🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

This week? Sure, Tesla was big news this week. So was Nike falling by 12%.

But that’s not what our model caught.

Three words for you: Truck. Bed. Covers.

Let us explain.

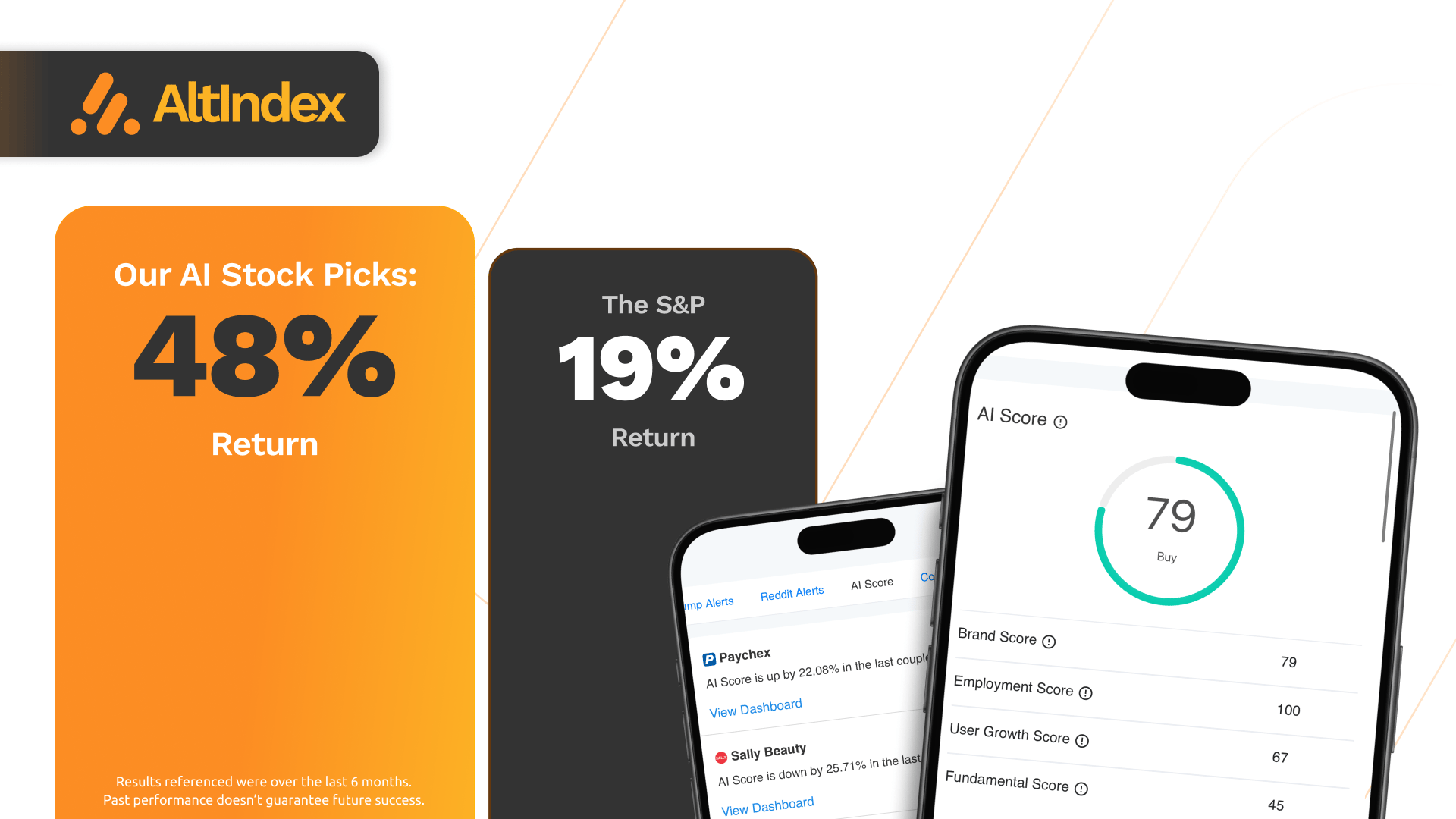

Data That Beat the S&P 500

We’re giving you a free 7-day trial of the AltIndex App.

Get top stock ratings and signals 24 hours a day. Never miss a signal on things like:

Reddit mentions surging 3,000%

A stock’s AI Score breaking above 80

Hiring data and web traffic jumping before earnings

We just rolled out a new update, too, including a personalization flow to tailor your AltIndex experience immediately.

