🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

The stock of the day today is an old favorite, but it’s back for new reasons. Even if you haven’t checked in on engineering and constructions stocks recently, you still may have heard of it. We look at fundamental and alternative data on the stock below.

😒 You Still Trading Like it’s the Early 2000s?

It’s time to upgrade the way you look at stocks.

Hedge funds have been getting ahead for decades, and it’s not because they’re crunching the same data as you, only better—it’s because they have different data.

If a stock is trending on Reddit, you don’t think these hedge funds know about it already?

And if there’s a huge insider or congress buy, you don’t think their models factor that in almost instantly?

You need better tools if you want to stand toe to toe with institutional appetite in this day and age.

AltIndex democratizes trader’s access to alternative data like Reddit sentiment, insider and congress trading, hiring data, and 20+ other signals.

One of its best features is that it wraps all of that data (along with technicals and fundamentals) into one clean AI Score, so you can tell if a stock is interesting at a glance.

AltIndex is used by tens of thousands of traders, and its mobile app makes it easy for all of them to access alternative stock data instantly.

If you’re ready to level up your trading game, click below to download the app:

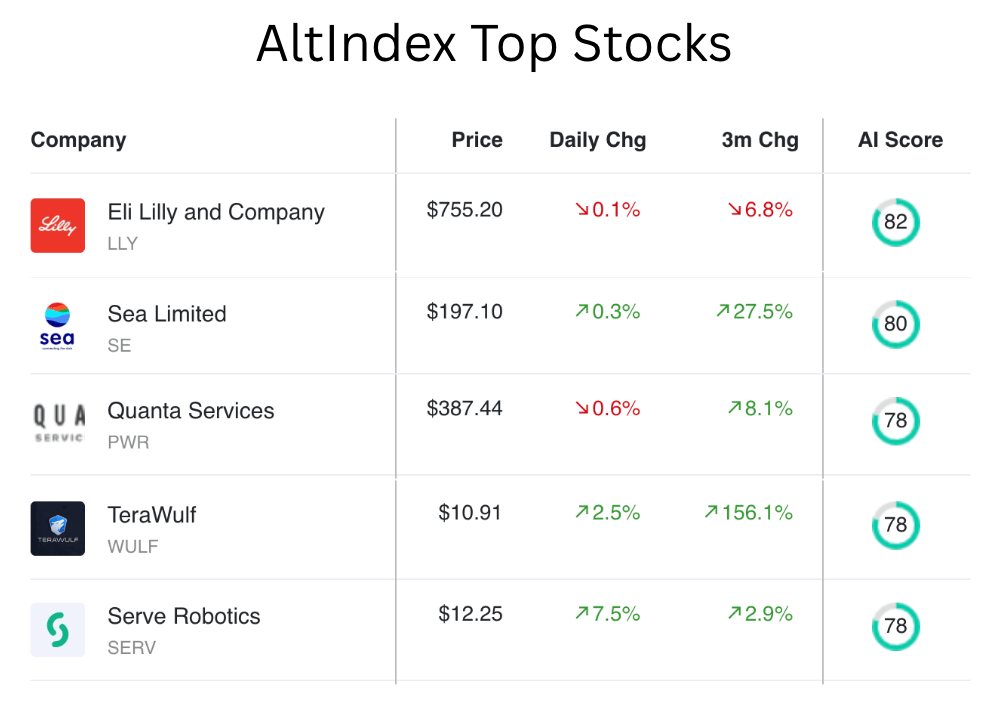

📈 Top AI Scorers of the Week

You may remember Quanta Services from earlier this summer—it had quite high AI ratings for a while there, but then dropped to a 61/100 rating seemingly out of nowhere.

But since then, Quanta (PWR) has been on an absolute tear in the rankings, climbing from a 61 all the way to a 78/100 over the course of two and a half months.

Here’s why our AI model thinks it’s a buy again.

Stock spotlight: Quanta Services (SERV)

Quanta Services, Inc. is a leading provider of specialty contracting services, delivering comprehensive infrastructure solutions for the electric power, natural gas, and telecommunications industries. The company operates across North America and spans several areas, including infrastructure planning, design, installation, repair, and maintenance services.

