🧠 The Signal Brief - AI Stock Insights & Picks

I can’t believe how long it’s been since we last wrote to you. It’s been, let’s see how many days, 1, 2, 5, 6, 7… Ah, right. We write a weekly newsletter.

Well, it’s wonderful to see you on another Friday. I hope you made it through the week alright. There were some crazy things happening, heard something about OpenAI with government bailouts and maybe The Big Short 2 happening right now in real time?

Anywho, we’ve got a great issue of the AltIndex Newsletter for you today, including a shiny new stock that our model thinks is as good as gold (and a new batch of congress trades from April Delaney).

In partnership with RAD Intel

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Please support our partners!

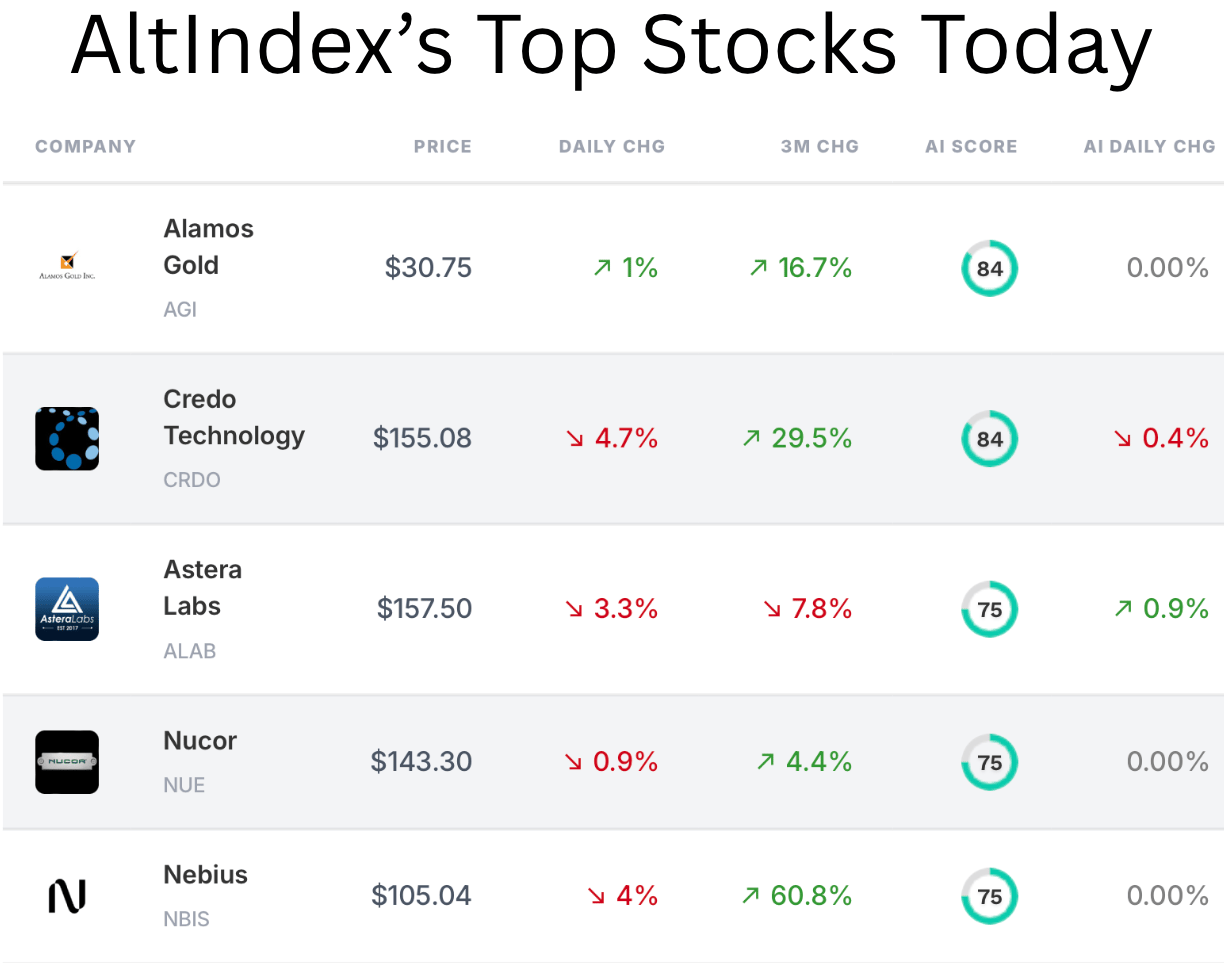

📈 Top AI Scorers of the Week

Strange times we live in, no? And one of the strangest things of all: gold has outperformed the S&P 500, Bitcoin, and a whole lot of other assets.

And I think that’s part of why our AI model loves Alamos Gold so much right now (that, and the company’s incredible financial performance).

