🧠 The Signal Brief - AI Stock Insights & Picks

Welcome back to AltIndex’s weekly update. Each week, we spotlight a stock making moves in our AI rankings.

We hope you had a great Thanksgiving. Markets were closed yesterday, but they’re open till 1:00 PM EST today, so here are the best stock signals out there for your viewing pleasure!

Enjoy.

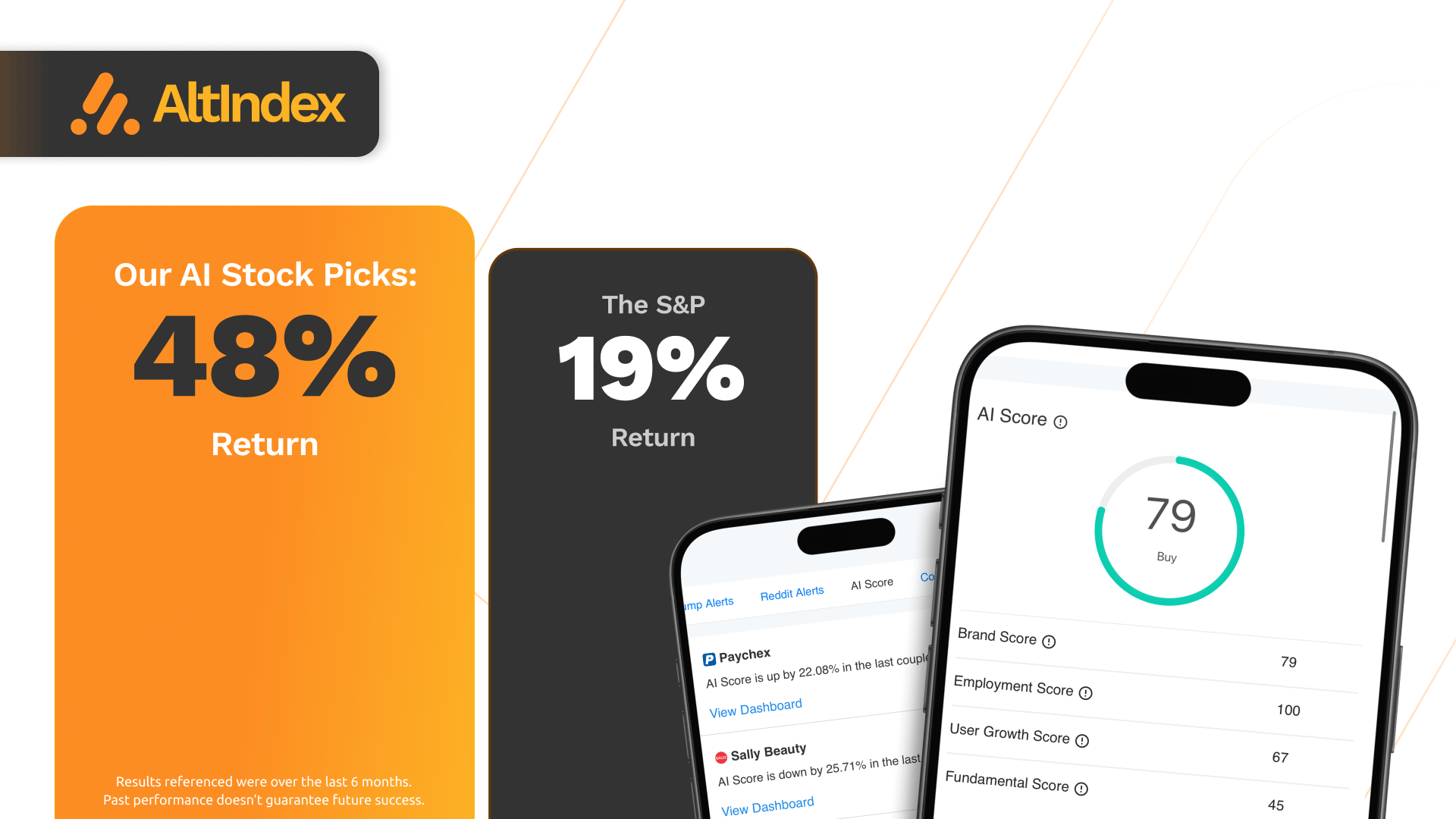

In partnership with AltIndex

This Black Friday: Never Miss a Stock Signal

Less than $0.30 a day. Stock insights that could change your portfolio forever.