Notable PWR narratives from AltIndex’s news aggregator:

Congress member Lisa McClain bought shares in mid-August

$PWR flashed a buy signal on Investors Business Daily yesterday

Seaport Res Ptn stock analysts just upped their PWR 2026 earnings outlook

The data:

Revenue: $6.77 billion last quarter, which is a 21.07% increase YoY (and a 8.66% increase QoQ).

Net income: At $229 million last quarter, Quanta’s net income is up 21.84% YoY and up 58.92% QoQ.

Analyst rating: 76% buy

Alt data from the past few months:

Job listings ↑ 50%

Employee business outlook ↑ 91%

Web traffic ↑ 6%

Insider selling over the past few months

The verdict:

AI score: 78 — buy signal.

Current price: $387.90

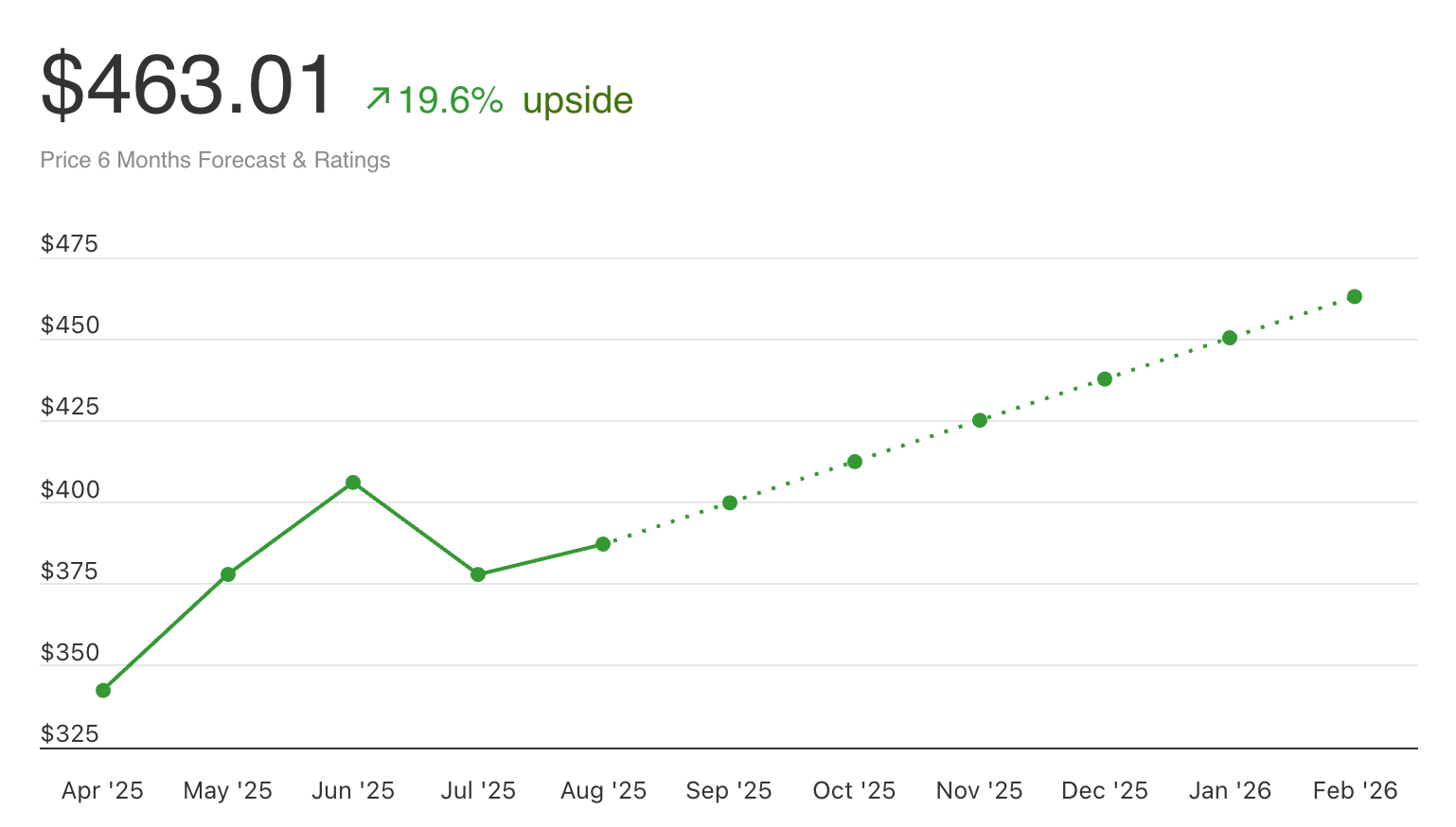

Price prediction: $463.01 (19.6% upside)

Bottom line: Quanta Services exhibits strong revenue and net income growth, signaling robust operational performance despite the concerning decline in EBITDA. The high P/E ratio warrants caution, as it may indicate overvaluation risks. Technically, the stock shows a bullish trend supported by a rising SMA10, although the high RSI warrants caution of a potential short-term pullback.

