🧠 The Signal Brief

AI may be dominating headlines right now—but headlines don’t always tell you where the real opportunities are. The strongest signals aren’t just coming from mega-caps. They’re bubbling up across industries, from semiconductors to heart surgery devices to online grocery platforms.

Let’s dig into what our AI model is picking up.

The Next Big Breakout Isn't a Chip. It's Glass.

Smartphones disrupted phones. EVs disrupted autos. Now smart surfaces are disrupting everything—and one overlooked company is at the center of it.

Find out why early investors are circling this.

📈 Top AI Scorers of the Week

These stocks had the highest AltIndex scores this week—based on Reddit buzz, hiring trends, web traffic, and more.

It’s funny—it almost feels like a given that CoreWeave will be in the top 5 AltIndex stocks every week this summer. Which is, of course, an exaggeration and not investing advice. But the stock’s persistent 80+ AI Scores and constant headlines speak for themselves.

This week’s top 5 also spans everything from semiconductors to heart surgery tools. That mix says something about where momentum and belief may be stacking up across the market.

Here’s some context for each pick:

Sector: Technology

Industry: Semiconductors/AI Infrastructure

What they do: Develop connectivity solutions for data centers and AI systems (e.g. PCIe, CXL). Strong ties to Nvidia and other AI-heavy hardware ecosystems.

Sector: Technology

Industry: Cloud Computing/AI Infrastructure

What they do: Provides GPU cloud infrastructure optimized for AI and ML workloads. Competes with AWS, Azure, etc., but focused on high-performance GPU scaling.

❤️ AtriCure

Sector: Healthcare

Industry: Medical Devices

What they do: Designs surgical tools and devices to treat atrial fibrillation and related heart issues. High growth in cardiac surgery innovation.

Sector: Consumer Services

Industry: E-Commerce/Online Grocery Delivery

What they do: Operates an online grocery delivery platform. Went public in 2023. Revenue from service fees, delivery, advertising.

Sector: Industrials

Industry: Infrastructure/Utilities Services

What they do: Provides infrastructure solutions for electric power, pipeline, telecom, and renewable energy. Core player in U.S. energy grid modernization.

Get the signals driving performance before the headlines catch up:

Want instant access to scores like this—any time, before the news hits?

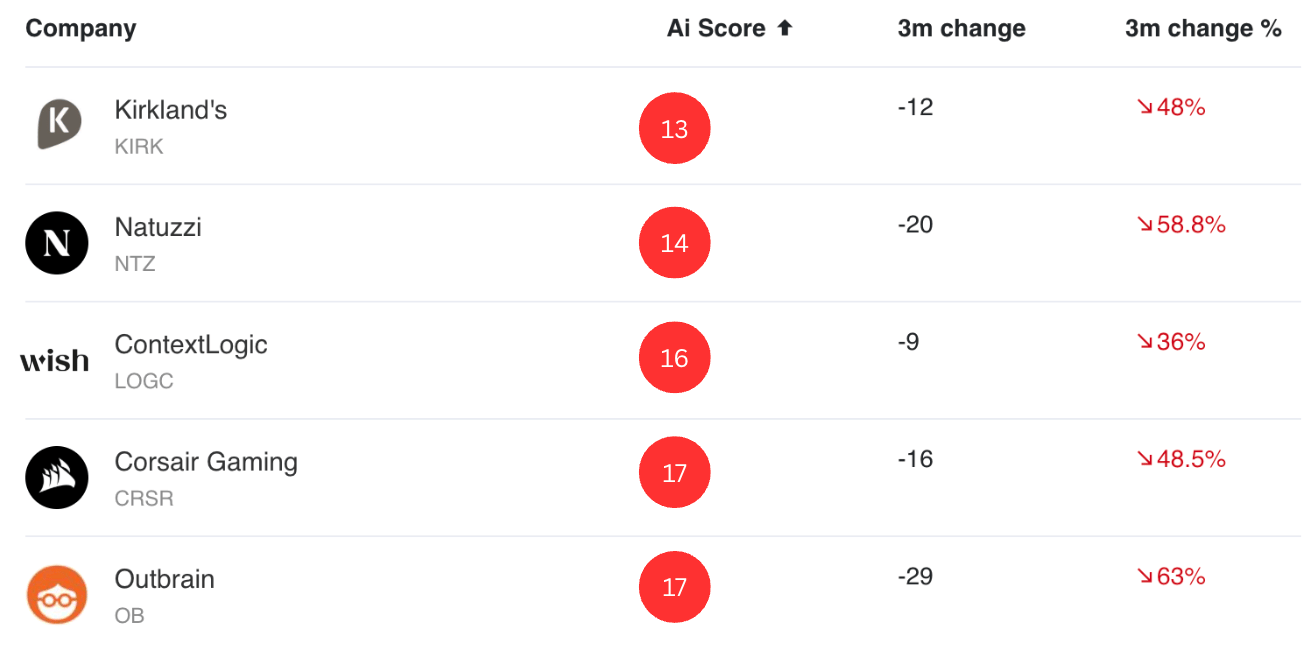

📉 Fallen Scores: Stocks Losing Signal

This is always a sad section (or an exciting one if you’re bearish and love to short things), but here are the worst-rated stocks on all of AltIndex:

If our AI model was an AI agent like OpenAI’s new product, it would probably try to sell these holdings for you while you weren’t looking. And you might thank it later.

Kirklands and ContextLogic have been haunting the bottom five for a while—we’ll be watching with baited breath to see if they can pull themselves up by the bootstraps or not.

🔎 Alt-Data Signal Watch

Anglogold Ashanti has posted YoY revenue increases of 67.63%—and they just acquired Augusta Gold.

Blackberry’s AI score is down 28.4%—but don’t worry, it wasn’t that high to begin with

Freelancing, anyone? Fiverr has seen a 61.3% increase in mobile app downloads.

O’Reily’s Facebook following has surged 63.3%—after falling almost 50% earlier in the summer.

Get Ahead of the Market with Data Signals

It’s no surprise that hedge funds and institutional investors have been using traditional and alternative data signals for their trading for years—it’s just felt impossible to find those data points as an individual investor.

That’s why AltIndex exists—to connect you to the stream of insights, signals, and beneath-the-surface data that paint a fuller picture of what’s going on in markets.

AltIndex comes with:

🤖 AI chatbot stock picker

📢 Automated stock alerts

📊 Portfolio manager

📈 More stock picks

🗣️ Reddit buzz

🕵️ Insider sentiment

🌐 Web traffic spikes

The signals are there. Now they’re yours.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected]

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

© 2025 AltIndex. All rights reserved.

103 Singleton Ave, Alameda, CA 94501.