Stock spotlight: Alamos Gold (AGI)

Alamos Gold Inc. is a Canada-based intermediate gold producer with diversified production from three operating sites in North America: Young-Davidson and Island Gold in Northern Ontario, Canada, and the Mulatos mine in Sonora, Mexico. The company has a robust portfolio of high-quality assets that underpin a strong production profile and long-term growth opportunities. Alamos Gold’s vision is to be a sustainable capital generator by focusing on safety, profitability, and prudent capital allocation.

The data from this quarter:

Revenue: $457M. Up 4.33% quarter over quarter (QoQ) and up 26.68% year over year (YoY).

Net income: $273M. Increased 71.42% QoQ and 223.36% YoY.

EBITDA: $421M. Increased 79.81% QoQ and 105.50% YoY.

Price momentum: short term negative, long term positive.

Analyst rating: 100% buy

Alt data from the past few months:

Employee business outlook: 90% positive

Web traffic ↓ 25%

The verdict:

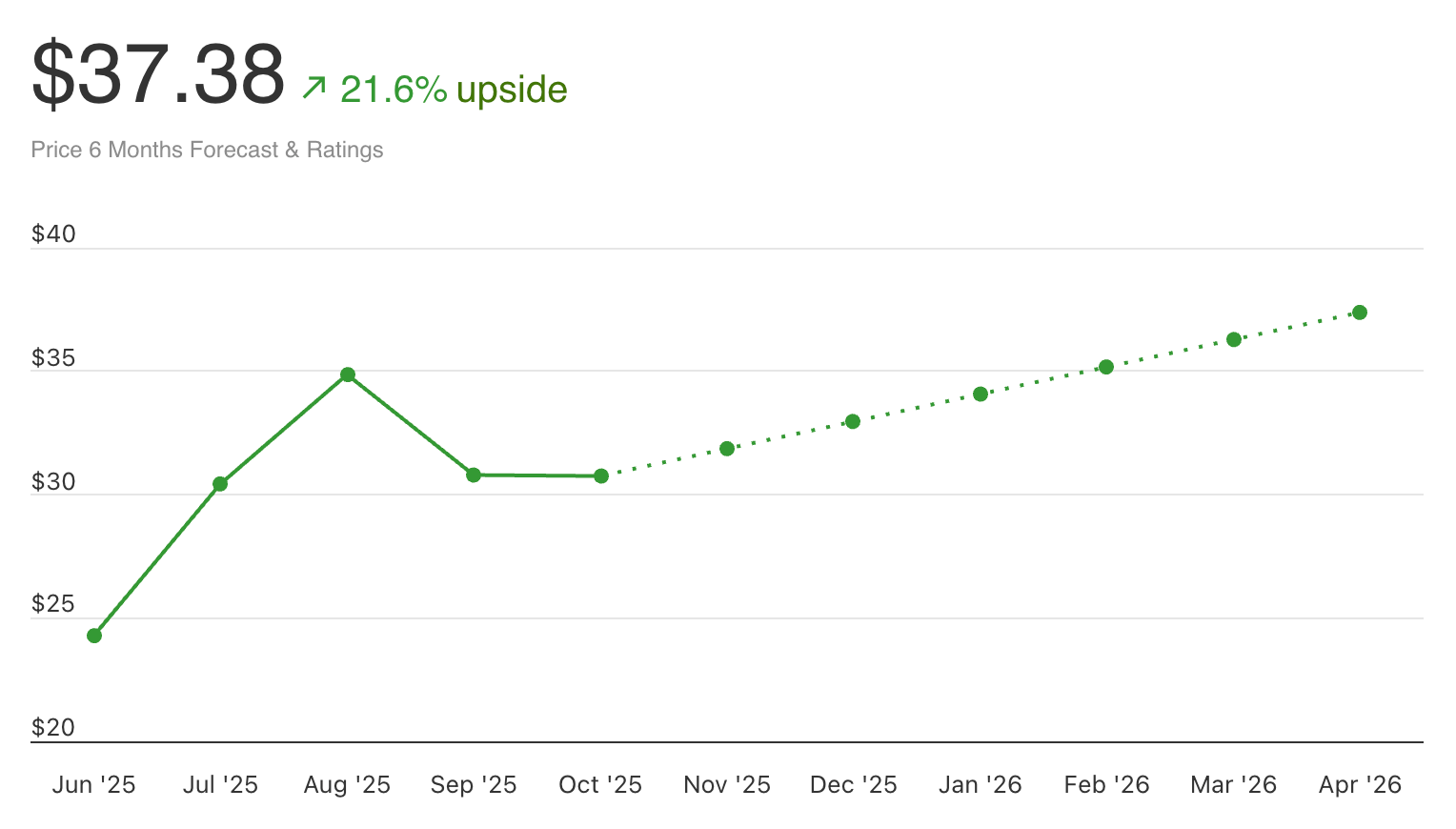

AI score: 84 — buy signal.