People waste so much money on Black Friday sales. This year, why not buy something that could help you make more money?

We’re running a half-off special this Black Friday for a full year of membership. With the code BLACKFRIDAY25, you get full access to every alternative data point, every social-media-driven stock run, and AI-based stock picks.

Sign up below.

Please support our partners!

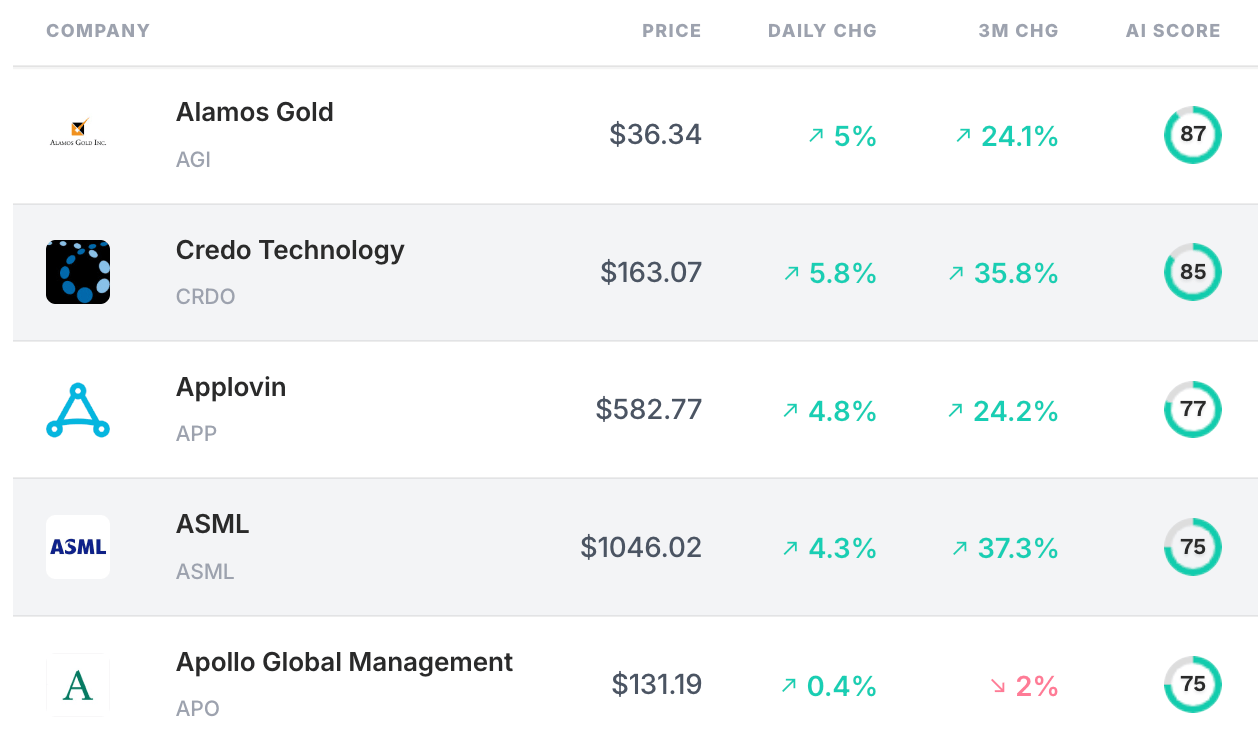

📈 Top AI Scorers of the Week

The semiconductor space is still going strong, and today’s stock pick is running hot right now. ASML looks like it’s preparing for growth while maintaining steady customer and investor interest.