Get smarter stock alerts on the data you care about.

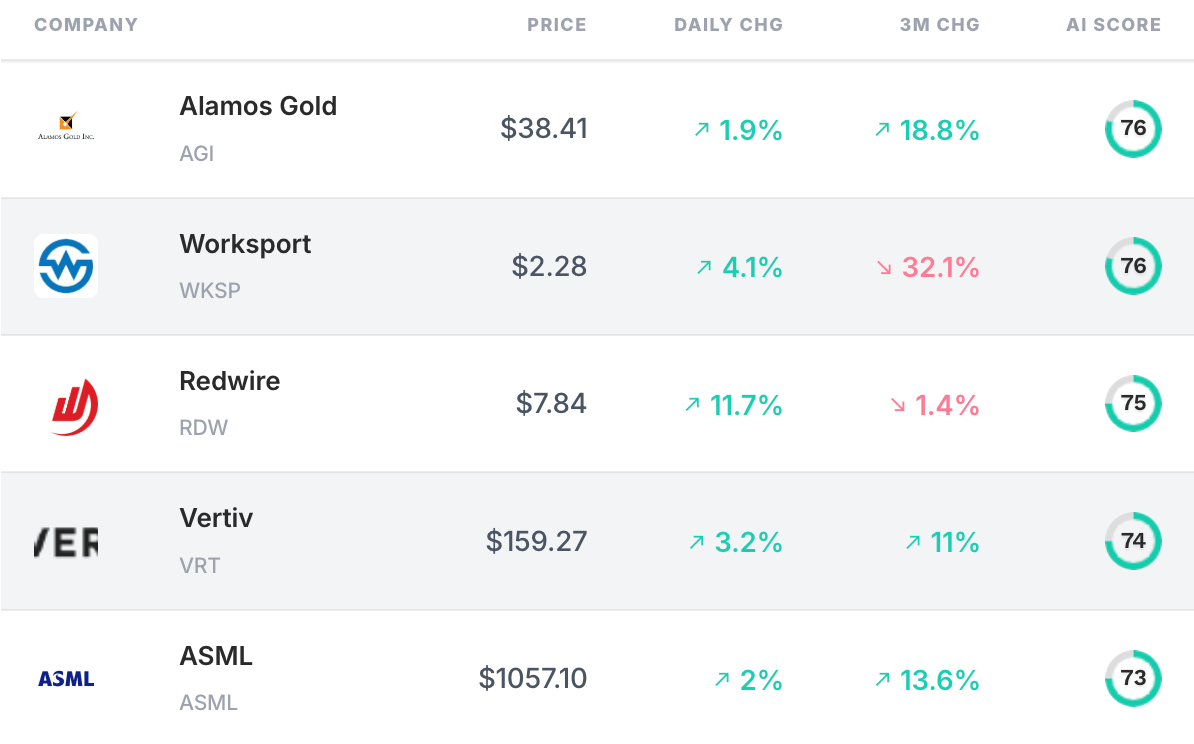

📈 Top AI Scorers of the Week

Alright, back to the truck bed covers. Worksport’s stock is looking like a potential work horse to our AI model right now.

Two more words for you: Web. Traffic.

Stock spotlight: Worksport (WKSP)

Worksport Ltd. is a manufacturer and innovator in the automotive accessory sector, focusing on the design and production of truck bed covers, known as tonneau covers. The company aims to provide high-quality, functional products that meet consumer needs. Their flagship products are designed to offer utility and added value to truck owners, garnering significant market interest. Worksport has also been eyeing expansion into sustainable and renewable energy sectors, which could offer diversified growth avenues in the future.

The data:

Revenue: $5M. Up 22.14% over the past quarter and up 60.58% over the past year.

Net income: -$4.9M. Down 31.98% quarter over quarter and down 19.20% year over year.

EBITDA: -$4.8M. Down 51.46% quarter over quarter but up 36.80% year over year.

Price momentum: Positive over the past month (+11.76%) but negative over the past year (-72.69%).

10-Day Simple Moving Average: Bearish. SMA10 is $2.51, which is lower than the previous 10-day SMA of $2.56.

RSI (relative strength index): Neutral at 68.6 (high end of neutral, though). Indicates potentially fair valuation, but close to overvaluation territory.

Analyst rating: 100% buy

Alt data from the past few months:

Web traffic ↑ 48%

Instagram followers ↑ 10%

The verdict:

AI score: 76 — buy signal.

