🧠 The Signal Brief - AI Stock Insights & Picks

Another week, another set of wild market moves. While everyone's talking about the Fed's latest signals and Big Tech earnings, there's a quieter revolution happening in the high-performance computing space.

Today's spotlight stock isn't your typical AI darling. It's a company that's powering the infrastructure behind the digital economy, and it just caught the attention of some very deep pockets. We're talking about a $3 billion debt deal backed by Google and arranged by Morgan Stanley.

But the real kicker is that our AI model just slapped an 83 score on this stock, suggesting serious upside potential. And with web traffic up over 300% and analysts almost unanimously bullish, we think you’ll want to at least take a look.

Like Playing Moneyball with Your Stock Picks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Insider Activity: UNH execs bought $31M before Buffett joined

While you analyze P/E ratios, professionals track Reddit mentions, Congressional filings, and insider purchases in real-time.

What if you had access to all of it?

Every week, our AI processes 50,000+ Reddit comments, every Congressional filing, and insider transactions from 500+ companies.

Then you can see which stocks show the strongest signals across ALL categories at any time in our app. Constantly updated.

The next big winner is already showing signals. Will you see them this time?

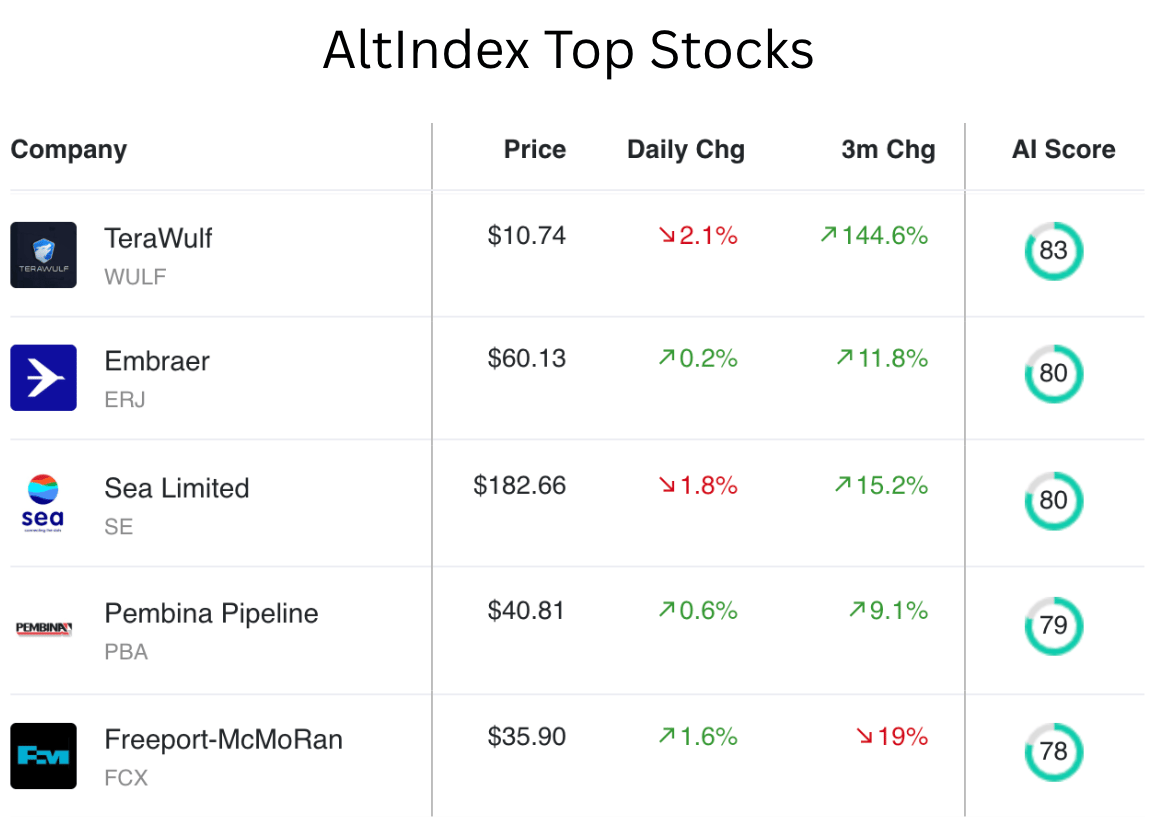

📈 Top AI Scorers of the Week

The usual suspects are still hanging around our top rankings; you know the drill with some of our AI model’s recurring favorites. One of those faces is a stock that’s been building serious momentum in the high-performance computing and digital infrastructure space.