Let’s take a closer look.

Stock spotlight: ASML (ASML)

ASML, a Dutch company, is a prominent player in the semiconductor equipment manufacturing industry. The company is globally recognized as a leader in photolithography systems, which are crucial for semiconductor production. ASML's technology enables the manufacture of smaller, faster, and more energy-efficient microchips. The company's strong position in the semiconductor industry has bolstered its reputation and financial stability.

The data:

Revenue: $7.52B. Down 2.28% since the previous quarter but up 0.65% the past year.

Net income: $2.12B. Down 20.62% quarter over quarter but up 2.31% year over year.

EBITDA: $2.74B. Down 24.84% quarter over quarter but up 2.47% year over year.

Price momentum: Positive over the past month (+1.43%) and VERY positive over the past year (+58.17%).

10-Day Simple Moving Average: Bullish. SMA10 is $998.12, which is higher compared to the previous 10-day figure of $994.22.

P/E (price/earnings) ratio: Relatively high at 35.46. Indicates potential overvaluation.

RSI (relative strength index): High at 80. Indicates overbought condition.

Analyst rating: 100% buy

Alt data from the past few months:

Job listings ↑ 8%

Instagram followers ↑ 6%

Twitter followers ↑ 8%

The verdict:

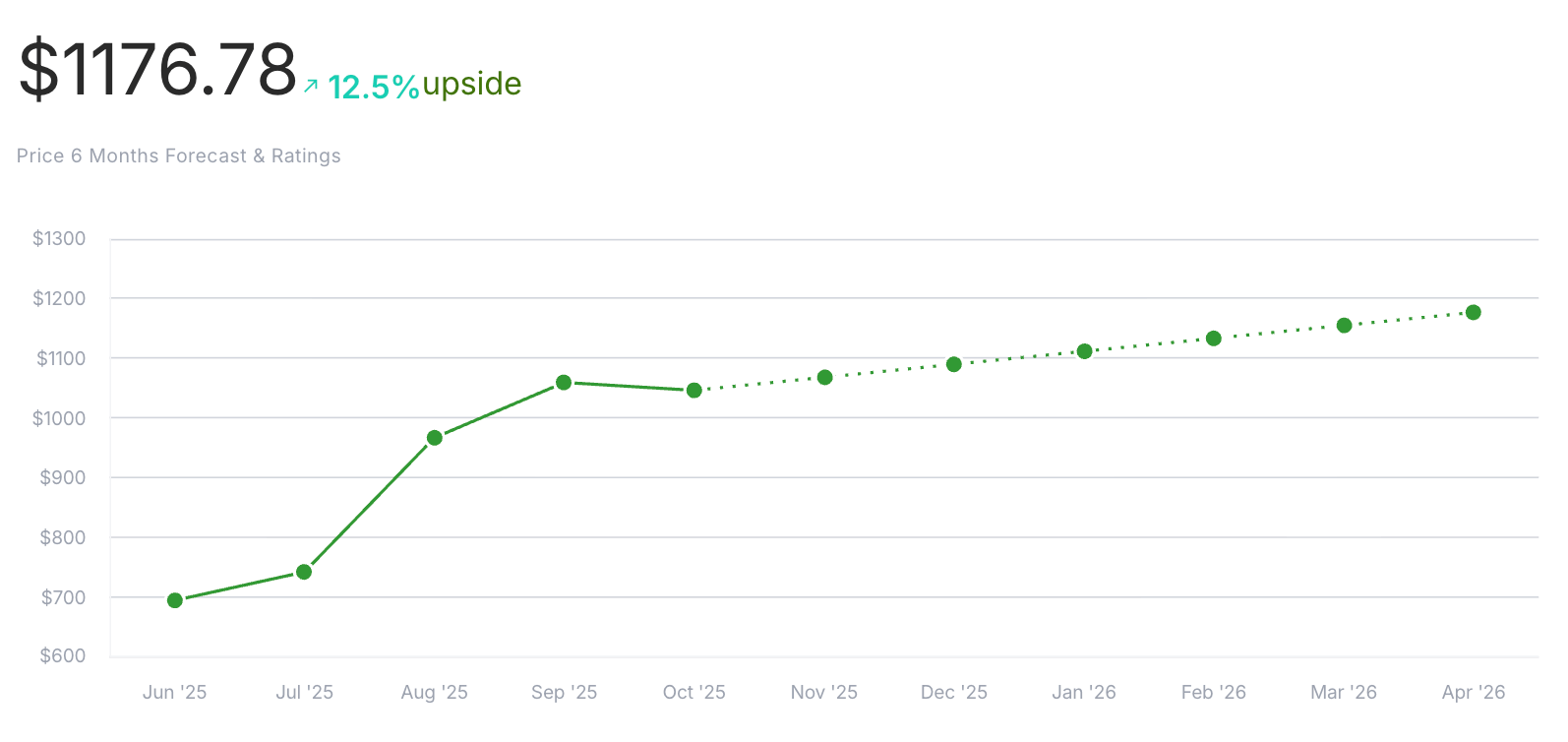

AI score: 75 — buy signal.

Current price: $1045.00

Price prediction: $1176.78 (12.5% upside)

Bottom line: ASML showcases a blend of mixed short-term and positive long-term indicators. While recent quarterly results reveal certain operational challenges, the year-over-year data suggests steady growth. Technically, the stock's bullish trend is evident both in the short and long term. However, the high RSI suggests caution due to the possibility of a short-term overbought condition.

Alternative data, including job postings and social media interest, portrays a company preparing for growth and maintaining steady customer and investor interest. With an AI score of 75, which indicates a buy signal, there seems to be confidence in ASML’s continued success.

Considering all factors, ASML appears to be a promising investment with a strong long-term outlook. However, potential investors should remain cautious of short-term volatility and ensure their investment strategy aligns with market conditions.