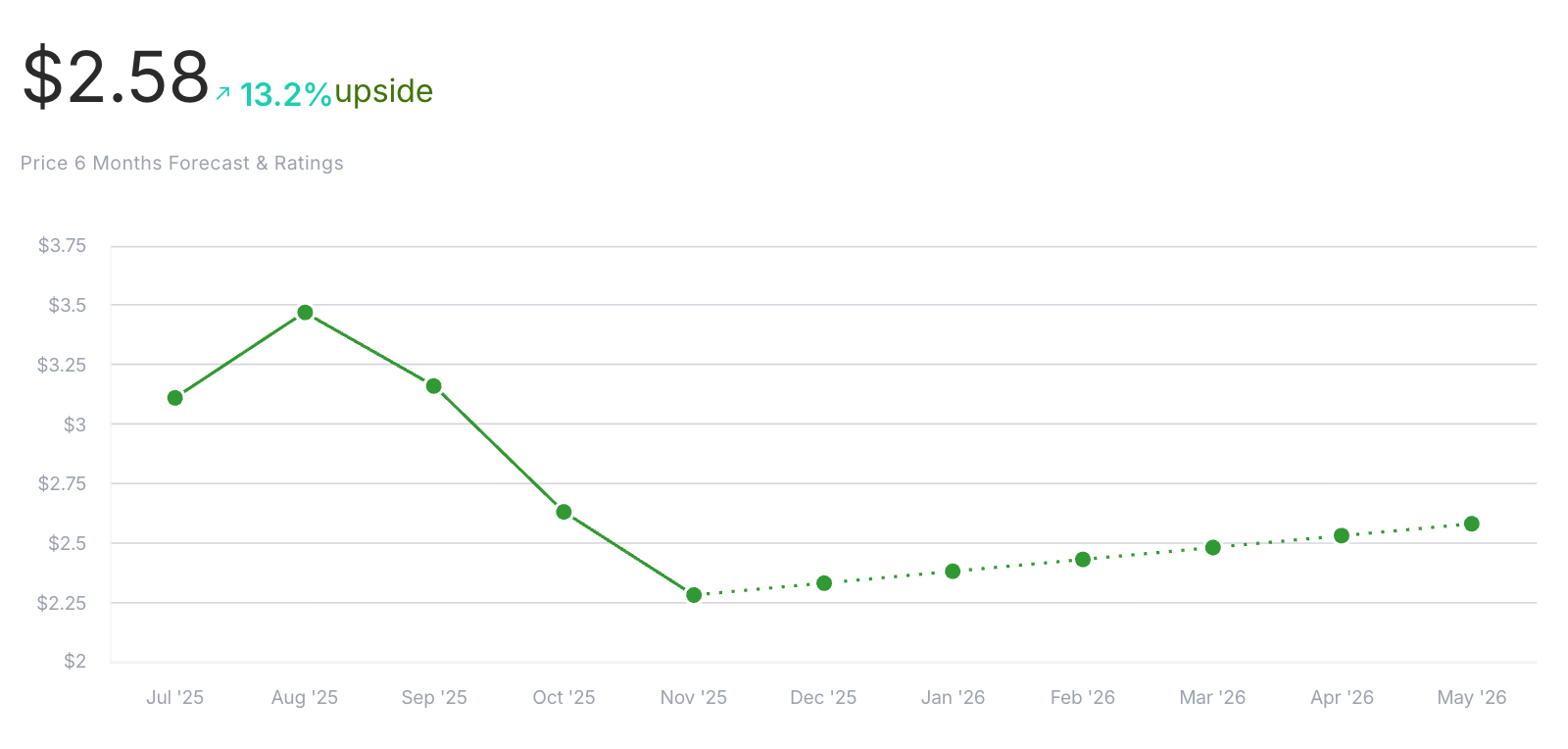

Current price: $2.28

Price prediction: $2.58 (13.2% upside)

Bottom line: All in all, Worksport Ltd. demonstrates a strong potential for growth, as evidenced by its impressive revenue increase and stable operational metrics. However, the concerning declines in net income and EBITDA highlight areas that need immediate attention, such as cost management and operational efficiency. The stock's short-term trend looks positive, but the long-term bearish trend suggests possible underlying issues that need addressing. However…

On the alternative data front, increasing web traffic and Instagram engagement are positive signs. Given these various data points, the comprehensive AI score of 76 suggests that the stock is currently a buy. However, investors should stay vigilant and monitor the company's efforts to resolve profitability issues and convert growing interest into sustainable revenue.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Here are some of the most interesting, eye-catching trades that congress members reported over the past couple of days:

Congressman Cleo Fields bought up to $500K of GOOGL in the past 3 weeks. He also bought up to $15K of IREN, which he also bought in July (up 135.64% since).

