term (+6.45% on the year)

Insider trades: there was insider selling in August, potentially signaling profit taking

P/E ratio: normal at 21.69

Alt data from the past few months:

Job listings: ↓ 23%

Web traffic ↑ 39%

Employee business outlook: 86% positive

The verdict:

AI score: 79/100 — a buy signal.

Current price: $150.59

Price prediction: $179.34 (19.4% upside)

Bottom line: Nucor Corporation shows solid fundamental strength with consistent revenue and net income growth, despite a slight drop in EBITDA quarter-over-quarter. The stock's technical indicators reveal both short-term and long-term upward trends. While the decline in job postings might be concerning, the positive employee sentiment and rising customer engagement offer a bullish signal.

Taking into account the comprehensive analysis, the stock's performance outlook appears optimistic. Based on the fundamental, technical, and alternative data analyses, our model recommends Nucor stock as a “Buy” for those seeking stable, long-term growth.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Congresswoman Marjorie Taylor Green is back with even more tech industry stock purchases made on Oct 24th (reported on Oct 29th).

Note that she is buying even more IBIT after buying twice earlier in the month. Green seems to be all about stacking Bitcoin (through the stock market, at least).

She also bought energy (KMI), e-commerce (AMZN + MELI), and alternative investments management (BX), among other things.

Buy: iShares Bitcoin Trust (IBIT)

$1K - $15K

Buy: Palo Alto Networks (PANW)

$1K - $15K

Buy: Microsoft (MSFT)

$1K - $15K

Buy: Amazon (AMZN)

$1K - $15K

Buy: Kinder Morgan (KMI)

$1K - $15K

Buy: Blackstone (BX)

$1K - $15K

Buy: Mercado Libre (MELI)

$1K - $15K x 2

Buy: Occidental Petroleum (OXY)

$1K - $15K

Reddit Alerts

Redditors are talking about a user's large transaction on Robinhood (HOOD) involving NVDA shares, where he was forced to buy at a higher price and sell at a lower one, resulting in an out-of-pocket loss. Additionally, there is talk about the performance of Robinhood's stock (HOOD), suggesting it is going 'parabolic' and speculation that it might outperform SOFI following their earnings announcement.

People are actively discussing the recent surge in Palantir's (PLTR) stock price, which has just exceeded $200 for the first time. There is a debate about who is investing in PLTR, with some speculating it to be institutional investors despite its perceived overvaluation. The upcoming earnings report and potential effect on the stock's volatility is also a topic of discussion, as well as Palantir's role in AI technology and government contracts.

Other Alternative Data Signals (3 Month Time Frame)

Noodles & Company’s (NDLS) TikTok followers just rose by 32.7%.

Encompass Health’s EHC’s job listings are up by 42.4%.

Want instant access to data and stock ratings like this at any time, before the news hits?

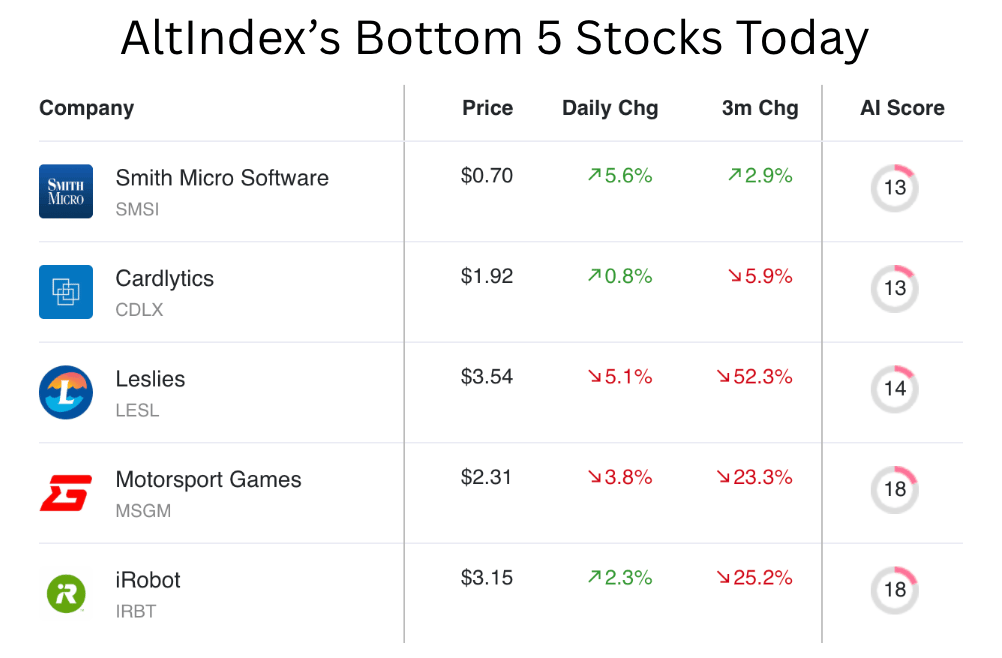

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algorithms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.