Current price: $30.73

Price prediction: $37.38 (21.6% upside)

Bottom line: Overall, Alamos Gold presents a compelling investment opportunity based on strong financial performance and favorable long-term technical indicators. The company’s significant year-over-year revenue and net income growth, along with increasing EBITDA, underscore its operational excellence and potential for continued profitability. Despite a recent decline in stock price and a bearish short-term trend, the long-term outlook remains positive.

The alternative data offers some mixed insights. Stable job postings and positive employee sentiment indicate a robust internal environment. However, the drop in webpage visits raises some concerns regarding customer acquisition. Nonetheless, growing social media engagement and a high AI score of 84 reinforce an optimistic view.

Given the comprehensive analysis, our AI model sees Alamos Gold as a “buy”, factoring in its strong financial health, growth prospects, and positive long-term technical indicators.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Congresswoman April Delaney made a TON of trades throughout October and filed them yesterday.

Note that she bought Nasdaq twice, and the first one was her biggest purchase. This implies Delaney is highly bullish on the tech industry in general.

Here’s what some of her trades were:

Buy: Nasdaq (NDAQ)

$15K - $50K

2nd Buy: Nasdaq (NDAQ)

$1K - $15K

Buy: Bio-Techne (TECH)

$1K - $15K

Sell: Teledyne Technologies (TDY)

$1K - $15K

Buy: Brown & Brown (BRO)

$1K - $15K

Sell: Idexx Laboratories (IDXX)

$1K - $15K

2nd Sell: Idexx Laboratories (IDXX)

$1K - $15K

Reddit Alerts

People are actively discussing Tesla's (TSLA) recent shareholder approval of a record-breaking compensation package for CEO Elon Musk, which could potentially grant him up to $1 trillion if the company achieves ambitious performance and market value milestones. The vote indicates strong investor confidence in Musk's long-term leadership and his role in expanding Tesla into AI and robotics. However, some Reddit users express skepticism about the potential for such growth and question the future valuation of Tesla shares.

People are talking about Modular Medical (MODD) on Reddit too, with many users indicating that they have invested in the company. They believe that the stock is currently undervalued and anticipate a significant price increase leading up to the company's earnings report on November 13th. Some users also speculate about a potential buyout if the results are positive, which could further boost the share price.

Other Alternative Data Signals (3 Month Time Frame)

Humana’s (HUM) job listings spiked by 44.2%

Holley’s (HLLY) Facebook Ptat grew by 454.9%

Kenvue’s (KVUE) job posts decreased by 17.8%

Want instant access to scores like this—any time, before the news hits?

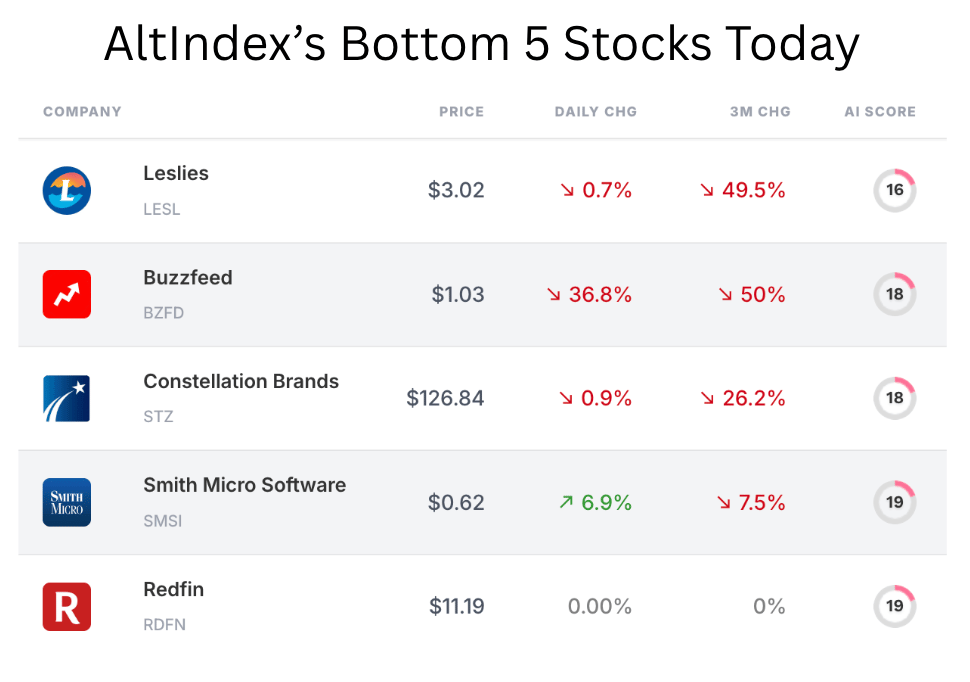

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.