Given the combination of these indicators, Quanta Services appears to offer promising long-term potential, despite short-term valuation concerns. Investors should consider this stock cautiously, balancing the strong growth indicators against the high valuation metrics.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congresswoman Virginia Foxx just reported buys of Hercules Capital (HTGC) and Alliance Resource Partners, L.P. (ARLP).

Paramount Global’s (PARA) Reddit mentions are up 638.2% (likely because of its potential purchase of Warner Bros.)

Target’s (TGT) job listings are up by 24% to 10,000 total.

Interestingly, WolfSpeed’s (WOLF) Reddit mentions are up by 107.7% too. The US bankruptcy court just approved its restructuring plan.

Some Redditors think that LoanDepot (LDI) could be the next OpenDoor.

Want instant access to scores like this—any time, before the news hits?

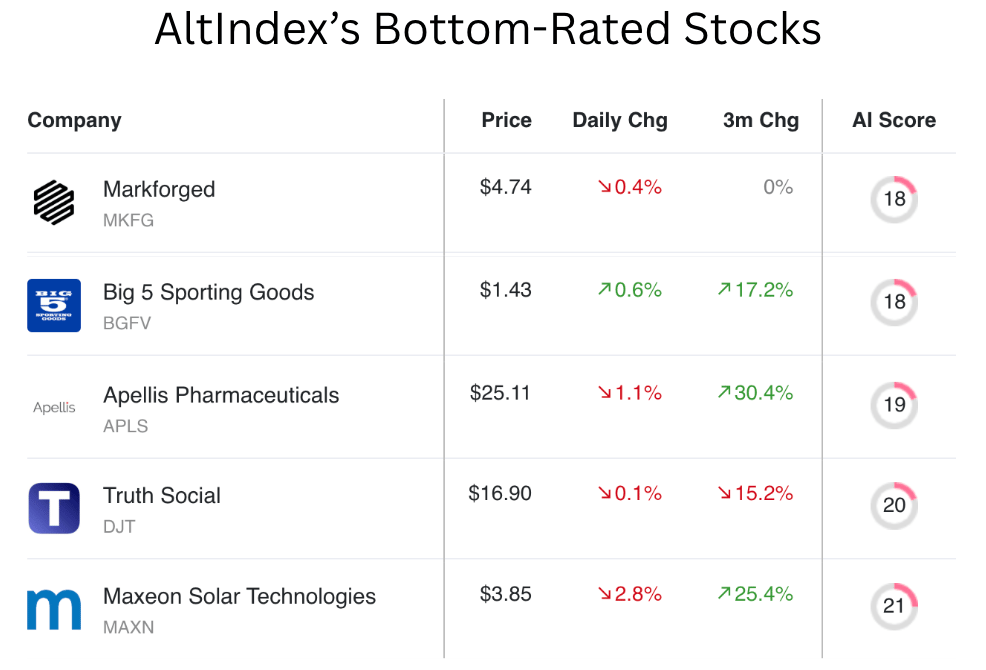

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.