🧠 The Signal Brief: Special Edition

Hello, and welcome to the AltIndex newsletter. In today’s special edition, we’ll be breaking down the #1 rated stocks in 5 new industries.

Where are we looking? Insurance, gaming, biotech, lithium, and fintech. The companies we’re listing have some of the highest AI Scores on our platform.

But before we jump in, a potential opportunity stock at the intersection of AI agents and consumer data:

On Behalf of The FUTR Corp.

The $4.4 Trillion Shift Few See Coming

McKinsey says AI could add $4.4T annually. Microsoft, Salesforce, and early startups are racing ahead. But one small-cap with $3B processed and 88% margins is ready to launch its consumer agents.

The Best Insurance Stock

Arch Capital Group (ACGL) is a global provider of insurance, reinsurance, and mortgage insurance. Founded in 1995 and headquartered in Bermuda, the company has built a diverse and comprehensive portfolio that covers the risk management needs of its clients across the globe.

The signals

Revenue: at $5.21 billion, revenue increased 13.51% QoQ and 28.32% YoY

Net Income: $1.24 billion. Increased 115.51% QoQ but decreased 2.52% YoY

ACGL has a short-term positive (but long-term negative) price momentum

Over the past few months:

47% increase in job listings

50% positive employee outlook

AI Score: 77/100

Current Price: $92.26

Target Price: $109.58

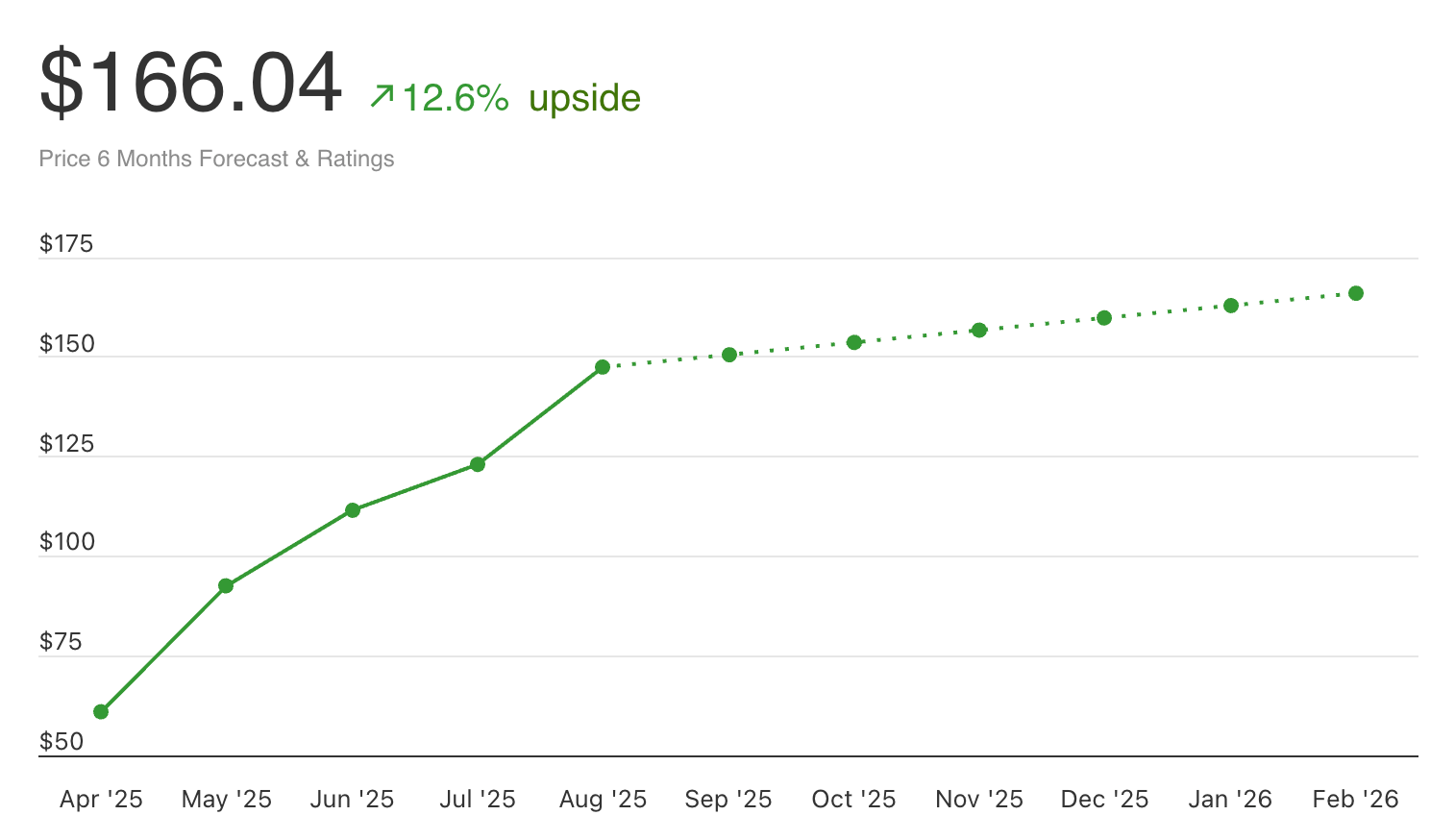

The Best Biotech Stock

Alnylam Pharmaceuticals (ALNY) is a leading biopharmaceutical company specializing in RNA interference (RNAi) therapeutics. With a focus on transformative medicine, Alnylam's innovative solutions target rare and genetically-defined diseases for which there are limited or no treatment options available.

The signals

Revenue: $774 million. Up 30.21% QoQ and 17.26% YoY

Net Income: $66 million. Down 15.31% QoQ and down 292.43% YoY

ALNY has positive short- and long-term price momentum

Over the past few months:

67% increase in job postings

25% increase in web traffic

AI Score: 74/100

Current Price: $465.89

Target Price: $542.53

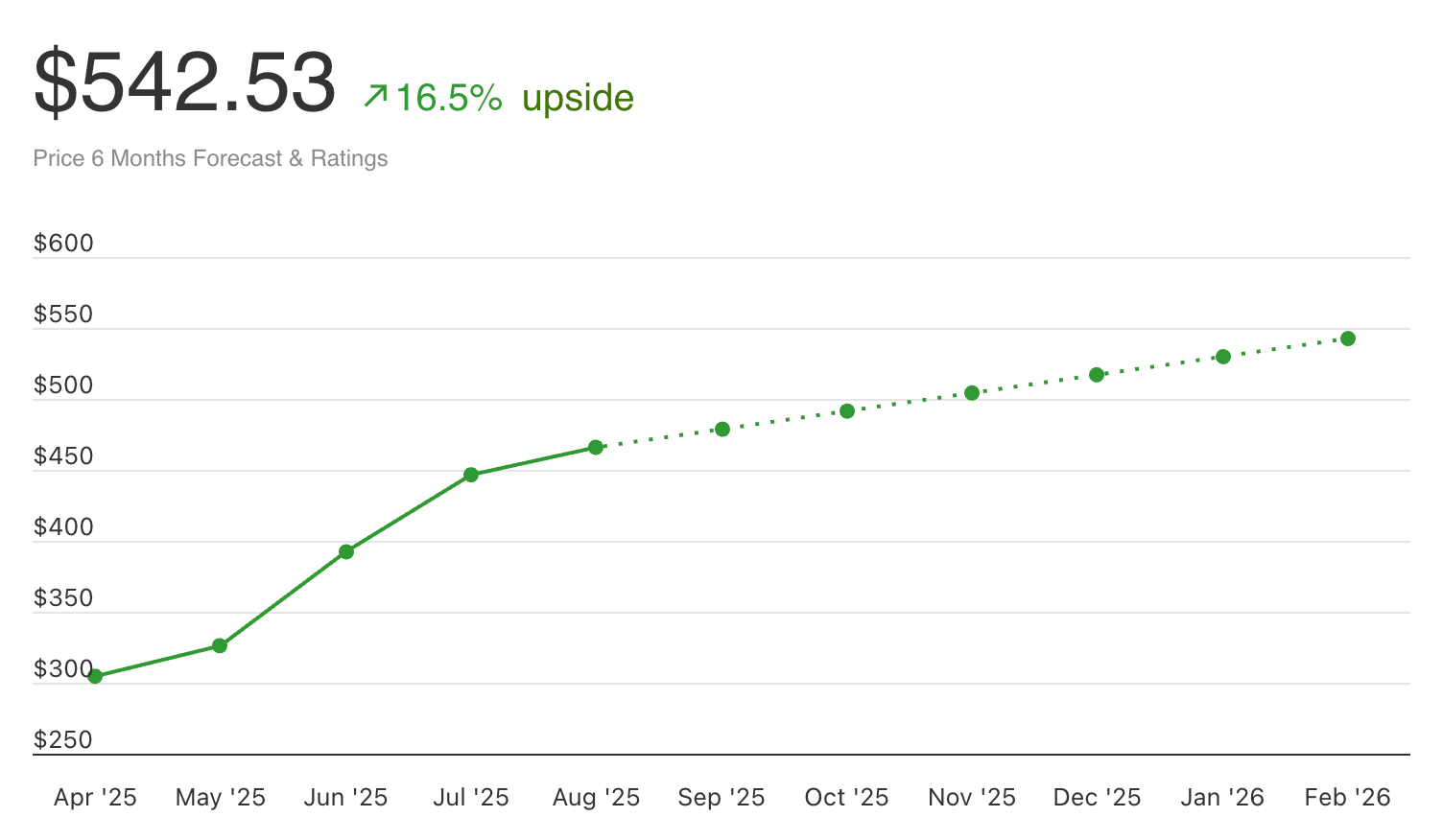

The Best Gaming Stock

Light & Wonder, Inc. (LNW) operates as a cross-platform games company in the United States and internationally. The company operates through three segments: Gaming, SciPlay, and iGaming segments.

The signals

Revenue: $809 million. Up 4.52% QoQ but down 1.10% YoY

Net Income: $95 million. Up exactly 15.85% QoQ and YoY (we checked)

LNW has slight short-term upward price momentum but negative long-term

RSI is 15.4, which could indicate an oversold condition for the stock

Over the past few months:

14% decrease in job listings

50% increase in web traffic

17% increase in Instagram followers

AI Score: 73/100

Current Price: $9.20

Price Target: $10.62

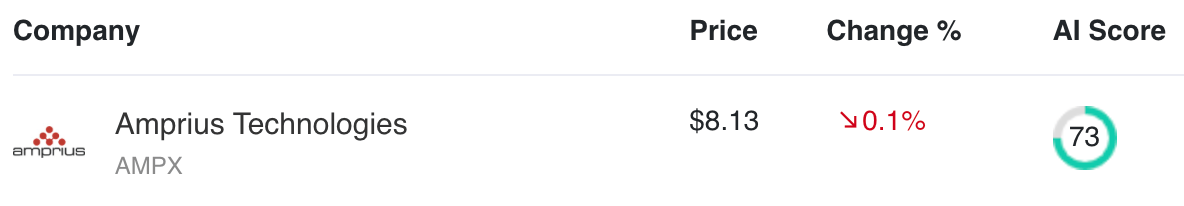

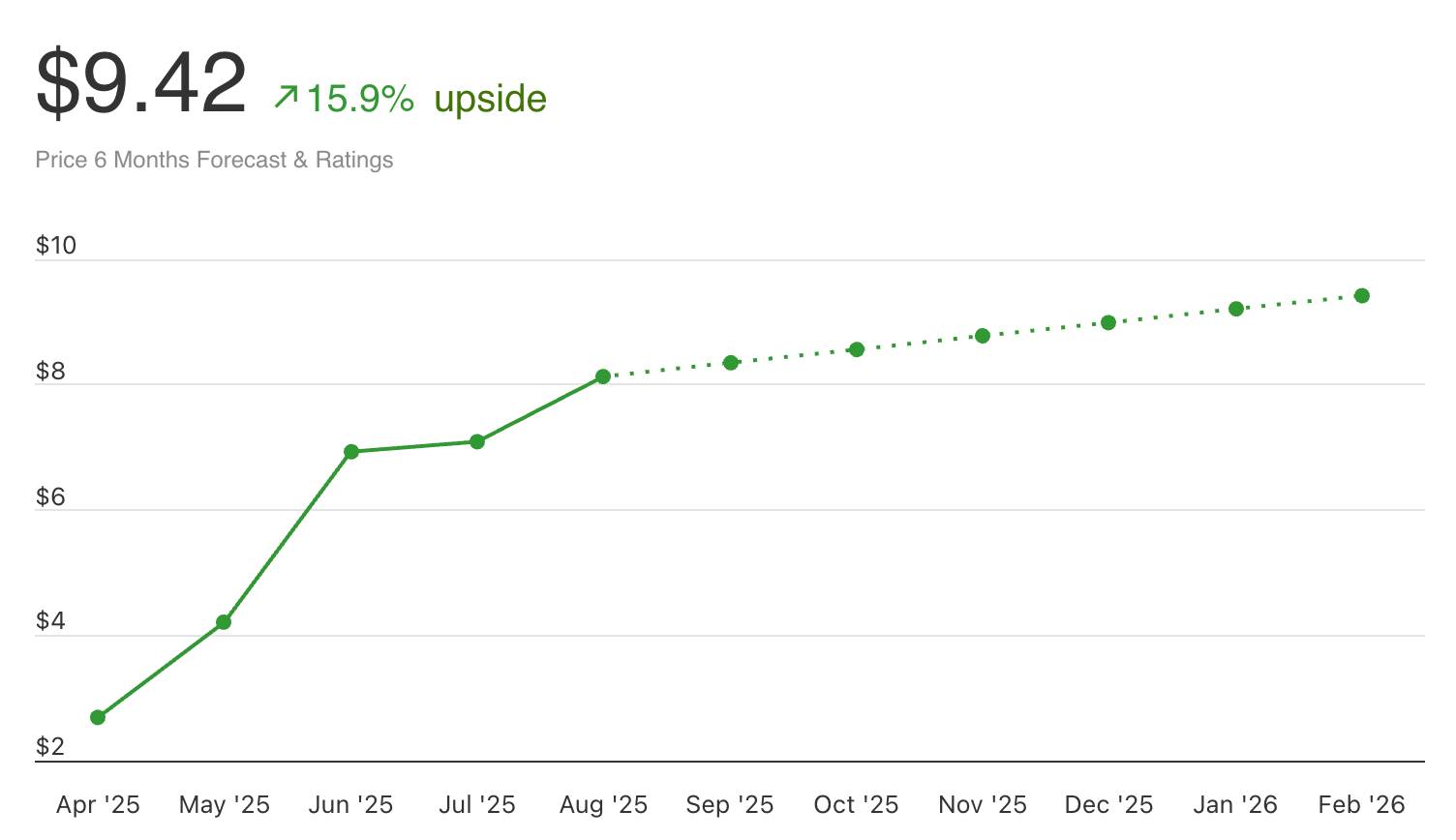

The Best Lithium Stock

Amprius Technologies (AMPX) Amprius Technologies, a prominent player in the field of advanced energy storage technologies, focuses on the development and manufacturing of high-energy lithium-ion batteries. Their novel silicon nanowire anode technology promises to deliver superior energy density and longer life spans compared to traditional lithium-ion batteries.

The signals

Revenue: $15 million. Up 33.53% QoQ and 350.43% YoY

Net income: $6.4 million. Increased 32.02% QoQ and 49.11% YoY

Both short- and long-term stock price growth (+834.48% in the past year)

Over the past few months:

Job listings increased by 125%

Employee outlook is 100% positive

Web traffic increased 84%

Twitter followers are up by 18%

AI Score: 73/100

Current Price: $8.13

Target Price: $9.42

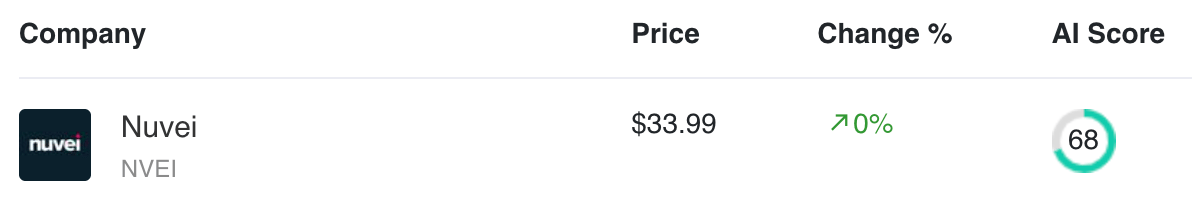

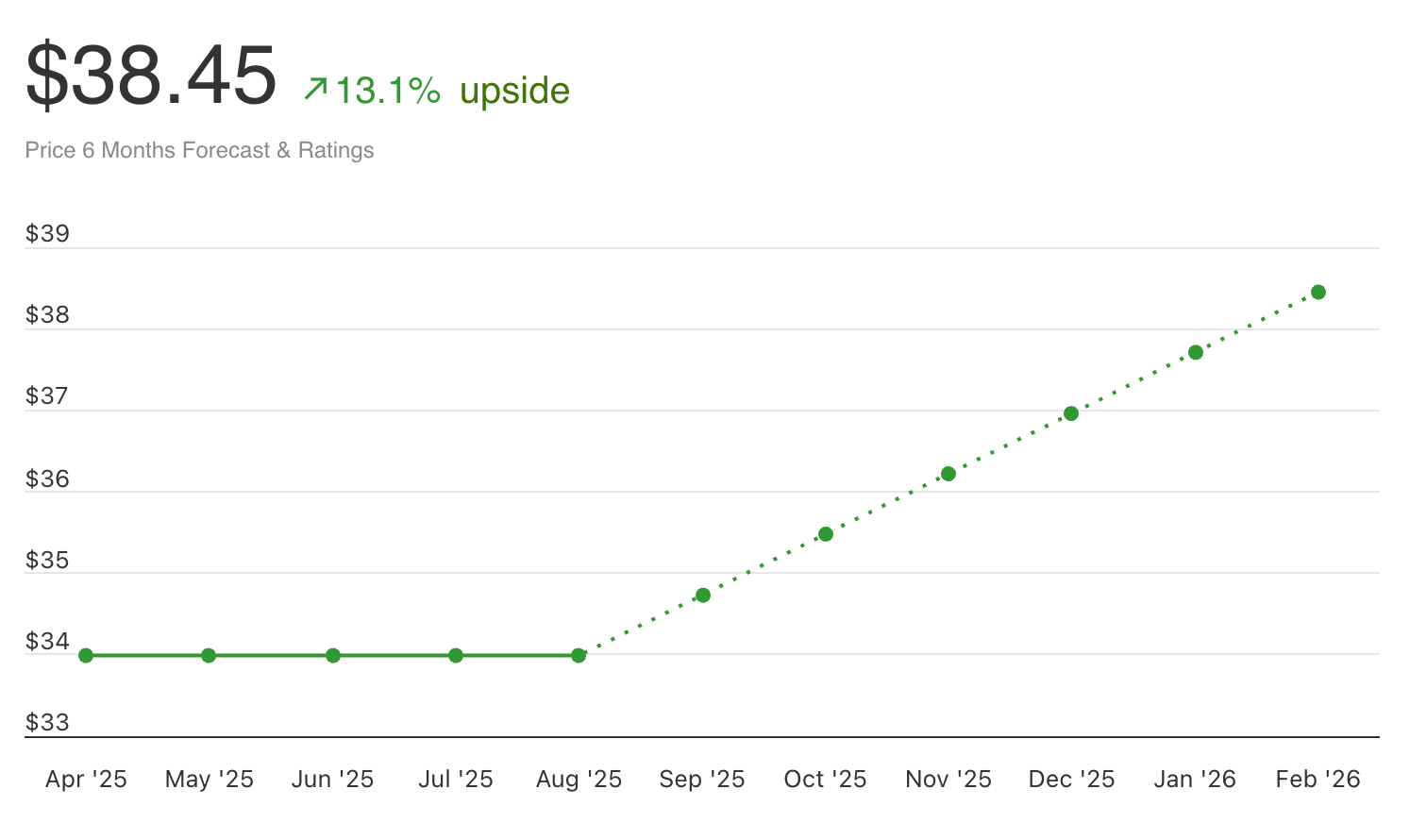

The Best Fintech Stock

Nuvei (NVEI) Nuvei Corporation is a payment processor headquartered in Montreal, Canada. Nuvei provides businesses with pay-in and payout options.

The signals

Revenue: $358 million. Up 3.54% QoQ and 17.31% YoY

Net income: $15 million. Increased 343.41% QoQ and 177.54% YoY

Stock price has remained relatively stable both short and long term.

Over the past few months:

Job listings increased by 52%

Web traffic increased 11%

AI Score: 68/100

Current Price: $33.99

Target Price: $38.45

👋 See You This Friday

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.