🧠 The Signal Brief: Special Edition

Hello, and welcome to the AltIndex newsletter. In today’s special edition, we’ll be breaking down the #1 rated stocks in 3 different industries.

Where are we looking today? Rare earths, Bitcoin stocks, and… beverages. Can you guess which beverage company is CRUSHing it right now? This one’s a mystery!

But first, we’ve got a potentially even bigger opportunity. Take a look at a pharma stock that’s got a “melt-in-your-mouth” value proposition:

On Behalf of BioNxt Solutions Inc.

The Strip That Could Replace Injections

This tiny dissolvable film could upend billion-dollar drug markets dominated by Big Pharma.

The Best Rare Earths Stock

Freeport McMoRan Inc. (FCX) is a leading international mining company with headquarters in Phoenix, Arizona. The company's assets include significant copper, gold, and molybdenum deposits. Freeport McMoRan has a well-diversified resource base and is a major player in global markets. Over recent years, it has focused on optimizing its operations, advancing sustainability initiatives, and ensuring efficient resource management.

The signals

Revenue: at $7.58 billion, revenue increased 36.51% QoQ and 19.03% YoY

Net Income: $772 million. Increased 123.12% QoQ and 26.56% YoY

FCX has short-term positive price momentum and long-term negative price momentum

FCX’s Alternative Data over the past few months:

53% increase in job listings (could signal growth)

109% increase in web traffic (could signal more sales)

