🧠 The Signal Brief: Special Edition

Hello, and welcome to the AltIndex newsletter. We’re bringing you a special edition today with a different kind of update: today, we’ll be breaking down the #1 rated stocks in 5 key industries. From biotech to semiconductors to cloud computing, view this as a playbook for anyone looking to make short- to mid-term swing trades informed by AI analysis.

And first, a look at a potential top biotech play that we haven’t seen anyone talking about:

In partnership with Trading Whisperer

$9 Target on a $1.50 Biotech. Time to Look Closer

This biotech is targeting a billion-dollar heart market. Analyst upside targets are in triple digit percentage gains.

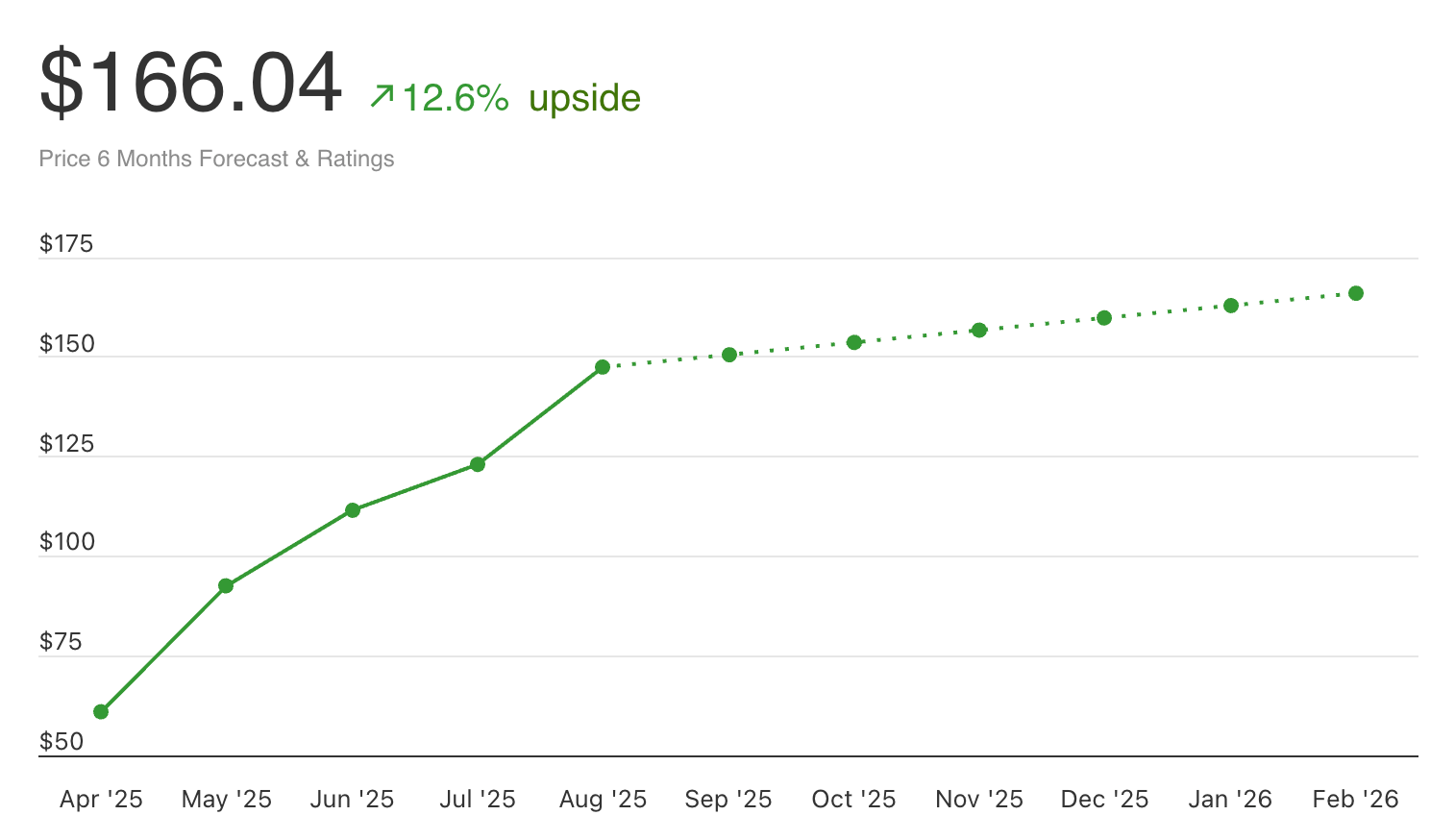

The Best Semiconductor Stock

Credo Technology (CRDO) is a prominent player in the technology sector, known for its innovative solutions and robust market presence. As the demand for technological advancements surges, Credo Technology has positioned itself to capitalize on this growing market.

The signals

Revenue: increased 273.57% YoY and 31.20% QoQ

Net Income: increased 764.56% YoY and 73.28% QoQ

CRDO has a short- & long-term upward price trend (up 508.04% the past year)