Meet TeraWulf, the company that's been flying under the radar while building the backbone of tomorrow's digital economy. With a monster AI score of 83 and Google's backing, this might be a serious infrastructure swing trade play.

Stock spotlight: TeraWulf (WULF)

TeraWulf is a company operating within the burgeoning domain of high-performance computing and financial technology. As a promising player in this space, TeraWulf focuses on leveraging advanced technologies to provide robust solutions. Given the rapid pace of technological advancements, the company's prospects look favorable for both short-term and long-term investors.

Notable narratives for ___ from AltIndex’s news aggregator:

TeraWulf aims to raise $3 billion in debt with support from Google in a deal arranged by Morgan Stanley (Crypto Briefing).

WULF has a 91.67% buy rating among a group of 12 total analysts, according to Market Beat.

Roth Capital raised their WULF price target by $7.50 from $14 to $21.50 (TipRanks).

The data:

Revenue: $48M, up 38.46% QoQ and 33.91% YoY

Net income: $18M, up 70.09% QoQ but down 68.90% YoY

Analysts’ take: 92.67% buy rating

Price trend: Positive both in the short term (+18.72% the past month) and long term (+122.06% the past year)

Alt data from the past few months:

Web traffic ↑ 307%

Stocktwits mentions ↑ 265%

Twitter following ↑ 9%

The verdict:

AI score: 83 — buy signal.

Current price: $10.78

Price prediction: $13.91 (29.5% upside)

Bottom line: TeraWulf shows a mix of strong growth potential and certain risk factors. The notable increases in revenue net income from the previous quarter, along with the bullish technical indicators, suggest a promising trajectory. However, the year-over-year decline in net income could be a reason for caution.

The increased web traffic and growing social media presence indicate an expanding customer base and enhanced brand recognition, reinforcing the company's market position. The strong AI score of 83 further suggests a good entry point for new investments.

In light of these factors, TeraWulf appears to be an appealing investment to our AI model with a combination of growth potential and emerging market interest. While there are areas to watch closely, particularly concerning long-term profit margins, the overall outlook remains positive.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Buys

Lisa McClain bought between $15k and $50k of Big Bear AI (BBAI) buy on Aug 7 (filed Sep 15). She was the first politician to ever buy the stock. BBAI’s CEO is President Trump’s former Secretary of Homeland Security, and a lot of the company’s business comes from government contracts.

Thomas H. Kean bought $1K - $15K of Check Point Software Technologies (CHKP) on Aug 4 (filed Sep 19). CHKP is Israel’s fourth largest company and it sells cybersecurity to governments like the US and Israel. Of note: Kean is on the communications & technologies subcommittee.

Rich McCormick filed 33 trades on the same day in 2023 and didn’t file them until 2.5 years later (this month). The trades included MSFT (he’s up 95.2%), WMT (up 129%), COST (up 96.4%), AAPL (up 68.7%), and many more.

Reddit Buzz

Intel (INTC) is currently the most-mentioned stock on all of Reddit, most likely because the company approached Apple about securing an investment from the iPhone maker. INTC is followed closely by GameStop in Reddit mentions.

Redditors are saying that Google could become the biggest company on earth, point to its advancements in AI technology, its potential partnership with Meta for ad targeting, and its strong infrastructure (including its own chips, cash flow, distribution channels, data centers, and decades worth of data).

Miscellaneous

CyberArk Software’s (CYBR) job listings are up by 71.6%, possibly indicating that the company sees growth on the near horizon.

Payoneer’s (PAYO) app downloads are up by 87.6% over the past 3 months.

Want instant access to scores like this—any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.