13% increase in Instagram followers

AI Score: 69/100

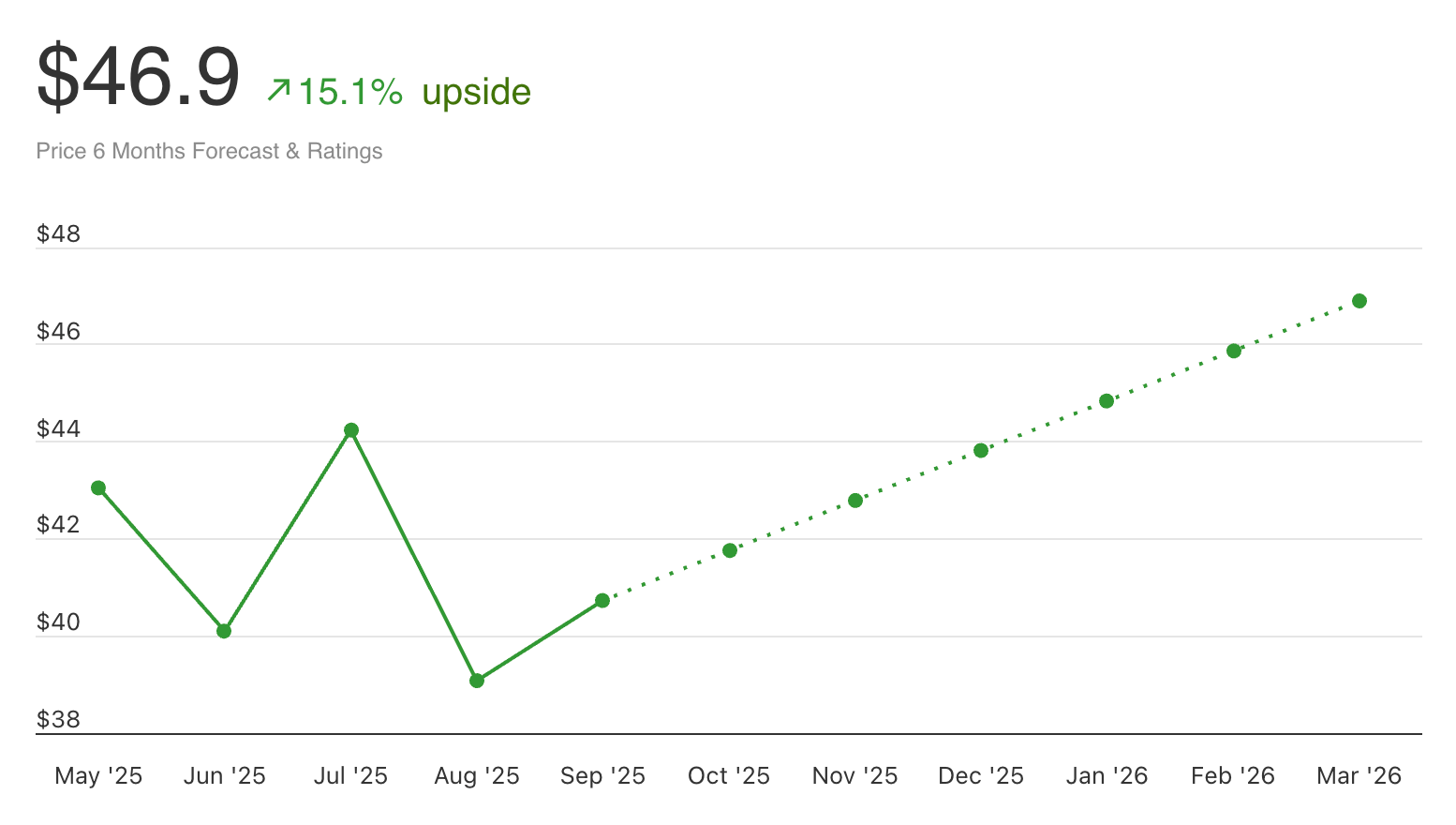

Current Price: $40.78

Target Price: $46.9

The Best Bitcoin Stock

Riot Blockchain, Inc. (RIOT) is a company focused on cryptocurrency mining, specifically Bitcoin. The company operates large-scale mining operations in North America, leveraging its state-of-the-art facilities to maximize mining efficiency and production. By utilizing cutting-edge mining hardware and software, Riot Blockchain aims to be a leader in the cryptocurrency ecosystem.

The signals

Revenue: $153 million. Down 5.20% QoQ but up 118.50% YoY

Net Income: $219 million. Up 174.05% QoQ and up 359.87% YoY

RIOT has highly positive short- and long-term price momentum

RIOT’s Alternative Data over the past few months:

71% increase in job postings

28% increase in web traffic

11% increase in Instagram followers

AI Score: 69/100

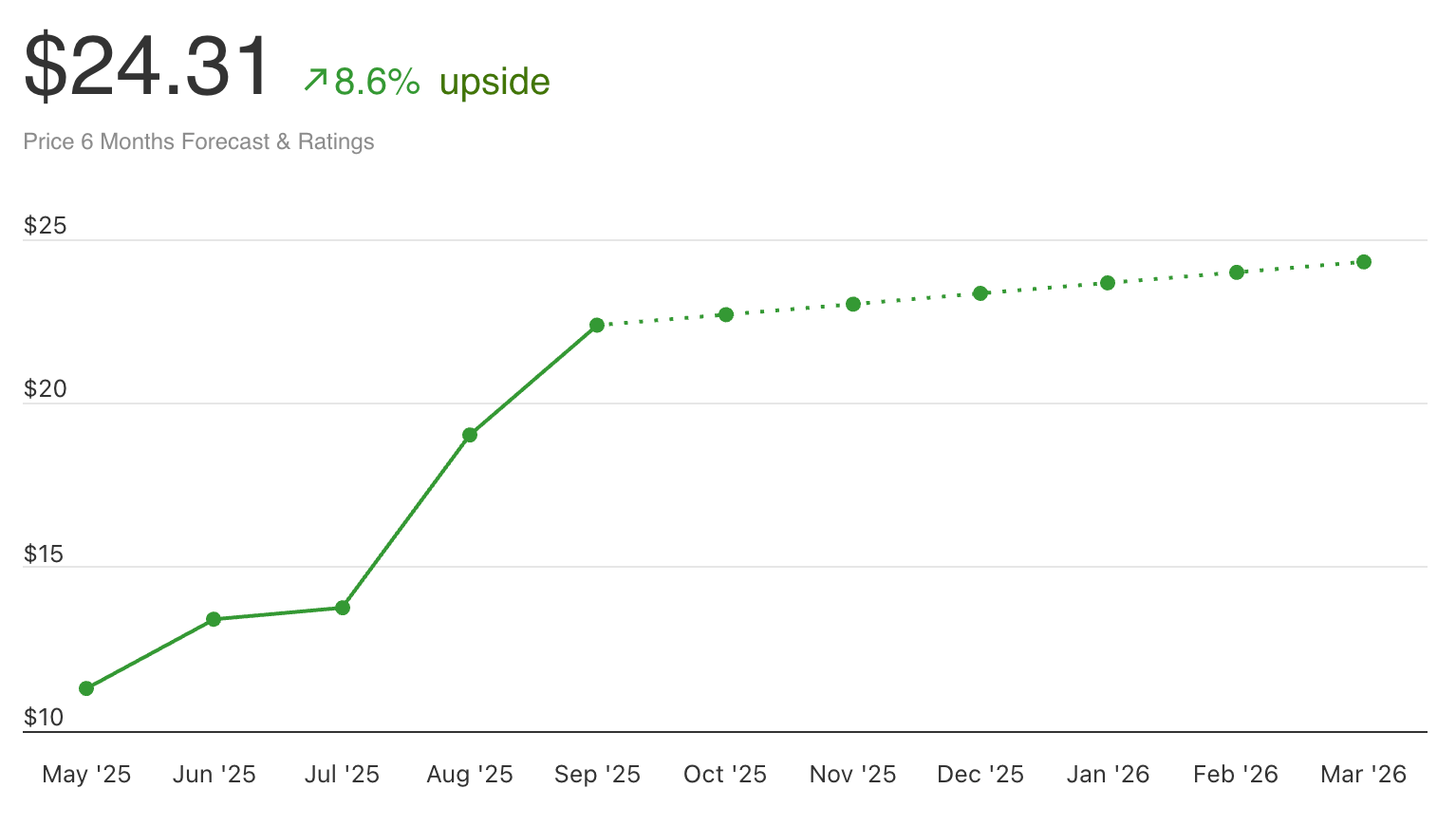

Current Price: $22.38

Target Price: $24.31

The Best Beverage Stock?