Congressman Gilbert Cisnersos filed 173 trades on Dec 15. Big buys included up to $100K of LB and up to $50K of BABA, AMD, and AMZN.

Reddit Alerts

(You can get all of these alerts as notifications on your phone with the AltIndex App)

Rocket Labs (RKLB): Redditors are actively discussing the recent performance of Rocket Lab, with many expressing satisfaction and excitement over its stock price increase. There is also mention of a significant firm fixed-priced OTA agreement with a total potential value of $805 million to provide 18 MWTD SVs awarded to RKLB, which has further boosted investor confidence. Some users have shared their personal investment experiences, including successful bets on the stock's movement and decisions to shift investments into RKLB from other stocks.

Truth Social (DJT): People are actively discussing Truth Social in relation to suspicions of financial irregularities. They are speculating about possible connections between the trending of this platform and events such as the release of Epstein files, suggesting potential manipulative strategies like a "pump and dump" scheme.

Other Alternative Data Signals (3 Month Time Frame)

Coty’s (ABAT) web traffic is up by 60.6% and its job posts are up by 84.5%.

Honda Motors’s (HMC) job listings are up by 132%.

Northern Trust’s (NRTS) job listings are down 66.5%.

Want instant access to scores like this—any time, before the news hits?

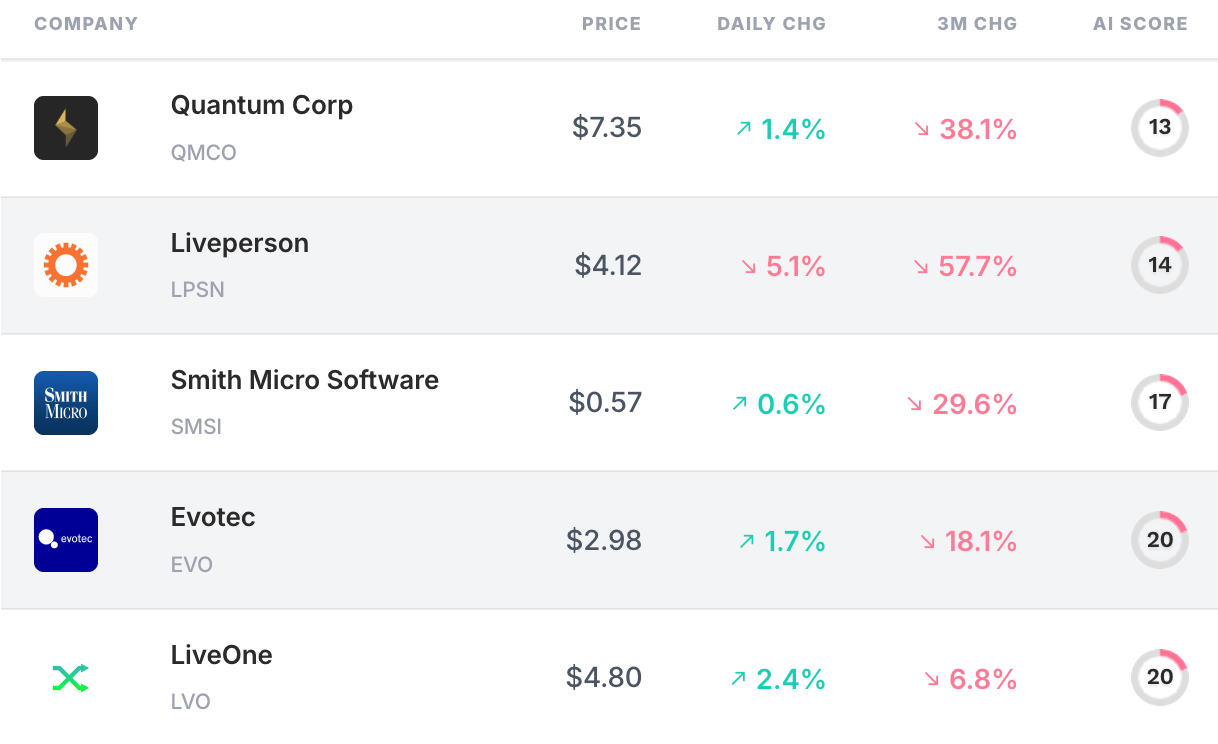

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.