44% increase in job listings

87% positive employee outlook

AI Score: 76/100

Current Price: $147.53

Target Price: $166.04

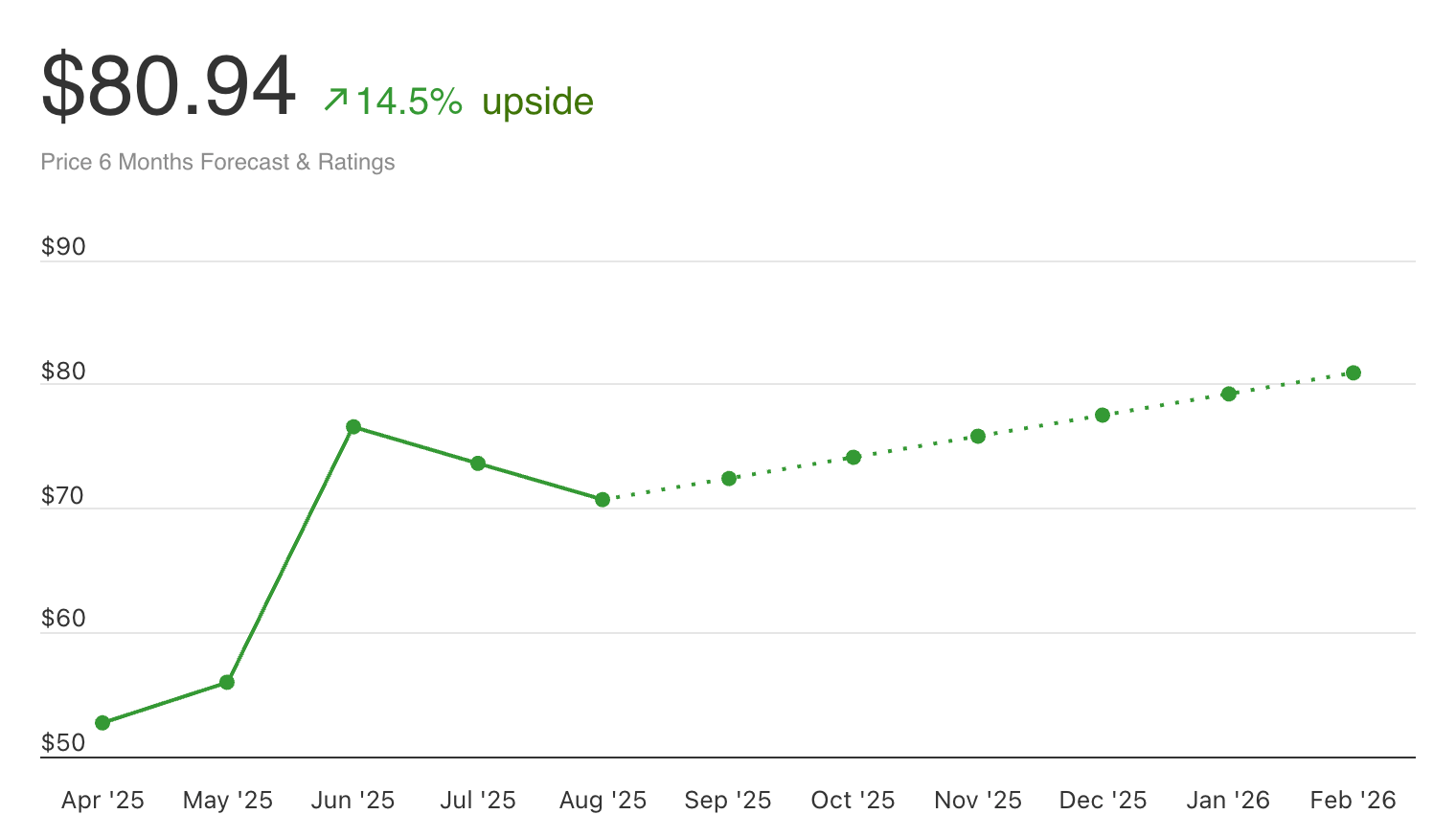

The Best Energy Stock

Oklo (OKLO) is an innovative company in the energy sector, primarily focused on developing nuclear reactors designed to provide safe, reliable, and sustainable power. The company prides itself on technological advancements and aims to revolutionize the nuclear industry with its compact and efficient designs. Oklo may be pre-revenue currently, but the company has shown resilience and consistency in its operational metrics despite the challenges faced by the nuclear energy sector at large.

The signals

Oklo is pre-revenue (expected to earn revenue in 2027 on reactor deployment)

Stock is up by 1,151.68% compared to a year ago, down 6.11% this month

109% increase in web traffic

29% increase in job postings

OKLO gets consistent mentions on Reddit, and sentiment is 88% bullish

AI Score: 73/100

Current Price: $70.72

Target Price: $80.94

The Best Crypto Mining Stock

TeraWulf (WULF) develops, owns, and operates sustainable, large-scale data center infrastructure for both Bitcoin mining and high-performance computing (HPC) hosting. The tech company utilizes mainly zero-carbon energy sources like nuclear, hydro, and solar power. The stock rallied 90% in August, and our AI model still thinks WULF might have legs to run.

The signals

Revenue: up 33.91% YoY and 38.46% QoQ

Net Income: down 68.90% YoY but up 70.09% QoQ

WULF has upward price momentum in the short and long term

Reddit sentiment: 90/100 (bullish)

AI Score: 73/100

Current Price: $9.20

Price Target: $10.62

The Best Cloud Computing Stock

Research Solutions (RSSS) is a publicly traded company that specializes in providing software as a service (SaaS) solutions within the knowledge and research management sectors. The company's key product offerings encompass tools for document delivery and scholarly communication, designed to assist businesses and academic institutions in managing, accessing, and distributing research materials efficiently.

The signals

Revenue: up 4.50% YoY and 6.27% QoQ

Net income: increased 183.71% over the past year and 110.93% QoQ

Both short- and long-term stock price growth

Web traffic increased 34% the past couple of months

Instagram followers up by 23%

AI Score: 73/100

Current Price: $3.16

Target Price: $3.86

👋 See You This Friday

That’s it for today. Hope you found these signals helpful and/or interesting.

Have a great weekend, and happy trading.

— Brandon and Blake

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The stock picks and rankings provided by AltIndex are designed solely for informational use. They are not to be taken as investment guidance or a suggestion to purchase or sell any form of security. These rankings are the outcome of smart algoritms that are estimating future performance based on fundamental and alternative data analysis. We strongly advise that before you make any investment choices, you should thoroughly consider a variety of information sources and consult with a qualified financial advisor. It's important to remember that all investment activities come with inherent risks, and the historical performance does not assure future results or returns.