??? is an innovative company within the functional beverage sector, best known for its ______ energy drinks. With a strong market presence and a unique product offering, the company has demonstrated robust growth over recent years. The brand appeals to health-conscious consumers, merging the benefits of energy boosts with metabolic enhancements.

The signals

Revenue: $739 million. Up 124.51% QoQ and 83.91% YoY

Net Income: $100 million. Up 124.80% QoQ and up 25.16% YoY

TME has large short- and long-term positive price momentum.

???’s Alternative Data over the past few months:

109% increase in job listings

18% increase in web traffic

12% increase in Instagram followers

Employee sentiment is up 13%

AI Score: 69/100

Current Price: $62.08

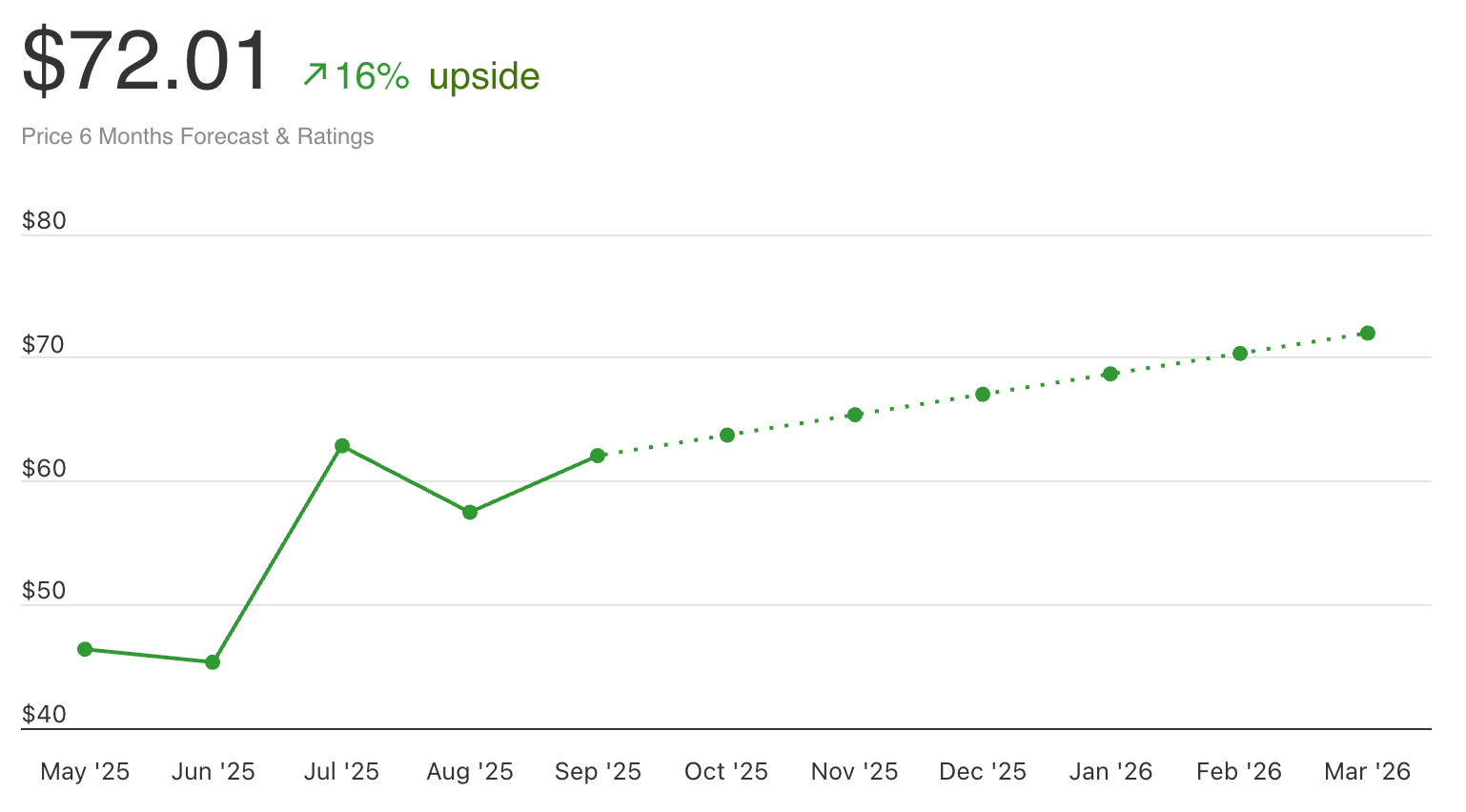

Price Target: $72.01

👋 See You This Friday

That’s it for today. Hope you found these signals helpful and/or interesting. Happy trading!

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.