🔎 Alt-Data Signals

What’s cooking in the markets right now?

Congress Trades

Here are some of the most interesting, eye-catching trades that congress members reported over the past couple of days:

Cleo Fields: NFLX (buy)

On Nov 3, Fields bought $100K - $250K of NFLX

Lisa McClain: APPF (sell)

On Oct 31, McClain sold $1K - $15K of APPF

Gilbert Cisneros: BABA (buy)

On Oct 14, Cisneros bought $15K - $50K of BABA

Jared Moskowitz: CSCO (buy)

On Oct 10, Moskowitz bought $1K - $15K of CSCO

Reddit Alerts

People are actively discussing the vertical integration aspects of Nebius (NBIS) and comparing it with IREN. They are debating about the different focuses of these companies, with some emphasizing on software-driven differentiation while others on facility-level control and cost efficiency. There is also a mention of Google's TPU in relation to Nebius, indicating a discussion around their potential usage.

Redditors are also talking about the potential profitability and growth of Reddit (RDDT) itself, especially as the company starts to launch more products to compete with other social media platforms. They're also speculating on future events such as a possible deal with Google or inclusion in the S&P 500 that could significantly impact Reddit's stock value. The massive amount of data Reddit possesses for training language models is also seen as a valuable asset.

Other Alternative Data Signals (3 Month Time Frame)

Merck & Company’s (MRK) job posts increased by 212.3%.

Humana’s (HUM) job posts decreased by 26.8%

Torrid’s (CRV) Facebook Engagement is up

Want instant access to scores like this—any time, before the news hits?

📉 Lowest Scores: Stocks Losing Signal

These are the five worst-rated stocks on our platform. Our AI model sees these as strong sell signals. Always do your own research.

👆 Need real-time alt-data at scale?

AltIndex powers hedge funds, fintechs, and financial publishers with institutional-grade signal access.

If you need API integrations, full historical datasets, or white-labeled solutions, reach out at [email protected].

🐦 Tweet of the Week

🎤 We Want to Hear From You!

What did you think of today's edition?

👋 See You Next Week

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested Inc.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.